January '24 Stock Pick

A situation with a durable risk/reward that one could use to build a nice cornerstone of a portfolio.

I’ve decided to make the first pick of my new “paid” tier free to give everyone a sense of what they can expect.

So let’s get into the idea I like the most this month.

When deciding which name I wanted to highlight, my mind kept wandering back to the idea that I have recently participated in, plus will be participating in after this is sent to everyone. (I always buy the name or in this case, names, after I send out the pick each month.)

It stuck out to me because I see a risk-reward return profile that I find attractive. It will bore most of the growth investors as it deals with an asset-heavy business and IRRs that are not eye-popping.

But R/R works on a sliding scale and if I can achieve these satisfactory rates of return with a below-average risk profile, I will take the bet every time.

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your research and consult with an investment professional before making any investment decisions. Thank you.

This month my picks are a small basket of Multifamily REITs, more specifically:

Mid-America Apartment Communities MAA 0.00%↑

Camden Property Trust CPT 0.00%↑

Equity Residential EQR 0.00%↑

This is the basket I own and these are the horses I’m betting on.

You should know as the reader I am return agnostic. If I feel confident in my ability to analyze the cash flows, it can come from a portfolio of Real Estate or an Oil well. The money is green either way and if the price is attractive enough, I am willing to look at anything I feel I can understand.

I feel comfortable with these.

I can’t take credit for the originality of this pick, Bill Chen of Rhizome Partners, introduced me to the idea when he did a podcast with Bill Brewster. At first, it didn’t stick out to me but as time went on it began to age in my mind and I began to find it more and more attractive for a few reasons.

Why I Like It

1) An Asset like Multifamily Real Estate comes with a different risk-to-reward profile than a normal “Stock”

One of the first questions I like to ask myself when thinking about an idea is, “How durable are the assets and the cash flows”.

You don’t get much more durable than owning real estate. In exchange for this enhanced durability, you have to be willing to give up some returns.

Bill likes to call these REITs your “left tackle” of the portfolio and I fall in line with that assessment. Making an investment like this is not going to give you Hall of Fame returns but from where they trade today, I think they offer the ability to put money to work in one of the more durable asset classes and achieve acceptable rates of return.

This could also be known as a satisfactory return like the great Mr. Graham has instructed us all to seek. You are not going to shoot the lights out but you are also not going to shoot your foot off.

With this opportunity set, I believe you could build a solid backbone of a portfolio.

What gives me the confidence?

2) These REITs own hard assets in popular cities where long-term supply is falling off.

Real Estate is an asset that comes with inflation protection as the buildings were built in yesterday’s dollars, so it is normal for the value of real estate, in most cases, to drift in an upward movement with time.

If you are lucky enough to own property in a place where the demand to live there is outpacing the new supply, then you have a serious appreciation in the asset value over time. (We will get to the bear’s point on new supply killing demand later on)

You don’t need to venture far to run into the biggest determination of value: Location, Location, Location

Here are the top 5 cities for each name in the basket

Here is a population migration chart from CPT 0.00%↑ that I found helpful.

It would be easy to make this more complicated but I keep coming back to the simplicity of the idea of owning Class A buildings in high-demand cities is something I find very attractive, throw in the embedded inflation protection and natural appreciation of value, and it’s a cherry on top.

But it’s not the only thing that gives me confidence

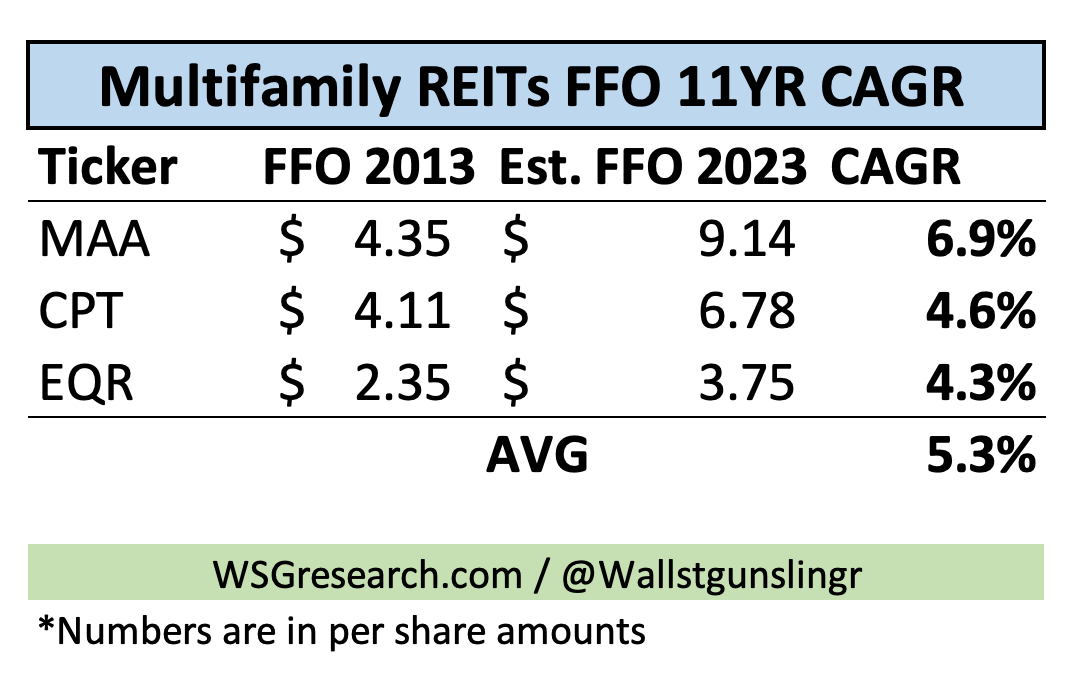

3) They have a long track record of FFO growth.

Here are the 11-year FFO CAGRs for each.

If we use the simple, Yield plus growth formula this basket would produce an annual IRR of ~12% before any multiple expansion.

Which I think is a nice kicker

4) Right now these are cheap from both a replacement and historical perspective.

Here are the current cap rates for each name in the basket:

One of the points above spoke to the inflation-protection nature of these assets and how they were built in yesterday’s dollars. Right now these REITs are priced below what it would cost to rebuild them in their locations. Why?

The IRRs for ground-up development have changed dramatically since the rise in interest rates began in 2022.

From what I have been able to gather, developers aim for an exit cap rate of 6%. Two years ago, in a ZIRP world, the returns of developing ground-up were large enough to compensate for the inherent risk that comes from developing.

But the borrowing environment has changed.

The rise in interest rates has pushed both the borrowing cost up and has brought down exit multiples. MAA 0.00%↑ for example traded at a 3% yield ~2 years ago and now trades closer to 7%, which is over a 50% cut in multiple.

If I am a developer now, my speculative returns have decreased dramatically and it’s much harder to raise money for the same amount of risk with a forecast of lower returns.

From a historical perspective, these REITs are cheap too. Cap rates on multifamily REITs on average have traded in a range of 100-200bps above the 10-YR, over the past few months we have seen the spread widen to 300-400 bps.

With this information I am betting that the odds weigh in favor of these assets trading on the cheaper side than not, giving me a comfortable margin of safety.

5) A rising tide of demand for apartments

It is much easier to invest in situations where the wind is at your back for the demand.

In this case, we have two gusts, one with the population migration into the cities that the basket represents, and two with the ongoing demand for rental properties instead of occupants choosing home ownership.

I will leave some charts here for you to ponder but the conclusion remains the same. Along with other large life events such as marriage and deciding to have a family, becoming a homeowner is one of those events individuals are willing to push off. Creating more rental demand.

I think this small detail only strengthens the argument for the premium value these assets can show in a few years.

But, this doesn’t come risk-free.

The Bear Case

From where I see things 2 huge risks come along with these.

•Overwhleming New Supply

•Increasing interest rates

Let’s start with supply.

The rent market for these REITs has turned a bit soft and in 2023, new multifamily deliveries totaled over 565K which is the highest level the industry has seen since 1980. In 2024, Co-Star expects deliveries to pull back to around 444K.

Nobody wants to stand in front of this oncoming supply and the softening rent market, which is why these trade at historically low valuations.

Supply by itself isn’t scary, it is only when the supply overshoots demand to a point of suffocation. I don’t think that is what will happen here.

If we reflect on the chart above and compare it to the top 5 cities for each of our REITs there is a minimal amount of overlap in the highest areas of new supply but we should also remember that the companies themselves only have a portion of their FFO come from these cities.

Even if they experience oversupply and softer rents in certain markets the diversification of their portfolio will hold them up.

Plus, if we reflect on the migration trends I believe the new supply will not have trouble being absorbed. Will it cause some short-term rent pain? Probably. But when we stretch the timeline out past the current supply wave, I don’t think it destroys long-term FFO growth.

I wouldn’t be surprised if the basket above has flat FFO growth over the next two years but what happens after this supply is worked through the system?

New development, as measured by multifamily starts, has fallen off since rates have begun to increase.

These assets take 3-4 years to build, giving us a runway to about the middle of ‘27 if interest rates fell today. The longer the rate stays up here the longer this timeline stretches out only enhancing the competitive position of these REITs once this new wave of supply passes.

Rents might stay flattish over the near term but once this supply is worked through, these premier assets, in strong cities, will likely have some pricing power and it is in these later years that this basket grows in value as they can raise rents.

Interest Rates

I am not naive to the reality that Real Estate is an asset class that is extremely sensitive to interest rate movements. I am not an economist and I have no view on the direction of rates but here is how I see the range of outcomes for this basket if rates move in either direction.

If They Move Up

The cap rates on these assets continue to increase and, likely, the price continues downward.

However, the effects of this increase will only make it a stronger reason to cut off more supply and thus lengthen the timeline for new supply to enter the market only putting these current assets in a stronger position.

If They Move Down:

These assets likely re-rate to a higher multiple and we get nice price appreciation in the short term.

We have a strong amount of loosening to go before development becomes attractive again but if rates fall to that level then these REITs do not trade where they stand today and we still have a good runway before new development hits the market again.

If They Stay the Same:

Supply continues to stay on the sideline and let’s say the price of these don’t move, we collect a 4%+ dividend and wait through the new supply wave. Each passing month keeps new supply off the field and only lengthens the amount of time these assets have pricing power in the later years.

Even if FFO stagnates or decreases, we have a strong 6.5-7% yield today, which is a strong return given the R/R here.

In Closing

I put my initial REIT position on about a month and a half ago but still find the opportunity set to be attractive even after a small price appreciation.

I will be buying at the higher prices because I will never write about a name I won’t buy myself.

If rates increase and these prices come down I would be open to adding more as it only strengthens the competitive position over the long term. This basket of REITs represents a portfolio of quality apartments in some of the most popular cities in America that are trading below replacement cost.

To me, this is a simple proposition where I am forcing myself not to make it complicated.

Over the next 5 years, I wouldn’t be surprised to see mid-teen to high-teen IRRs at the current prices.

I expect to see flattish rent stability over the next 18 months based on a blended rate, (new rents combine with renewal rates) then see pricing power come through in about 2-3 years as new supply thins out.

Based on a yield plus growth formula I think you can hit a mid-teens IRR, multiple expansion would be the cherry on top. If cap rates move back to 5 instead of ~7% where they are today, that is like going from a 14x to a 20x multiple on earnings, a nice tailwind.

I chose a small basket approach here because I believe multifamily apartments as a whole are on the cheaper side and it gives me an added layer of protection on incentives for each management team.

I am confident that I can say this pack of “horses” is fast but less confident in my ability to pick the one who will win the race. In this scenario, I don’t feel the need to, they will all likely trade in the same return range anyway.

I would not have come across this idea if Bill Chen had not introduced me to it. Please look at his work on the space and listen to the podcasts he did with Andrew Walker and Bill Brewster.

And check out this small “memo” he published on Twitter a few days ago on this exact topic, which I thought was great timing.

If you are looking for an idea that can give your portfolio a solid foundation to build on, this could work for you. Don’t expect it to get you on the cover of Forbes but you have the chance to put money to work at attractive IRRs in a highly durable asset class.

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

How many REITs does Buffett own?

What about a recession lowering occupancy & rents?

What about passive investment flows reversing and lowering stick market valuations?

Zero interest in this.