Netflix: Relentless Focus on Two Religions

Legacy media is coming in to take the castle, will the performance first culture be able to hang on to the lead and come out the other side profitable?

If you are interested in the full deep dive which includes the analysis and the research you can download the PDF for free below. Thanks for reading and enjoy.

About a year ago Netflix released its first quarter results that stunned Wall St, the stock which had already halved from its previous high of $700 was trading at around $350 on April 18th, 2022. 10 days later the share price reached $190 a share. What the heck happened?

“Our revenue growth has slowed considerably as our results and forecast below show. Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration - when including the large number of households sharing accounts - combined with competition, is creating revenue growth headwinds.” - Q1 Shareholder Letter

The company, who no one ever thought would slow down, was showing signs of weakness and within days people rushed for the exit. The party was over.

The start of 2022 was a challenging period for Netflix, but the ending wasn’t as terrible as some expected with annual growth in revenue, profitability, and subscribers. What most thought could be the end turned out to be a small bump and the trend resumed by the end of the year, much to shareholder's relief.

For most of my investing life, I have stayed away. Spending time on the company seemed like a waste given the sky-high valuation and what looked like a never-ending debt load. That was until the first quarter report of 2022.

A company at 50x earnings is one thing but at ~20x earnings, down ~70% from all-time highs, seemed like a good time to look below the surface.

Relentless Focus

In the first paragraphs of the Netflix 10-K, there is a section with the title, Business Segments. Underneath it states, “We operate as one operating segment.” They sell memberships for their streaming platform and nothing else. All effort goes to making make Netflix the most entertaining company in the world.

Right now, they are the largest streaming video streaming platform. They lead the industry in subscribers, engagement, revenue, and profit and they hold the largest amount of market share in terms of % of TV viewing measured by Nielsen of ~7.3% total viewing with the closest streaming competitor being Hulu with 3.3% (I should note that they trade places with YouTube who holds a similar position.)

How did a company founded in 1997, which started by mailing DVDs, disrupt legacy media in a way that now they had the target on their back?

Two Religions

Reed Hastings is one of the best entrepreneurs of the twenty-first century. A strategic genius, he took Netflix from prey to predator while all the competition still considered them the former. The reality became “How do we compete?” before the others even caught on.

Can you imagine being the CEO of The Walt Disney Company, a 100-year-old institution, with the biggest reputation for entertainment in the world answer this question about a 25-year-old company that has been making content for a decade. Bravo sir, take a bow.

In an interview with Andrew Ross Sorkin, Reed made it clear where his attention was in terms of running Netflix,

“I have two religions: Customer satisfaction and operating income. Everything else is a tactic.”

You don’t get to the top of the ladder with a subpar product and when Netflix launched the streaming business in 2007, the mission was growing subscribers. Putting more people on the platform created a positive flywheel. Adding subs meant more revenue, more revenue meant more spending on content, and more content added value to the product which attracted more subscribers.

For 6 years they streamed everyone else’s content, putting on popular shows to attract viewers. They built their own business on the backs of others until they got to a scale where they could turn from distributor to competitor. The flexibility of streaming made the viewing experience more enjoyable, you didn’t have to sit through any ads and you could watch as much as you want when you wanted. The offering was superior to cable, where you needed a hook-up, a TV, and a specific viewing time. Here, you needed a laptop and a WIFI connection.

At first, I am sure the other companies were happy to collect the licensing fees from a streaming platform. But in 2013, Netflix dropped the hammer with House of Cards and the show went on to win 3 Emmys, which was the first of any Internet streaming platform. Since then, it’s been all gas no brakes on producing originals.

This spend has been subsidized by debt up until recently when the company stated in Q4 of 2021 it had reached a scale large enough to fund the growth with cash from operations. This achievement of critical mass meant the company no longer relies on the public markets to reach its vision. They can do it on their own.

The Center of it All

The growth of Netflix can be attributed to one variable: the ability to entertain its subscribers for hours on end. This has been earned through the years by investing a ton of capital into content and technology.

They created binging and when asked why they don’t stagger the release of their shows, Reed responded, “We put out a binge-able show every week, there is no need to window”

The content is a result of the players in the organization which is run more like a sports team than a family. Less unconditional love, more accountability, and high performance. They do not mince words on their culture deck, either you are here to give it your all, which might not even be enough, or you don’t work here.

This looks harsh from the outside but this it’s the way it must be if you want to win. Even though Netflix is a business, entertainment is more akin to sports than insurance. Everything revolves around your ability to perform at the highest level year after year. If you have a few subpar years, members will leave the platform, which is a kiss of death.

There is no time for coddling in this industry. You are only as good as your last piece of work.

On top of being all in on working to deserve the title of “Most Entertaining”, they work equally hard on making sure the viewing experience is seamless.

The backbone of Netflix is its own Content Delivery Network. Think of it like Amazon Warehouses. Right now, the competition is using 3rd party delivery systems that come with a handful of other risks. Netflix foresaw the increase in streaming demand and the stress it would put on their delivery partners, so they went out and built their own.

3rd party CDNs are responsible for the delivery of content for everyone on their platform, Open Connect (Netflix’s own CDN) is focused on delivering Netflix content (Think Amazon delivery vans vs UPS/Fedex), and right now there are 18K servers in over ~160 countries. This physical investment in the customer experience could be quantified by the lowest churn rate in the industry.

This spending on creating the best defense has paid unmeasurable dividends like those of a lighthouse. You never know how many lives they have saved, but you know how many they haven’t. My guess is they are big.

Profitability

Adding subscribers to a streaming platform is good but adding profitable subscribers is divine. In 2022 Netflix turned an operating income profit of ~$5.6B, Disney, Warner Bros, Peacock, and Paramount together lost a total of ~ $14B.

“Our core strategy is to grow our streaming membership business globally within the parameters of our consolidated net income and operating segment contribution profit (loss) targets.” - 2014 10K

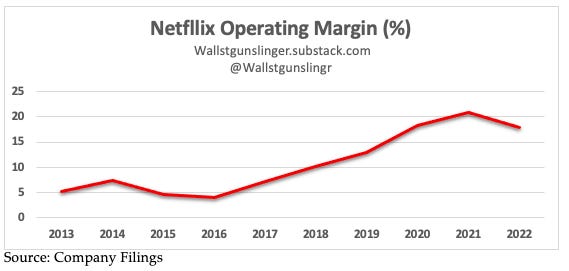

This line has been in the 10K since 2014 and hasn’t changed. The North Star is a 20% operating margin which they have been able to get around in the last 3 years.

The way they go about achieving it is simple:

“We estimate our future revenue, decide what we need to spend on content, and how much margin on top of that.”

60% of revenues goes to content, 20% for R&D, SG&A, and Marketing leaving 20% for profits.

In the past few years, we have seen a shift in operating cost structure as they believe the peak of cash intensity is behind them, now with 60% of the content on Netflix being original, this downshift in capital intensity has made the cost structure a bit more fixed instead of variable. They have built the theme park of entertainment, now they want to make sure the revenue coming through the door more than compensates for the build with a healthy margin on top.

This can come in two ways

Big Variables

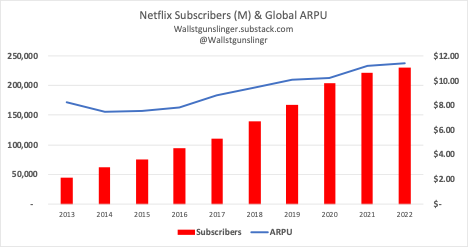

Most of the freight in Netflix is carried by number of subscribers and the ARPU on those subscribers. Running with the same analogy as before, for the theme park to grow operating income either more volume in terms of subscribers or larger ARPUs while maintaining their subscriber base. To understand the future of Netflix, one needs a handle on these two metrics and the future for both.

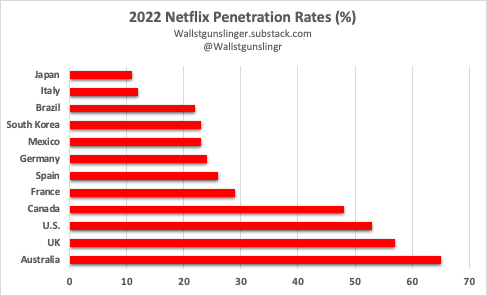

In terms of being able to add subscribers most of this growth is going to come from their expanding international markets where they have much lower penetration when compared to their mature markets of the U.S. and Canada.

Then you introduce the new effort to crack down on password sharing.

Management estimates that ~100M accounts use Netflix while sharing passwords with another account. Will they capture all of them? No way. But a 25% capture would still lead to subscriber growth, and I think picking this “low-hanging fruit” will be easier than trying to win new customers.

I would expect them to be able to add subscribers to the platform in the coming years. By how much? I’m not sure but hitting 250M by 2025 seems reasonable.

What about ARPU?

The company has been able to raise its global ARPU from ~$9.43 to ~$11.86 since 2017 and during that time there has been considerable growth in the subscriber count. We have not reached a point where the company has shown sensitivity to raising prices, but this will be tested much more in the coming years as the growth rates have slowed in mature markets which means revenue growth can only come materially from raising prices.

Then we have the new ad-supported tier.

The introduction of Ads is still a black box, and we don’t know how it will affect the company going forward. It is worth remembering that there is still a non-ad option that seems to be forgotten.

When asked about the decision, Reed spoke about how his CFO pushed heavily for it because of his front-row view of Hulu and their ability to have ads and still provide a valuable experience. Then he concluded the ability to offer a lower price tier with ~5 mins of Ads every hour gives the customer a value-heavy trade.

Reed also had a front seat to what a company can offer with massive amounts of data when he sat on the board of Facebook. He knew those with data could offer a superior product to advertisers which would translate into higher ad rates. He thought Google and Facebook would soak up most of the digital ads they have but he underestimated the demand for TV advertisers. These advertisers wanted to show ads to people between 18-35 but they couldn’t be found. Guess where they were they were?

“Ads came to Netflix, not the other way around” - Reed Hastings

Look, I am confident they will be able to grow their companywide ARPU over the coming years in a similar fashion which they have been able to do in the past. Why? They have invested in the platform content, talent, and infrastructure, and have now introduced an ad-supported tier. The Ad-tier could sell space for a premium because of the data they have been able to collect through years of viewing which might translate to higher ARPUs than non-ad subscribers. But, I wouldn’t hold my breath on it.

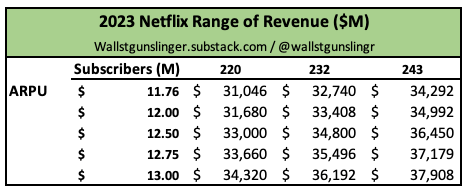

Here is a small sensitivity analysis for 2023

I am always hesitant to forecast any kind of earnings growth in the near term of 12 months or less. This would just be a range of outcomes if they are able to execute on their subscriber growth or increase companywide ARPU.

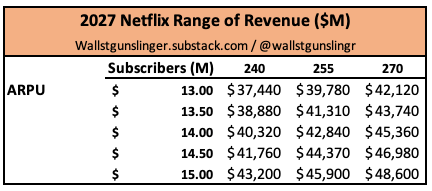

But as investors we have to look a few years out so here is an estimate for the 2027 earning profile.

I derive the earning power from the revenue numbers above and apply an operating margin between 15-20%.

These numbers might look large but the growth rate to hit the middle case of (255M subs and a $14 ARPU) would mean less than 10% revenue growth per year (which they have stated is a goal) and around a total increase of ARPU of 18% over 4 full years, numbers which I think are more than achievable.

When it comes to determining the value of the business, I ask myself, how much is a business worth that can grow revenues ~10% a year with 20% margins and 20%+ returns on equity? I would say a 17-18x multiple would be appropriate if the average business commands 15x. It could be even higher, but I don’t feel comfortable stretching the valuation into the 20s. A 5-6% earnings yield that grows over time is respectable especially when the company has margins and returns on capital in the range stated above.

What Get’s In The Way

I am bullish on the company, and I am bullish on the growth of streaming overall. However, there are a few things that might stand in the way of them being able to hit the targets.

Competition is obviously the first one. We have these legacy companies entering the space with their own offering. The arms race is heating up and we have seen quotes from Disney and Warner that they are going to spend $30B this year each on making content.

Do they all make it? I don’t think so. There will come a point when the companies will have to look into the mirror and ask, “Are we getting enough juice from this squeeze?” The term “Arms Dealer” came up in two separate interviews with Netflix management when discussing the future of the media industry. We have seen a wave of consolidation and I am sure there is more to come. There will be less # of platforms than content companies, but having one of those platforms will be a gold mine.

Getting on a content treadmill is another headwind, we have been told that the peak cash intensity of the business is behind them but if these companies are coming out guns blazing and are successful it could cause a tit-for-tat game. Netflix might have to spend more to compete and maintain its position in the market. It isn’t fun to think about them all overspending because then only the consumer wins.

Subscriber TAM could be smaller than expected. If this is the case peak subscriber count could be closer in the future than we think. I don’t think we will know this for another couple of years so it’s a thought but not a serious concern yet.

The last headwind pushing in their face could be an uptick in churn due to password crackdowns or price raises. I am sure this will increase the churn over the short term which could cause some headwinds for the company. Management has said this crackdown would hurt viewership in the near term. I wouldn’t be surprised if the market overreacts when this becomes a reality.

What Lies Ahead

If there is a trend that is lifting all of the boats, it is the growth in streaming as a means for enjoying the content. The growth in Internet speed, connected devices, and changes in consumer desires for content enjoyment have all pushed this category into huge growth even over the past few years.

Right now, streaming accounts for 34% of overall TV viewing, and if I had to pick a more certain bet to take, I would bet on the growth of streaming over any one company in the industry. Even though I have my own horse in the race, streaming is much better than cable and broadcast. So far, I have never had a cable subscription and I might be able to go my entire life without one.

Netflix is the big kid on the block and is the only one turning a healthy profit. As we have seen operating a profitable streamer is hard enough, the fact they are able to do it with 20% margins speaks to the business they have built since introducing streaming in 2007. Usually, it is the established players who spend to keep new entrants out but, in this case, it was the disruptor that jumped in the pool and yelled, “Raise the water level let’s see how good these guys can swim”.

The coming years will be interesting to watch for all the competitors and possible consolidation. I think it will become clear within the next 3 who can swim and who needs the strong players to throw them a life raft.

I will be paying attention to the growth in all the important metrics with a keen focus on ARPU and the number of subscribers. Should management be accurate in their forecasts we should see FCF ~$3B in 2023, which would double from 2022 levels. With the major content spending behind them, this number will likely grow with operating income over the years.

Right now, at ~28X EV/Pretax is a little rich for my blood. Should this drop down to the levels we say in early April of last year, I would be much more inclined to add to the position but at this price, I am holding.

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investment decisions. Thank you.

At the time of this writing, WSG does own NFLX shares