$NICK Thesis

A pile of cash, plenty of experience, and skin in the game

Disclosure: I hold a position in NICK 0.00%↑ at the time of this writing.

Last week I published a post about Nicholas Financial (NICK from here on out) and it was a roadmap of events that have occurred over the last year. If you have not had a chance to take a look at it here it is:

After doing the work, I found the situation to be interesting and the price provided enough margin of safety that I decided to take a swing at it. Although the last post was akin to a timeline, I did write down a rough thesis that I will now articulate. I believe with every investment decision I make there needs to be a paper trail to look back on as the future plays out. This of course will be helpful whether the investment works or not.

90 Second Pitch

NICK currently trades $7.00-8.00, I estimate the intrinsic value to be ~$11.50-$16.

NICK is primarily a subprime auto lender with a book of loans. They generate earnings by collecting on the finance receivables. As of the most recent quarter, there are ~$140mm down from ~$162mm in May of 2022.

They have recently taken part in a refinancing of the balance sheet and a restructuring of the operations that I believe have created a better foundation for the company to build on.

The refinancing freed up around $4.81-5.75 in cash per share which the board has signaled they are looking to allocate to either share repurchase or investments outside their traditional business. They (the board) currently have plenty of experience with capital allocation and all together own ~35% of the company, with the Chairman approx. doubling his own share ownership a few months ago at an average purchase price of ~$6.57 a share.

After the new corporate restructuring, there should be cost savings annually of around ~$20-25mm which will approx. double operating income overnight. There is the possibility for a recession on the horizon, combine this with the speculation that interest rates can move a lot higher, and we have a depressed share price. If both of those risks show their face in an aggressive fashion, this company will suffer.

From their most recent quarter, they have a book value of $13.11 and a loan-to-equity ratio of $1.45-$1. Most subprime borrowers run their businesses at a 2-3 / 1 ratio. If the causes for concern are overblown and the loan Portfolio can produce sufficient earnings we could see a nice return. If the latter occurs and management is able to allocate the excess capital effectively we could see a great return.

Overall I think we could see a downside from an $8 share price of ~$3 per share if everything rolls over. On the upside, I think we have the potential to return to 1-1.5X book value if the loans can produce and capital is allocated in an effective manner. Thus I am risking a 40% loss to a possible 60-150% gain at the current share price with no consideration for further growth.

This is not investment advice. These are my thoughts. Do your own due diligence and consult with a financial professional before making any investment decision

Longer Version

I am going to break this thesis down into 4 sections: positives, negatives, valuation, and risks.

Positives

I have come to a point in my investing career where I really can not stand behind an investment if I don’t like and trust management. This is cliché but the importance can not be overstated. I once heard that the bridge between shareholder value and intrinsic value is capital allocation. I have yet to find another expression so true. This is why a vast majority of the investments that I make have a large capital allocation theme to them. This one notwithstanding.

There are two big variables for me that are the driving points for this thesis. The shift in capital allocation and the recent change in operating structure. These two things to me bring with them plenty of positive forces working in the same direction that when combined can represent a significant upside opportunity. I will flesh out each of these so you have a detailed look at how I see this.

A Pile of Cash, Plenty of Experience, and Skin in the Game.

This company went from 0 to 1 in my mind because of the facelift after the refinancing. During the old lending agreement, the company was unable to pull the excess capital out of the loan business to reach an appropriate loan-to-equity ratio that would translate into a more optimal return on capital employed. As stated in the letter to shareholders from the Board back in May the company was currently sitting with a ratio of about $1.45 loans to $1 of equity when the optimal ratio would be between $2-3 loans / $1 of equity. Before they were unable to reach this optimal level, but with the new lending agreement, it is much more doable.

What this will do is bring equity out of the lending division (referred to as NFI going forward) and be placed at the parent level which will then be allocated elsewhere. It is looking like the parent company will be sitting on between $30 to $50mm. This is a significant amount of money for a company with a market cap at the time of this writing of $56mm.

The capital will have “no strings attached” and the board can do with it, pretty much as it pleases. This to me, is a positive, here’s why.

The board is made up of 5 members and as a group, they own around ~35% of the business, the largest shareholder is Adam Peterson who, through himself and his fund, controls around ~33%. (I believe these numbers are higher on a percentage basis but we will see when the new proxy comes out) 3 of the 5 board members are also on the Boston Omaha (BOC) board where Adam is Co-CEO. Boston Omaha itself is a holding company with multiple business lines including Fiber Broadband, Billboards, Surety Insurance, and Asset Management.

When I look at the track record of capital allocation that is BOC it is easy to see that these individuals, Adam, Jeffery Royal, and Branden Keating all have experience in their own respective industries, which combined produce opportunities for investment. Adam has been more focused on investments running The Magnolia Group which has managed private investment partnerships since starting in 2005. Jeff has a background in banking, he is the President of the Dundee Bank of Omaha and Brendan is the CEO of Logic Real Estate and runs 24th Street Asset Management, an investment firm with a focus on real estate. Logic is also 30% owned by BOC.

What they have been able to do at BOC leads me to believe they’re fit for the job of allocating the extra capital that has arisen in NICK. I am confident that will make the right decisions that will lead to an increase in shareholder value and if they don't their money will be lost too.

Where is the money going to go? I am not sure. I would have to say that it is likely to be invested in the areas in which the board has a big expertise in. Any of the lines BOC currently participates in seems like it will be the most likely fit. BOC has begun to allow outside investors to invest alongside them in their new asset management division. I won’t be surprised if a large portion of NICK’s extra capital ends up there.

Either way, I think the bottom line is they are going to respond opportunistically with the new excess capital and they deserve the trust of shareholders to allow them to invest it on their behalf. The great part is, they are shareholders too.

New Outsourced Operating Model

In November of 2022, NICK made the announcement they would be changing their operating structure. Not a small adjustment but a massive overhaul. What used to be a branch model got the ax and in one fail swoop, they decided to close 34/36 branches, let go 82% of the workforce, and outsource all of the receivable management to Westlake Portfolio Management. Going forward Westlake will be responsible for all of the duties that come along with the collection of these receivables.

This new outsourcing model will create substantial cost savings for the company. These savings will translate to a much higher bottom line. Here is a simple example of what it would have looked like if the implementation was done for fiscal 2022.

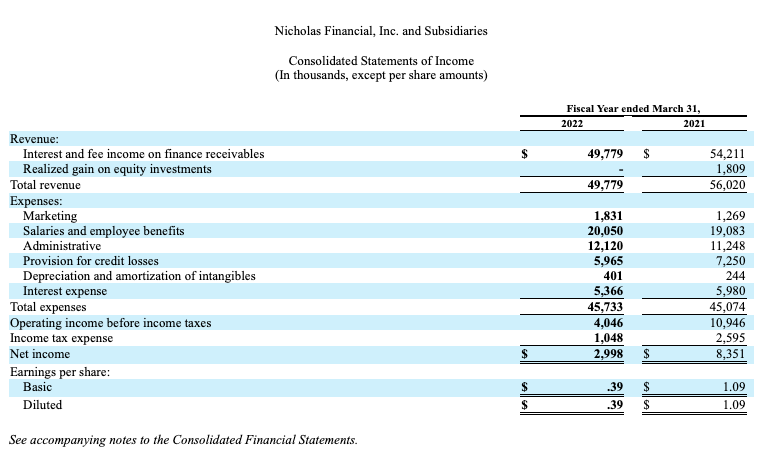

Here is NICK’s income statement for 2022:

If we took away 82% of the Admin and Salaries line we would have a cost savings of $26.2mm which would have increased the operating income from $4mm to $30mm.

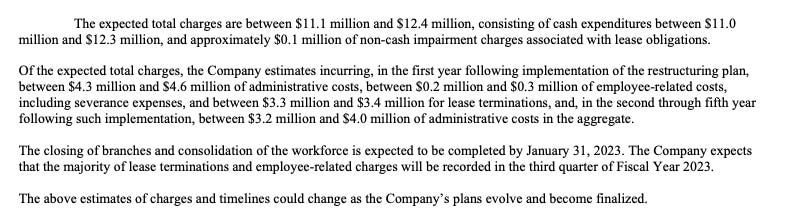

Do I expect that kind of rough translation after this implementation? Absolutely Not. This was just an example of what could be in the works for margins going forward. I expect revenues for the years going forward to be in decline and they are going to incur around $12mm in costs related to this restructure in year 1:

Now, I might be overthinking this too much but does the term “in aggregate” mean if you add up all of the admin costs for years 2-5 you get $3.2 to $4mm, or is that an annual charge? I am fine with it being an annual charge so that’s my assumption but I’ll be happy if I am wrong.

Overall this new operating structure could prove to be pretty lucrative if the loan portfolio doesn’t roll over.

With this change also came an interesting separation. During the shareholder letter, the board was looking to separate the NFI business from the excess capital in the parent company, NICK. They spoke about how the earnings from NFI going forward could be sent as a “dividend” non-recourse to the parent, meaning, all cash sent to NICK would be no longer applied to the NFI capital stack as it remained a separate entity. If NFI blew up, the creditors could not come after the money from the parent. This was one of the restrictions they were looking to alleviate and with the most recent refinancing, I believe the odds are good but I am not 100% certain.

Negatives

This company does not come without its ugly side. At the end of the day, the company has a portfolio of loans that are subprime to borrowers who can not obtain a regular auto loan through traditional outlets or credit unions. These loans can prove to be very volatile and the charge-off rates are usually much higher than a normal bank. In this blurry photo, we can see from their investor day in August a static pool analysis. Over the past few years, we have seen an improvement in cumulative losses but if we throw a “recession” in here I am not sure how well this portfolio does.

The reality of being a subprime lender comes with plenty of baggage. It’s hard to predict with any large degree of certainty how this portfolio fares during a hard economic time.

Another negative about this is the move to “give a better balance of debt to equity” means the company is pulling away the redundancies that could be the saving grace during a trying time. If the equity is traffic cones filled with sand to stop a speeding car from crashing into a guard rail, they are taking away some of the cones to achieve the most effective amount. But if the car is going 150 mph, those extra cones might be the difference between life and death for NFI.

This business is also subject to interest rates and the profitability moves up and down with the moves in interest rates. Their most recent lending agreement includes the accrual of interest on the loan as a % + the overnight financing rate, if that rate moves so do their payments, thus tightening the spread they collect.

If you combine the interest rate risk with the “removal of the cones” it could spell a perfect storm where the interest rates are increasing and the delinquency rates on the loans increases.

These negatives provide a nice push in the other direction from the positives I laid out earlier. They must be kept in mind.

Valuation

When I begin my estimation of value for this company it’s easier to break it into two buckets, a lot like management did in the shareholder letter.

The first one is easy, Nick Parent will probably have an account balance of somewhere between $30-50mm so I am going to just ascribe a similar value.

Nick Parent Value: $30-50mm

The next part is valuing NFI. I steal the definition that intrinsic value is the present value of all cash flows from the asset. The loan book is no different but needless to say the cash flows can vary by a wide degree and I feel as though pulling out Excel and making a DCF model for a subprime loan book is a bit of overkill.

For the sake of simplicity, I am going to take the approach as if I was to acquire the entire book of loans. With each purchase price I am going to take the cash received and subtract the debt needed and whatever is left over will be the value of the assets.

Using the most recent 10-Q they currently have financial receivables of ~$140mm

Bull Case: The delinquency rates are as expected and the earnings of the portfolio prove to be fruitful. A buyer approaches us and offers face value for the loans. This would be an inflow of $140mm minus the $44mm debt (from the most recent refinancing) we get a total cash out of $96 million.

Base Case: The delinquency rates are a bit higher than expected and the cash flows are okay. Interest rates go higher and profits decrease because of it. Mr. Investor shows up and will take the assets off our hands for .75 on the dollar. This would send an inflow of ~$105mm minus the debt, we get cash out of $61mm

Bear Case: These loans suck, take them off our hands at .50 on the dollar. $70mm minus the debt and we get cash out of $26mm

NFI Value: ~$26mm and $96mm

This puts the total estimate of intrinsic value between $56mm on the low end and $146mm on the high end. I am going to tighten the range around the middle and place the current intrinsic value between $75mm and $120mm (Current book value is ~$95mm putting it right in the middle of my estimate) At the current share count of 7,273mm shares outstanding that is a value of $10.32 - $16.49 a share. I will note I tend to be conservative in my estimates of IV, I would rather find the floor and let the upside take care of itself.

Risks

1) I see the biggest risk being the quality of the loan portfolio. In the most recent quarter, they showed us that the provisions for losses now make up 17% of the average receivables which is higher than their average loss ratio for the last few years (see graphic above). There is still a lot of unknown in there and if the perfect storm does arrive it could spell a lot of trouble for shareholders even after the Corporate changes. Garbage in, garbage out.

2) I have been studying Boston Omaha for about 5 years now and have come to trust management to a high degree. This means I could be overlooking flaws. A big part of this thesis rides on their ability to allocate capital effectively. I think they can do it but that is because I think highly of them and I am making my assumption based on their track record. In my eyes, there could be a few rosy glasses when I look at these guys which could be impairing my judgment.

3) They could screw up the capital allocation and the cash they were given doesn’t earn an adequate return on capital or even worse, the investments could result in a permeant loss of capital.

4) THIS IS A BOOK OF SUBPRIME LOANS

5) A financial company pulling away excess equity capital during what could be the wrong time could prove to be a very fatal mistake to the lending business leaving it exposed, with less of a raincoat, to the natural storms of the economic cycle.

6) The unknown unknowns. There is always something you don’t expect and this company could become a grab bag of “fun” surprises. The best way I know how to account for this is to assume the net charge-offs will be larger than expected. It’s the best way I know to handicap this risk.

7) The stock might not move for a long time. This is what happens when you decide to invest in microcaps. They can remain unchanged for years. This is the “dead money” risk.

Premortem

When I look over the sea of uncertainty I find it particularly smart to sit here today and craft a premortem as to why I think this investment could not fair well in the years ahead.

The first reason seems obvious, especially after the most recent 10-Q. The loan portfolio and BV are highly overstated given the loan book quality that could end up being a dud and sending the ship under. Let’s say they pull the excess capital out of the business and then the assets are so bad they have to put it back into keep things afloat. For this to happen management needs to pull out every last drop of excess equity and make the switch from ultraconservative capitalization to all gas no brakes. Is this likely? I don’t believe so but this is a premortem.

Another iceberg could be the environment in the future. Now, I don’t spend much time trying to predict the macro future but an environment of interest rates rising and a recession could send shock waves through the lending system. Delinquency rates rise and the cost of borrowing with it. Not a good outcome for a company with the primary asset being a book of subprime auto loans.

If I put myself 3 years into the future and look back on the miss that was the NICK investment the reason it failed will probably fall in too these buckets, the BV proves to be worse than I expected, we have a severe downturn which again subjects the loan portfolio to delinquency rates, or management takes the extra cash, loses it all on investments and lights at least $30mm on fire.

How Much Can I Lose?

I am going to do this risk of loss analysis using a share price of $8, which is higher than the current trading price of $7.70. As a simple way of finding the floor, I am going to take the less of the values from the valuation above, ($30mm from the Parent and $26mm from NFI) of $56mm and apply even a discount that price down to $50mm or $6.87 a share just to be safe. This would be a loss of 15% using the $8 share price. This is a rough estimate using napkin math.

I want to even go a bit further and say if we expect a 40% haircut down to $5 a share that would be a market cap of ~$36mm. Should this reality appear the company would be trading for less than the lower estimate of excess capital sitting on the parent’s balance sheet with no value given to NFI.

Closing thoughts

Playing out the numbers using a share price of $8 I would estimate on the downside we are risking $3 a share or ~40%. On the upside, if the portfolio proves to be decent and can generate solid earnings with higher margins than in the past plus the excess capital is allocated intelligently for shareholders I wouldn’t be surprised if this company could trade for ~$125-150mm which translates to a share price between $17.20 to $20. I see it as risking 40% to make between 115% to 150% at an $8 share price.

I went into this rabbit hole not really expecting much but came out with a new perspective and a new position. It is going to be interesting to watch as the movie continues to play out in the company. I don’t expect anything too drastic to happen overnight. Small companies like this require even more patience. NICK has a share turnover of 11%. That means the average investor holds their shares for a little under 10 years. To show you how low that is, NFLX has a share turnover of 520%, meaning the average shareholder holds their position for less than 3 months. If this thesis proves to be correct it could still take a while for everyone else to figure it out.

Taking my initial position with plenty of uncertainty out there reminds me of when Howard Marks talks about investing with uncertainty. If you wait for all of it go away, you will miss all the investment gains. You just need to know enough and pay a price that compensates for the risk. With NICK trading below a market cap of $56mm, I think you are getting compensated for the unknowns that lie ahead with a margin of safety big enough to survive if things go wrong.

This is not investment advice. Always do your own due diligence.

Peace and Love,

Michael

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investment decisions. Thank you.

Thanks for your post. I think you might be double counting some value here. Ascribing $30-50mn to the parent company on the basis of them being able to add debt to their loan book, but not subtracting this added debt when valuing the loan portfolio in your various scenarios is adding $30-50mn to your valuation outcomes.

Thanks for the post! Two quick questions:

- Do you see any advantage in investing in $NICK compared to Adam's other companies like $BOC or $NNI? All three are basically vehicles for capital allocation, what advantage does $NICK confer? Smaller base to start from?

- Do you see any risk in Adam being spread too think between all these companies?