Patrick Industries (PATK)

A component supplier for major OEMs in RV, Marine, and Manufactured housing. You might have never heard the name but they have compounded earnings ~40% a year for the last 10.

Here is my analysis of PATK, if you are intersted in learning more about the company or my research that goes along with this article you can download the 44 page PDF complete with analysis and the full supporting reserach.

Disclosure: I do not own PATK Shares at the time of this writing.

Patrick Industries (PATK) first came into my circle of attention about 6 months ago when running a screen. For me, screens have been a way to filter down ideas into simple metrics correlated to compounding capital. EPS growth, ROIC, and ROE have always been a mainstay of my search process, and finding a bunch of names who fit the hurdle rates makes the search a little narrower.

The first thing you notice when you look up PATK on a chart or a financial analysis provider is most of their metrics move up and to the right. They have been able to compound earnings and cash flow at ~40% and ~53% over the last 10 years. Impressive. This growth in the business with little to no change in the share count has led to a 9-bagger and an annual CAGR of ~26%.

When I see these results from an unknown name, I can’t help myself.

Patrick Industries is a manufacturer and distributor of small components that are found in RVs, Boats, Manufactured Houses, and in some industrial verticals within big box retailers. They mainly serve large OEMs in each respective product line. In 2022 their RV segment accounted for ~53% of total sales followed by Marine with ~21%, Manufactured Housing (MH) with ~15%, and industrial with ~11%. In total, they generated $4.8B in sales, $328M in net income, and produced an EPS of $13.49. The company prides itself on its longstanding relationships with OEMs, many of which are measured in decades.

There is little sex appeal in selling components. You get little recognition, no matter how good you are. Think about when you buy a pizza from your favorite spot. They don’t make the sauce, cheese, or toppings, they just assemble it. PATK is the person who provides all the ingredients for the OEMs to make the final product and sell it under their name. Even though they get little recognition for it, they are selling to all of them, so the volume makes up for the lack of brand appeal.

The Rub

You don’t 10x because you are the best provider of steering wheels to RV OEMs. You 10x because you’re a PE firm disguised as a component supplier with permanent cash flows to reinvest using a simple formula:

Earn money from existing operations, use the extra cash to acquire more component suppliers, don’t overpay, rinse and repeat.

Over the past 10 years, we have seen them do ~$2B in acquisitions which have led to a cumulative FCF of $1.27B. Not a bad ROI. The only part of the process which I am not a fan of has been the growth in debt to equity since starting this buying spree.

In 2013 debt to equity was .7 and is now 1.5, during the same time the goodwill balance increased from $17M to $638M, which means most of the purchases came with hard assets to backstop the debt. A position I favor over using intangibles as collateral.

If it were up to me, I would have liked them to finance more of the purchases with cash. This might have slowed growth a little but levering up a cyclical business comes with risks I’d rather not take on. If the tide goes out at the wrong time and they need to meet maturity, it could be ugly. For example, this year they had a $180M maturity that was refinanced out to 2027 with a revolver. There is a reason they refinanced instead of paying it off.

I am a bit conflicted inside with the use of debt over the past 10 years because the choice was either debt or issue equity. In this case, I am not sure which is worse, diluting the share count or heightening the levels of debt. When weighing the two, it looks like debt was the right decision, for now. For me, I’d rather not have to choose.

Two Big Variables

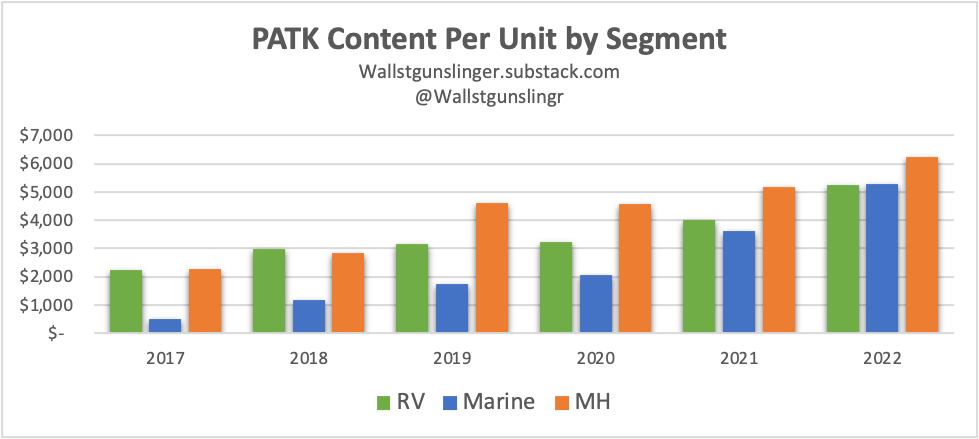

PATK’s business value is driven by content per unit and the number of OEM units sold each year.

Content per Unit

This one carries most of the weight. Even in down years, PATK has been able to support its own growth because of the increase in content per unit each year over the last 6.

For most of its history, PATK was a supplier to the RV and MH industry, but the decision to introduce Marine was a good one. They were able to transfer their knowledge from RV manufacturing and apply it to a new vertical which has grown to make up 21% of sales. The total percentage of marine as part of total sales will likely grow and it wouldn’t be surprising to see this trend continue with other complementary verticals being added over time. Don’t ask me which ones, but I bet they will rhyme.

The focus on this metric can provide a buffer against downturns in the industries for example, in 2017 we saw a small cycle in a decline in RV sales, but the company was able to weather this storm well and still comes out at year-end with an increase in sales and operating income YoY.

Make no mistake, PATK is an RV-heavy company with 53% of total sales coming from the segment and two RV OEMs (Thor and Forest River) making up 40% of the overall sales. But the ability to grow content per unit in all 3 main segments in 2017 meant that the industry downturn did not translate in the same way to PATK. The same thing happened this year as RV shipments declined and content per unit increased leading to a YoY increase in overall RV sales.

The ability to grow content per unit has provided a type of redundancy to keep the company growing even in harder climates. It will be interesting to see how this “trend” holds up with the RV decline looking to be larger than the past 2.

Total Unit Sales

The company can maximize content per unit in the short run (5-10 years) but the total number of units sold in each industry governs PATK’s ability to grow. Right now, the demand outlook for 2023 is a bit bearish.

In 2023 the RV industry is in the midst of a downturn. This isn’t surprising given the record number of units sold in 2021, topping out at 600K, last year in 2022 it was ~490K and the estimations for 2023 are ~340K.

At the end of 2023 it will have been 2 full years of declines in product volume and PATK’s sales and financial performance will suffer because of it. They could do what they did in 2022 and increase content per unit enough to keep the level of sales flat or +/- a small degree but the gravity of this pullback makes this analysis skeptical that they will be able to repeat the same trend for a second year in a row.

When it comes to Marine and MH there doesn’t seem to be the same ultra-bearish outlook. It has been guided that Marine wholesale shipments will be down low double digits which is meaningful, but nothing like RV where we are seeing ~30% decline. Marine outlook for the year could be between 170 to 180K units and MH could be anywhere from a flat YoY of 112K units to down a little given the correlation with housing starts which we have seen a pretty good decline since April of 2022.

When we stack all three of these together, the consensus for units sold this year points to a decline in RV, a decline in Marine, and a pick ‘em in MH, up or down a few points. This means it is likely PATK won’t be able to have the same financial results they saw in the last fiscal year.

I don’t see this as the worst thing in the world, it is the nature of the beast when you operate in cyclical verticals. For a company like this, the question becomes whether can they make enough money in good times to ride out the slow to stagnant bad times, which for the past 10 years they have been able to do.

However, if we are to look back to the cycle prior to 2017, the GFC cycle, the industry took a long time to come back and PATK took 5-6 years to get back on the footing it had before the crash, we haven’t seen one of those in a while and should it come, this company could be in for a heap of pain.

How Much Does This Business Make?

The ability to generate earnings for this company links to the variables above when content per unit is increasing and the total number of units is growing the company does well. But we aren’t there, the unit volumes overall look to be headed down and the levels reached in the near past might not be seen again for a few years.

From here I would be comfortable saying the normalized meaning power of the company probably ranges in the realm of around $250-$325M in EBIT per year with operating margins around ~8-9%.

What Would I Pay For It?

Now, if we take those numbers and assume non-growth or M&A in the future, based on the margin profile, the customer concentration, and the near-term outlook for the industry I would feel comfortable giving this company an intrinsic value of around 5-6x normalized EBIT, which translates to a value ~$1.25-$1.95B today.

The biggest problem I have with this value is the 3-year stack was a good one, one where there was a year with a record number of units sold in their biggest business vertical (600K RV units in 2021) and I don’t feel confident saying we will reach that number again anytime soon or at least within the next year or two, I’d be shocked if we get back there by 2025.

With this in mind, in a future where the normalized power decreases and thus the EBIT multiple increases so paying 5-6x today might show up to mean paying 7-8x a year from now.

This valuation assumes no growth in M&A which would be unrealistic given the company’s history.

2027 Outlook and Estimate

I did my best to put together a range of outcomes for this company once we have bottomed out in the RV cycle and begin to come out the other side.

Here are some assumptions incorporated in the estimate, first) I think by 2027 the industry will have had enough time to bottom out and begin to recover even to a level of 500K units in RV which would still be less than the record set in 2021. In Marine and MH, I estimated the total units to be a little higher than the forecast for 2023 with units ranging from 190K to 210K in Marine and 115K to 125K in MH.

The next assumption is the growth in content per unit, I assumed they would be able to reach ~7.5 K, 7K, and 6.5K in RV, Marine, and MH content per unit respectively. This would mean growing at lower growth rates than they have shown in the past and most of it is likely to come from M&A.

How many more components can they capture? Based on the average selling price for each unit, RV ranging from ~$75K to $300K, Marine ~$180K, and MH $162K the total component content served by PATK is still less than <10% of the selling price. This tells me, there is still a runway ahead. Will it be like the past? Probably not, but that’s why I have the next 4-year growth in CPU less than the past in this estimate.

My confidence interval on this forecast is low given the uncertainty in the outlook for the industry over the next couple of years, but I will be able to update this analysis as time passes and see how PATK does with M&A over the next few years.

If they can continue to keep content per unit climbing with the backdrop of a decline in industry sales that could be a signal for the normalized earning power heading into the next upcycle.

What to Look Out For

The business has some real customer concentration (especially in RV OEMs) and even though these are longstanding relationships spanning decades there is still risk here. This is a cyclical industry so there are ups and downs. Selling RVs, boats, and MHs is not like selling Netflix subscriptions. These are once-in-a-few-year purchases if you can afford them. I have always heard good things about campers, but I haven’t heard the same about boats, I am sure you know about the happiest days as a boat owner.

The other thing that gives me concern is the management team has bought little stock on their own accord and has sold a ton of it. Management sells the stock for all kinds of reasons, but when their only ownership is through grants and options, it makes me wonder.

Closing Thoughts

I came to PATK because I couldn’t comprehend a component supplier compounding earnings at >40% a year for the last 10 years, it all came down to the simple formula: take cash thrown off from the operations and reinvest it back into the business by adding more and more companies onto their “platform”.

Leveraging their deep relationships and adding more solutions means fewer phone calls for OEMs which is a win-win for both. With the heavy reliance though comes some serious customer concentration risk. Is it likely they leave PATK? I don’t think so but it would be a crucial risk to miss if not taken into consideration when assessing this company.

Their platform is likely to continue to grow through up and downs, cycle after cycle, and the current balance sheet give them plenty of runways before any major obligations arise. Given the backdrop, this is a big plus.

I will be watching the sales of each of their verticals through the rest of the year and paying close attention to their M&A activity. Great companies get stronger in hard times and if we are on the precipice of a downturn, their actions will tell us all we need to know.

The market currently values the business at a market cap of $1.5B and an EV of $2.75B. If I see a market cap below $1B and they continue to add content per unit, I will be giving this name much more thought. But right now, I am going to stay on the sideline, there is too much uncertainty about the earnings compression, and I can’t put a high confidence interval on the outlook for the earnings over the next 5 years, with time and new information that could change, but for now, I’ll stay a spectator.

Disclosure: I do not own PATK Shares at the time of this writing.

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

Great post Michael. We are long-term shareholders in the company and we think the business is currently underappreciated and that the valuation is very attractive. Although we share your concerns about the business cycle, my opinion is that one has to buy these businesses when there are some clouds over the next few quarters.

You did a very good job in describing the company, so I don't have much to add. Maybe I would highlight the following points (in no particular order):

- I would point out the nature of PATK's cost structure, which is highly variable as automation is not high in the industry. That makes economies of scale very difficult to achieve, but it gives you some cushion during recessions. Although economies of scale are not high as I said, the limited size of the market (for most parts production may be less than 200k units per year) makes future competition to be very unlikely.

- LGI is a formidable competitor as you said, but overall market shares mask the reality that industry concentration is higher than it appears. Although they do compete for the same customers, they specialize when it comes to specific pieces (LGI has historically had a stronger aftermarket business). Obviously, OEMs would not risk their supply chains with just one provider (as the recent supply chain crisis has taught us), but it is true that for some pieces the suppliers have almost total control of that niche.

- I also worry about OEMs' future vertical integration plans (as the acquisition of Airxcel by THOR exemplifies), but I think it has been an one-off acquisition. For what it's worth, in my conversations with PATK they don't seem to be very worried about this trend (I cannot comment about the marine side). They are very close to their customers so one would assume they know something. It is true that THOR's future growth plans are less enticing from now on (European market is a less attractive market for THOR as it is a highly motorized one, and further US acquisitions would probably encounter antitrust issues), but I think at some point (when the cycle turns) they will pivot to share buybacks as the most rational use of their capital.

- Finally, as you point out, Indiana is where the industry is localized. That gives some advantages, in terms of costs (labour is an important component of total costs) and in terms of competition, as the industry is not exposed to international competition, as it has happened in the auto industry. I think this last feature has been crucial in sustaining a good level of profitability in the RV industry, and more importantly, it does not seem it will change in the future.

I wrote some months ago an analysis on PATK, just in case you are interested:

https://seekingalpha.com/article/4563287-patrick-industries-serial-acquirer-with-attractive-end-markets.

I hope it helps.

Thanks!