I am sure the story of Norbert Lou pitching NVR in Value Investors Club has made its way in front of most of the readers of this article. We know buying this stock went on to earn tremendous returns for Lou, or rather his mother as he was handling her retirement account at the time. These writings on VIC also catapult Lou into launching his own Fund with seed money from Greenblatt himself.

This series of events are those that some of us dream of during our young investing years.

The name has floated around in my head for years now but other than the occasional glance I have never taken the time to sit down, read the reports, internalize the ideas, and think. Why? I don’t have a good answer. I remember scoffing at the name in 2018 when it was around $2,500 and trading for 15x P/E. Who is scoffing now?

What was the tipping point? A few semi-related events:

I have been pushing myself to study quality and simplicity more.

I just re-read the Tao of Charlie Munger.

Someone bought the name for Berkshire, It isn’t their biggest position and I am not sure which manager bought it, but the activity brought the name back to the top of my mind.

Stack all of these together, sprinkle in my current bullish stance on housing, and NVR fits nicely. Therefore I thought it was time to put some thoughts down on paper.

I recently went back to Lou’s write-up out of curiosity and not much has changed in the company since he blew the whistle back in 2001. All of the KPIs are much bigger today but on the operational front, the past 22 years have been business as usual.

To most, the lack of razzle-dazzle over this long of a period might be boring. To me, however, it makes me salivate. The language in the annual report is still similar to that used decades ago. As I was re-reading the 10K I felt the same feeling I get when sitting before a sunset. There is something bigger than words about a company that has earned high returns on capital over many decades doing the same thing, year after year.

NVR’s Operating Model

When someone is quick to throw a label on the company, it can be written off as just another homebuilder. The normal way of doing business is to buy a bunch of land, build the homes, and then sell them. This cycle is very capital-intensive and lends itself to vulnerability.

By purchasing and developing the land homebuilders play a game of hot potato hoping to get the property off their books and into the seller’s hands as quickly as possible. But, when this ugly side of the demand cycle shows up, conservative builders take large inventory write-downs and levered builders go bankrupt.

NVR avoids this common fate by a simple tweak in the operating model.

Instead of going out, purchasing a bunch of land, and tying up loads of capital, they use options. Similar to a stock option, for a small payment today they own the right but not the obligation to purchase the land if they are able to sell it. Going this route allows them to tie up plenty of land for prospective building sites without having to invest large amounts of capital to do so. This leads to less inventory risk and much higher returns on capital employed.

So how does this work in practice?

After paying the option to acquire the finished building lot from land developers the company goes out and markets a new home. The heavy capex portion of the business, the actual operation of fronting the money to build, does not begin until the home is presold which means the customer’s deposit finances the build instead of NVR. Another small detail that improves returns on capital.

The Dell Computers of Homebuilding

I got the following story from Warren Buffett, Inside the Ultimate Money Mind By Robert Hagstrom

Back in the late 90s, Bill Miller began buying the PC maker, Dell Computer. Historically to this point, PC stocks traded between 6-12 times earnings and a sales slump in ’96 led the industry to retreat to the lower end of the range which was when Miller began to buy up shares. However once the stocks began to retrace back to the upper range of the multiples, he continued to hold instead of selling and moving on like the other “value” investors.

Others wondered, “What did Miller see in this company that kept him from selling and moving on?”

Most PC manufacturers like Gateway, HP, and Compaq sold their machines to retailers which then marked up the price and collected a margin on it. Dell ran their operations slightly differently. Instead of selling to retailers, Dell sold directly to consumers which allowed them to keep their prices lower to than their competition.

However the capital cycle of the manufacturing process within Dell was the secret sauce.

To purchase a computer a customer would call a 1-800 number, place the order, and then pay for the entire purchase upfront. The computer was then built and shipped to the customer within a few weeks. By having the customer pay upfront for their own product, they financed the build of their order and Dell didn’t need to outlay any capital to do so. The only bill for Dell came when the suppliers would send an invoice 30 or even 60 days after the initial build.

It didn’t matter for Dell because they already had the profits in their pocket all they needed to do was set aside a portion of the sale to forward to the supplier when the invoice was sent.

This “negative” working capital model allowed Dell to be the first company in history to generate returns on capital greater than 100% and hit a high of 220%. This is what Miller saw and why he held on. The Dell position became the largest in the Value Trust and was selling for 35 times earnings.

When asked why he didn’t want to swap PC makers and sell his Dell for Gateway, which was priced around 12x earnings at the time, he replied that Dell earned 200% returns on capital as opposed to Gateway’s 40%. Dell was 5x more profitable but only 3x the P/E.

When it comes to NVR, it doesn’t transfer 100% but the model rhymes.

Only build when you have cash in hand and allow the customer to finance the build. Much unlike the traditional homebuilding model, this keeps capital out of inventory and frees it up to be allocated elsewhere.

Slow and Steady

Part of NVR’s ability to earn such high returns on capital over time has been their disdain for the institutional imperative. I believe this resistance has stemmed from the compensation structure.

NVR pays their NEOs based on ROIC and other home builders like, DHI, use SG&A and Gross Profit in their compensation programs. Because of these incentives, it’s not surprising to see the growth in size for these two companies. Bigger isn’t always better, especially when it demands large investments of capital.

“One metric catches people. We prefer businesses that drown in cash. An example of a different business is construction equipment. You work hard all year and there is your profit sitting in the yard. We avoid businesses like that. We prefer those that can write us a check at the end of the year.” - Charlie Munger

NVR has taken a different approach than expanding rapidly. Bruce Greenwald in “Competition Demystified” explained how the best economics for a company are local economics scaled. Local economics come from the idea of being the #1 player in one geography and slowly expanding replicating the hometown dominance.

NVR is a local company scaled.

Since 2016, NVR has entered 6 new markets compared to DHI’s 27, guided by the invisible hand of incentives, but also by the desire to maintain or compete for the #1 market share in the markets they serve.

“In addition to our focus on liquidity, another key aspect of our business model is emphasizing local market concentration. We strive to be the dominant builder in each of our markets. The local market scale achieved from this strategy allows us to leverage our employees, management staff, local market knowledge and relationships with business partners. As a result, we are able to maintain lower costs and achieve higher returns on capital.” -From the 2016 NVR Annual Letter

Where Does the Cash Go?

NVR is a stable growing, operational-focused, homebuilder. Who keeps their liquidity in check by acquiring plots of land. This operating system opens itself up to being very cash flow positive.

The final lever that catapulted NVR into the “quality” category of business for me has been the historical track record of capital allocation. Proper capital allocation bridges the gap between shareholder value and intrinsic value and the way they have bridged their own gap has been the dedication to buybacks for decades.

Dollar cost averaging into a great business over time might not shoot the lights out but it is a great way to not go broke.

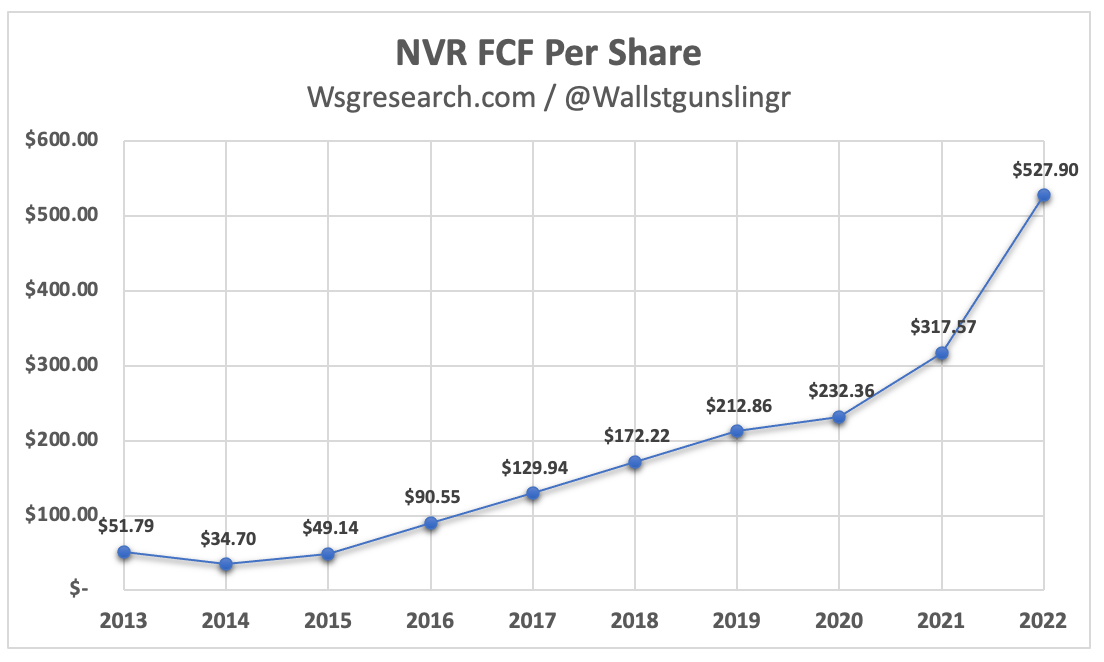

In 2001 the company had ~7.9M shares outstanding. As of 08/2023, that number stood at ~3.2M. Over the past 10 years, the company has generated ~$ 7.07 B in FCF and spent ~$7.4B on share buybacks.

By pulling this lever EPS has CAGR’d at ~30.2% over the past decade leading the stock price to CAGR at ~22% a year. It’s hard to argue with the results.

Future Expectations and Current Valuation

As of this writing the valuation of NVR, as displayed on Quick.fs, is EV/EBIT 9.5 and EV/FCF 11.1. When compared to years past the current P/E ratio for the stock is on the lower band of multiple that we have seen it trade for in the past.

If taken at face value this doesn’t seem like a bad place to buy into a position and I have contemplated adding it to the portfolio but for right now it still sits on my watchlist. I could change my mind and if I do I’ll let you know.

I have a feeling I am committing a mistake in front of everyone by not selling some of the other names in the portfolio to make room. I won’t hesitate to tell you that the quality of NVR is much higher than the quality of one of the other names.

However, I believe the forward returns to be higher with the other names which is why I am holding out. This could be a huge mistake as I am choosing prospective returns over quality.

If one believes we are headed for a massive build cycle in the US locking in a 10% earnings yield today could prove to be a nice buy if earnings grow into the future. I am not an economist so your bet is as good as mine but I own stock in a lumber mill so that should tell you my stance on what I think.

NVR has proven to be a simple hold for investors over time. Through its performance, the company has shown it can deliver results year after year and drive returns for shareholders. This doesn’t mean it hasn’t been bumpy. Shareholders who bought prior to 2008 had to sit through 3 separate moments of 40%+ declines.

Those who have had the stomach to hold on have been rewarded but who said long-term stock ownership is easy?

There are two main themes that I think will continue for the company. The buybacks will continue to shrink the share count by a few percentage points a year and income growth will continue mid to high single digits maybe even low double digits. These two expectations are somewhat conservative using the companies historical records.

When you pencil those together they provide a nice return already without counting for possible expansion in the multiple.

I am happy I was finally able to sit down and give this company the time it deserves and I wish I had done so sooner.

It is hard to bet against this name as it has been an absolute workhorse since 2001 when Norbert first wrote it up. Since then they have continued to execute on their operating system and it has been beneficial to owners. I believe them to be a high-quality organization and definitely have a spot on my watchlist. Maybe one day I will get a chance to own it.

Disclosure: At the time of this writing I do not own shares of NVR

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

Some resources that helped me with my own research:

Norbert’s write-up on VIC: https://www.valueinvestorsclub.com/idea/NVR_Inc./1871818862

Eagle Point Capital’s NVR Write Up: