Pondering Shopify

My Adventure In Entrepreneurship, Starcraft Strategy, and Call Options

Disclosure: The Family Fund is long SHOP at the time of this writing.

At some point during my sophomore year in college, I decided to read, Rich Dad Poor Dad by Robert Kiyosaki. Forgive me for my ignorance but when you don’t have a rich uncle to point you in the right direction you thrash around in the water for a while. Books help. And there are people who have sworn by this book. So I decided to give it a shot. I came away with one large understanding, if I want to get rich, I need to own assets.

Listen to the Podcast

Spotify:

Apple:

Now it took me another year to view public equity ownership from the same perspective that Robert talked about rental properties but that is a story for another time. I’m a slow learner. It takes a little while for information to seep through the surface. Stocks take years to work which was too long for me so I texted my roommate and said, “We are starting a business.”

“What kind?” He replied. A great question.

Google search, “what is the easiest business to start” and the first result was a Shopify post on “How to start a T-Shirt company on Shopify” so I clicked. After the short 10-minute video explaining how easy it was to set up a store, link a fulfillment provider, and boom, you are a small business owner.

“A T-Shirt business” I texted back not more than 30 minutes later. Some game plan.

“I like it”

I walked into 8 a.m history a college student and I walked out an entrepreneur. Without Shopify, it wouldn’t have happened.

To build brand awareness I forced my friends to wear the shirts to parties and gave away merch to people I knew had a decent following. We plastered stickers all over the place. After a few months, there were about 50 or so people wearing our staff on campus. It felt pretty good.

But all good things must come to an end and I never had a passion to be in the T-Shirt business anyway. We shut it down 4 months later but not before making enough profit to pay for a few weekends. What I should have done was take the profits and bought $SHOP when it was $90 a share. Oh wait, I did that too but after reading The Intelligent Investor for the first time I sold it at $150 because there was little quantitative logic to make the valuation rational.

When the share price started to take off I kicked myself because I knew the product well and saw its power. Then when it really took off during COVID you can imagine my cocktail of emotions.

I was a card-carrying member of Buffett and Mungerviile and they would never buy a stock with a triple-digit PE so I wasn’t even going to give the idea the time of day. I was committing the authoritarian fallacy Munger talks about, which was ironic. I talked myself off the ledge remembering I dismissed the company because it was “out of my circle of competence” but I used the term as a scapegoat. It was a way to write the idea off without having to do any work. It was laziness.

Fast forward to November of 2021 and the share price starts to come back to earth and my fire of interest begins to grow larger as the price keeps falling. During the same time, I learned about Mike “Non-Gaap” and his write-ups on Shopify so I thought it might be a fun place to start in terms of research.

Here is the article:

Well, it was. He then wrote about the evolution of Tobi Lutke as a leader:

Reading the title connected memory of hearing about Tobi on a Podcast with Tim Ferriss where I believe he said Tobi was one of the best public company CEOs. Which only made me dig deeper.

These past few months have become a bit of an investor odyssey. I’ve challenged my thinking, gone back to the drawing board, and put my process under a microscope. There is no desire to rattle off memorized answers from my heroes. This helped when I first started. Now, there is only so much value from rereading The Snowball. Thinking for myself has been liberating and I am slowly getting more comfortable in my own skin. This shed has pushed me to drop some thoughts and ideas and embrace new ones.

One of the new ones that have been on my mind a lot lastly has been the triangle exercise that Bill Miller uses/ has used with his associates. When I first read about it I found it incredibly appealing and most of all, fun.

It’s simple, just write down the name of a company and ask, “What is it?”

Now, we investors might lean heavily into the logical and mathematical definitions but leave this at the door for this experiment because an answer of, “A company that makes $3 Billion a year” is lame. Think a little deeper. Throw everything you can at it and make it crazy. When Wittgenstein asked the same question about a simple triangle, he gave 11 answers and a business is way more complex so have at it.

This game is a gateway to seeing something from multiple perspectives. It flexes the “worldly wisdom” muscle. Take a name, think of how you would label it from each discipline, and go from there. What we saw from Non-Gaap is an excellent example of what it means to blend multiple disciplines together. In the spirit of honesty, I wouldn’t have been able to see the value in Shopify if it wasn’t for this piece.

Shopify: Make Entrepreneurship Easier

“Shopify is a leading provider of essential internet infrastructure for commerce, offering trusted tools to start, grow, market, and manage a retail business of any size.” -First sentence of their 10K, (Well 40F because they are Canadian)

The word infrastructure brings yawns. It dosen’t sound sexy. But this is where the magic lies because when the boring things are done really well they are taken for granted. The second they don’t, it is everyone’s worst nightmare. Think about how you drive home every day, how often do you think about the pavement? Probably never. But how often do you think about it when there is an ongoing road job?

The best infrastructure stays in the background but this doesn’t make it less important.

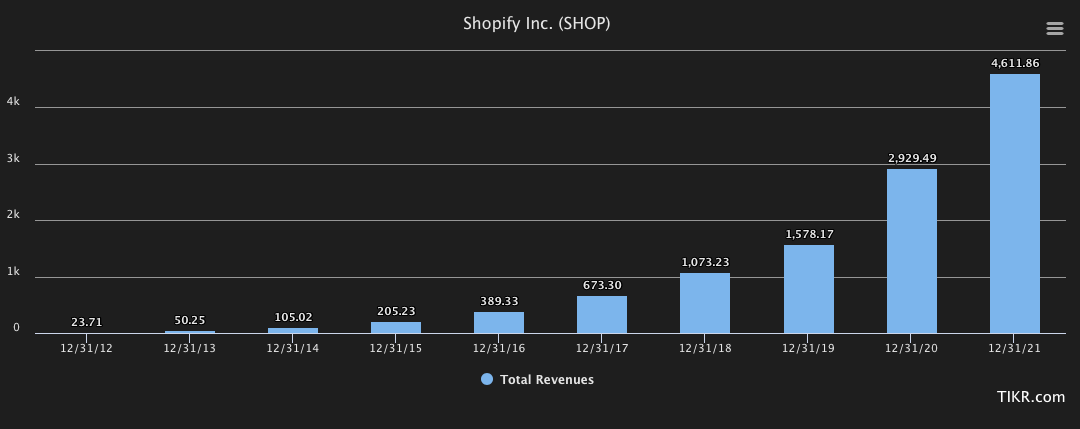

Shopify is working to build the best infrastructure for entrepreneurs to leverage. They do this through two lines of business.

The first is the monthly software subscription that gives you access to their platform. This one product makes building an online store as easy as sending an email. I did it and I know nothing about software engineering. I frame this offering in my mind as leasing a storefront.

The second portion of the business is Merchant Solutions. The subscription gets you the storefront and merchant solutions to help you run the store. When someone decides to start a business, let’s use my T-Shirt business as an example, there are plenty more problems that need to get solved before the first sale is even made. How do I get inventory? How do I accept payments? Do I need a separate bank account? How do I ship things? What the hell is accounting? Should I run ads? This list goes on and on. Sometimes the weight of it all crushes the spirit of the creator and they give up because it’s too much.

Shopify helps answer some of these problems and is working to solve more. Right now they have 10 solutions:

Shopify Payments: Collects the revenues and pays them to you

Shopify App Store: Where Entrepreneurs can buy apps that have different offerings making their lives even easier, like sourcing wholesale products with Oberlo or maintaining a loyalty and rewards program with Smile. Some are paid and some are free.

Shopify Capital: A small lending program to help with working capital, like I need a loan to buy inventory, without needing to go to a bank.

Shopify Balance: A small business bank account linked directly to your Shopify Dashboard keeping all your financials in one place.

Shopify Pay Installments: A Buy Now Pay Later with payment installments like “Buy for $30 now or $10 for the next 3 months”

Shopify Shipping: Helps you create shipping labels without having to go to the Post Office, a huge time saver.

Shopify Fulfillment Network: This is a work in progress, and they have invested a lot of money to build this up, this is the delivery arm for merchants can use to store products all over the country and have them picked packed, and shipped by Shopify.

Shopify POS: Hardware for offline transactions that are linked directly into your bank account.

Shopify Email: Self-explaining. Have an email with your name and business website. Simple but you would be surprised how many hoops one needs to jump through to do this.

Shopify Markets: This allows you to sell in multiple markets around the world.

It’s not hard to imagine in a few years’ time there will be even more offerings in this segment that will only continue to make it easier to build and run a business. These solutions, “Arm the rebels”.

The Call Option on the Decentralized Economy

Over the last few years, we have seen a bigger and bigger move into the world of the creator economy. It has been glorified a bit. I can’t scroll through Instagram without seeing someone with a product to sell that isn’t a big brand name.

From observation alone, the underlying trend is climbing up and to the right. The day of every individual being able to make a living doing what they are good at is closer than we think. Before there was a big chasm to cross when someone wanted to venture out on their own. The internet closed this gap a little. And now, SHOP is making its mission to close it completely.

Shopify is doing for entrepenuers what the Federal Highway Act did for cars.

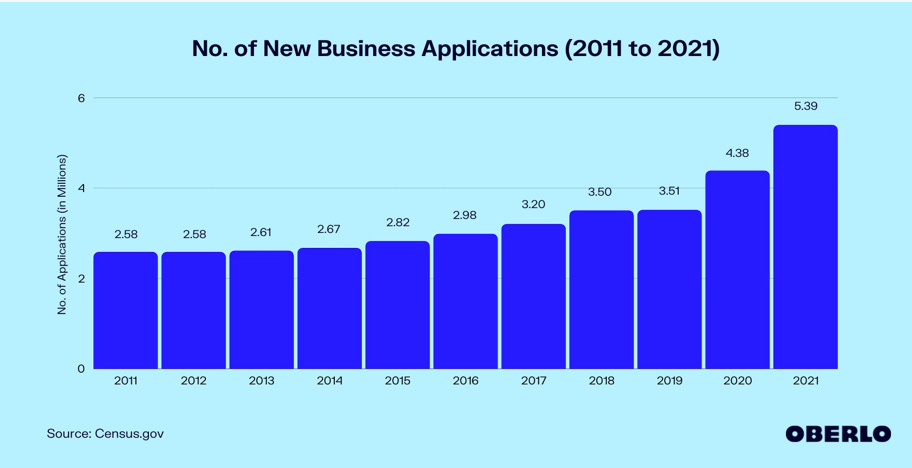

Looking underneath the hood I see a company that is rapidly accelerating the pace of innovation by lowering the barrier of entry into the world of entrepreneurship. This lowering will bring a flood of new entrants and cause some disruption.

We are starting to see the shift now with, “The great resignation” but I agree with Harley Finkelstein, Shopify COO, when he spoke about how it really isn’t, “The Great Resignation, it’s the great reset.” Individuals are becoming more and more aware of spending their time with their life’s work and are using entrepreneurship to push for their own independence.

Is there a correlation? I’d argue it’s more likely than not.

“We consider our merchants' success to be one of the most powerful drivers of our business model.” - Shopify 40-F

Why? Because when the merchant has a successful business grow, Shop benefits with them. More revenue for the merchant translates into more revenue for Shopify. Back to my T-Shirt company. If I sell 10 shirts a week, that’s 10 payments are processed by the shop, and 10 shipping labels bought through the Shop platform. What happens if my business starts to do 500 shifts a week? My revenues increase but the money I pay to Shop also does too, which I am happy to give to them for the value they provide through their services.

See what I am getting at here?

Each new merchant is a call option for Shop. Most will expire worthles but others will hit big, really big. It’s the 80/20 principle. So how do you win this game and grow? Get as many call options as you can with a small acquisition cost and try your best to help push each new business into the next level of success because their success is your success.

Now here are a few questions I am still thinking about:

1)What would you pay to have a piece of the entire creator economy?

2) By making failure essentially cost nothing, will it make more people try again and again?

3) Will these entrepreneurs get better with each falure, making the next itteration have a bigger chance to work? Thus increasing the odds of more revenue for Shop.

Peace and Love,

Michael

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.