GreenFirst Forest Products

We have seen a year of operations, ~$140 Mil (CAD) in asset sales, and $47 Mil in FCF. Here is why I recently made the name a larger portion of my portfolio.

Disclosure: I am currently long GFP at the time of this writing and the family money I manage also holds a position.

A Long Windy Road to GreenFirst

It wasn’t much of a 2x4 to-the-head kind of decision but rather after plenty of time in terms of marinating and feels like a bathtub moment, one where you are thinking about something and the stars align in your head to come to a decision. These are interesting because they don’t scream at you but rather have been sitting in plain sight for a little while now and you could say the idea reached critical mass in order to spur action. The thought and idea reached a tipping point and describing this action are what this article aims to do. In short, I am going to describe the thinking that led up to the point and why it has become a much greater portion of my portfolio than before.

I have been an investor in the Fundamental Global complex for about a year and a half at this point so the names are familiar to me. For a long time, my only exposure to $GFP was through $BTN at the time but is now FGH 0.00%↑ . FG Holdings towns about 9% of $GFP so the success of FGH is also tied to the success of $GFP. In my due diligence of $FGH, I learned more about the deal and was comfortable having exposure to it but that was all, until recently.

During the most recent 6 months, we have seen quite the environment for the lumber market and plenty of volatility to go with it. But when we focus back in on $GFP, there have been many other events along with the volatility that I believe have taken some risk off the table and thus unlocked shareholder value that I think will slowly begin to become reflected in the stock price within a reasonable time frame.

To understand where we are today we first have to go back to where this whole thing started. In the summer of 2021, GreenFirst was a tiny sawmill that made a rights offering to finance the purchase of a basket of sawmills from Raynoeir. In a very real sense overnight the company went from a minnow to a whale and became a top 10 Canadian lumber producer with an average annual production capacity of over 900 million board feet a year. The all-in cost of the big acquisition was around $300 million (Canadian Dollar).

It’s been a year post close so let’s check in on the results so for the year, using 3Q 2022 numbers. (At the time of this writing, these are the most current numbers)

Revenues: $540 Mil

Operating Profit: $78.5. Mil

Net Profit: $42.7 Mil

Operating Cash Flow: $65.8 Mil

Capex: ($18.6 Mil)

FCF: $47 Mil

Now, management touts EBITDA on their quarterly presentation slides which show higher numbers than OCF and FCF, I’d rather stay on the conservative side and use the cash numbers. I do understand the argument that EBITDA translates pretty well to FCF in this situation but for the sake of this write up I am going to keep it simple.

Overall, I would say these numbers look satisfying so far. With the futures lumber market currently hitting lows and GFP recording negative operating earnings and very little OCF with lumber around $600 it concerns me what the results will look like with the most recent print of below $400.

So Michael, with lumber hitting multi-year lows and the mills losing money why the heck are you so interested now?

Great question. The income statement side of the business shows us the operating nature of the company. As we shift over to the balance sheet side of the business, things start to get interesting. I want to remind everyone again of an initial purchase price of around $300 Mil for the mills. Here are some recent developments from the company.

1/ November 9th, 2022 GFP sold ~203K acres of prate land to Perimeter Forest LP for $49.2 Mil cash

2/ December 21, 2022 GFP sells their two Quebec Mills to Chanters Chibougamau for $90 Mil cash

*Cough* $140 mil just came back to the company *Cough*

After seeing both these events play out, doing the math, and having the background knowledge of the directors having plenty of skin in the game, I decided to take a closer look.

GreenFirst Post Sale

5 sawmills in Ontario with an annual production of 660 MMfbm and an inflow of $140 Mil in cash. They also own 114 acres of prime waterfront real estate in Lake of the Woods Kenora that I think could fetch a sale price higher than the value in which it is carried on the books.

GFP stated in the press release that they plan to use the proceeds to strengthen the balance sheet and invest in their remaining mills. With the higher cost assets gone, the Capex will now be optimized to focus on the lowest cost assets with any remaining, “low hanging fruit” investments possibly strengthening the mills themselves.

It is with these events in the subconscious that the attractiveness of this company became much more apparent in my eyes. Why?

I have bought into the idea that we could be moving into a single-family housing boom over the next 5-10 years given the increase in demand coming online as one of the larger generations transitions to the next chapter of like with marriage, kids, homes, and Minivans (I have heard someone on the Board of GFP drives a minivan, I won’t name names). I say these words as we sit on the edge of what everyone thinks is a recession, interest rates increasing heavily, and Lumber futures hitting lows so they come with a touch of tongue in cheek. But here is why I am okay making this bet.

The downside is protected.

Right now we sit with a portfolio of sawmills with over 660 MMbfm, cutting rights to 6.1 million Hectares, and 114 acres of prime waterfront land. What is that worth?

I am not 100% sure how to value the cutting rights so let’s say that’s a wash.

Using the same purchase premium the buyer paid for the Quebec assets we can value the mills around $135 million (660 MMbfm * $204 per thousand premium) over the remaining book value. If someone bought the entire portfolio of the remaining assets it could be worth at least a price tag of $325 Mil. I believe the remaining mills could fetch a higher “premium” than the higher-cost ones that were just sold so the estimate to me is conservative.

(I got this rough estimate of value by taking the book value of the company before the sale of $266 mil, dividing it among the 7 mills giving a value of around $38 mil per sawmill. I subtracted away 2 mills representing the sale leaving me with a value of $190 mil. Adding the $135 mil premium we get $325 Mil. This a very rough gauge. Doing it this way has severe limitations but for the sake of keeping it simple I think it does just fine.)

The waterfront I am guessing is ~ $15-20 Mil from comps pulled from here: https://gregkirby.ca/kenora-lake-of-the-woods-real-estate/

Taken all together we get a value of around $350 mil, today’s market cap sits at around $250 mil. So buying the assets for $.60 on the dollar and I think this is a conservative estimate.

A Few Words on The Environment

When the underlying product that you sell is linked directly to tradeable markets it can cause some serious volatility in the financial statements and wild swings from extremely profitable to extremely not. This can be demonstrated by the look at the earnings of GFP during the second quarter:

Results from the 3rd Quarter:

It isn’t easy to run a commodity company but given the financial set up of this company, I think there are some interesting opportunities that may come ahead.

Lumber became a household word when it began to head to the moon in 2020 and we have seen nothing but ups and downs since.

Talk about volatility. I don’t have a specific view on where lumber will trade during the next 3 months, when it comes to the next 3 years though I wouldn’t be surprised if we see lumber prices continue these rapid rises and falls.

I’m gonna borrow a few charts from Tweb’s write-up on GreenFirst which you need to read if you are interested in this idea. It takes a much deeper dive into the deal that was initially proposed and then you can overlay the information new now have a year later.

Given what we have been able to see in the operating results from this year alone when lumber prices are high, cash gushes out of the business. The flip side of course is when they are not above operating costs, well you know. So the big question comes down to whether can there be more good years than bad. Given the incoming demand from the next generation of home buyers, I would say it’s more probable than not.

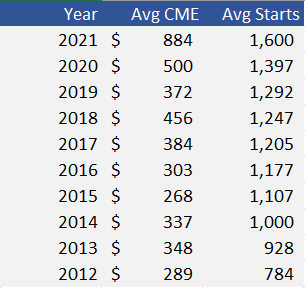

In the current environment we have been under a building since 2008 and if housing starts hovering around a sweet spot of 1.5 to 1.6 million I don’t see why lumber won’t trade in a higher range than before and thus there will be plenty of good times.

Here is a chart Twebs put together for his report that I found useful:

In 2022 we hit a little above 1.4 Mil starts and you can see the price fluctuations of lumber in the chart above.

The performance of this investment will be directly linked to the demand for housing and the price of lumber. Should we see an environment that resembles the past with lumber prices below $500 and housing starts under 1.4 Million this investment won’t pan out. We are still protected by the value of the assets but overall the thesis behind the initial purchase of these mills in 2021 will not prove to be true if those two main drivers do not capitulate. That is a serious risk here.

Closing Thoughts

Overall I believe it is prudent to put into simple words why I am making this bet. I believe at the current price, you get to purchase the entire company below an understated book value that if sold to a private company wouldn’t net a nice return of at least 40-50%, conservative. On top of that, you get exposure to a company that will throw off cash if the market conditions are good.

What makes this idea asymmetric is I believe when the cash is earned, the company will decide to do prudent things with it to really unlock shareholder value whether that be a special dividend payout, buybacks, or a tender offer. Either way. I am trusting that the executives of the company have the shareholder interests at heart. What makes me believe that is that there are at least 4 board members who have some serious skin in the game, they will be eating their own cooking. I wouldn’t be in on this company if I didn’t trust those who are leading it. Full stop.

Since this deal was put together it has been the thesis that the mills will one day gush cash, enough cash to make the initial purchase look silly. Since the initial purchase, there has not been a shareholder return plan and I wouldn’t be surprised if that becomes implemented within 18 months and a ton of shareholder value is unlocked because of it. The asset sales have taken care of the Capex needed to run the mills and thus the next logical step is a shareholder-friendly capital return plan.

The sale of the Quebec assets won’t be completed until Q1 2023 so it all be a quarter or two to see what the updated cost structure looks like with just a focus on the Ontario assets. I am looking forward to the progress that should be made within the next 6 months.

Peace and Love,

Michael

Further reading on the idea:

Twebs Article:

Mike Mitchell’s Pod with Andrew Walker describing the $ICLTF $GFP situation:

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investment decisions. Thank you.

In the end it is currently trading with lumber, no other downside is at least shown in the stock price. Frustrating to own, even if you know the assets are worth more but not sure when shareholders will be rewarded