Getting Familiar With Nelnet $NNI

Nebraska must have something in the water. A declining asset sending cash to other segments that are driving severe value.

When I was getting ready to go to college my high school held a prep meeting in the auditorium. All the anxious kids and nervous parents gathered in and sitting in front of the stage was a large projector screen with the words, “Are you ready?” I certainly was not. Back then there wasn’t much on my mind other than lifting heavy weights and trying to throw over 170’ in the discus.

As the meeting progressed there came a slide entitled “FASFA” and the presenter pounded into our heads that we needed to apply for these loans. They carried a lower interest rate when compared to private loans and the difference would save you thousands in the long run.

It was enough evidence to convince me so I went home and applied. 4 years later it came time to pay off those loans and let me tell you, they don’t waste any time making sure you know where to send the money. And who did I send the checks? Some odd company called Nelnet.

This was my first introduction to the name Nelnet. My second came when it was recommended to me by my fellow investors on FinTwit. They saw I posted about Boston Omaha and Ballantyne Strong (Now, FG Holdings) and told me to check out NNI. Then, a few weeks later I find out Adam Peterson was being elected to the board and NNI is the Magnolia Group’s largest investment. Curiosity took over from there.

About a year ago, I took a small position in NNI but no longer own the name as I have allocated the capital to other ideas. The opportunity cost has been a bit of a wash because some names did well, other’s not so much. At the time the share price was around $84 and today trades at ~$95. But I spent the past two weeks taking more time to look at the company, sticking with the Magnolia theme, and here is a small report and some thoughts around it.

Nelnet

Nelnet’s core business is net interest income from its portfolio of FFELP loans. The FFELP program began in 1965 and made federally guaranteed loans to students and parents. The company was founded in 1978 to service federal loans for two local banks, from there they grew operations to service and originate FFELP loans but this all came to an end in 2010 with the passage of the Health Care and Education Reconciliation Act of 2010. FFELP loans are no longer originated and these loans on the books of Nelnet will continue to be in decline until the very last FFELP loan is paid off or refinanced.

Even though the program ended in 2010, there are still $208 Billion in FFELP loans outstanding. As of the most recent report from the Federal Student Aid Office Nelnet (2021 document link) was the second largest holder of these loans with a total of ~$18B loans. In their most recent quarterly report, NNI held $15.8B in FFELP loans.

When the company came public in 2003 they wasted no time making it clear they wanted to diversify their revenue streams. In 2006, CEO Mike Dunlap said the following:

“Our goal is to increase fee-based revenue from businesses that are not dependent on government programs to reduce our political risk.” - Mike Dunlap, 2006 Letter to Shareholders

Well, I think he hit the nail on the head with that one given the change in the business environment in 2010.

Instead of holding the assets, collecting the spread, and then paying out the majority of the income in a dividend, Nelnet took a different approach and decided to invest the excess earnings into new lines of business both core and non-core to their traditional loan business.

Since then we have seen the growth of multiple “flywheels” as management likes to call them. Businesses that took capital to form but have since been able to now generate earnings and then reinvest those earnings back into the business. These flywheels have always followed behind the loan book in terms of earnings but I wouldn’t be surprised if, over the next 5 years, the trend reverses.

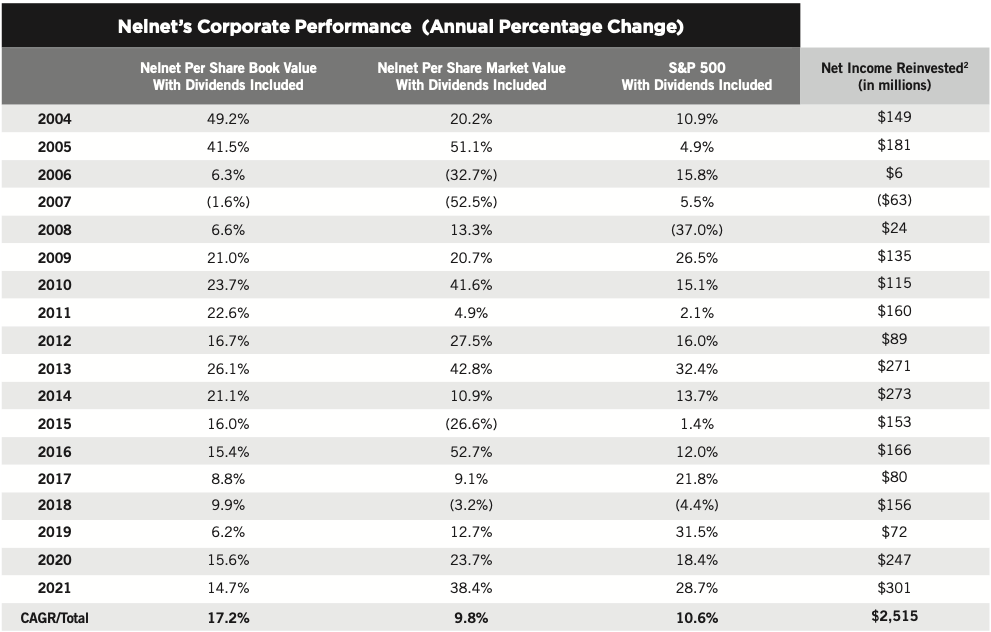

Below is a chart from their annual letter breaking down the company’s growth in book value, market value, S&P 500 return as a comparison, and the amount of net income they have reinvested.

Here is the footnote under this chart in their Letter to Shareholders:

We believe well-managed companies do not distribute to the shareholders all their earnings. Instead, they retain a part of their earnings and reinvest the capital to grow the business. Since going public in late 2003, the company has recognized $3.6 billion in cumulative net income and, of that amount, has reinvested $2.5 billion – or 70% of our earnings over time – back into the business.

Here is where they have deployed capital over the last decade.

What they have done at this company so far meets the definition of what it means to be a captain allocator, especially one that is siphoning cash from a declining asset and then allocating that cash into new business lines that will be the main drivers of value over the next 10-20 years.

When done well, like in this instance, capital allocation can represent a circle of life. The death of one business brings life to the next generation. If you’re a nerd like me, it’s a beautiful thing. Is somebody chopping onions?

In total there are 20 separate business lines divided into 5 main categories.

Loan Servicing and Systems (Nelnet Diversified Services)

Education Technology, Services, and Payment Processing (Nelnet Business Services)

Communications (Allo)

Nelnet Bank

Asset Generation and Management

These 5 main categories are the ones that are broken down in their main 10-K. To me though, there are 3 more that deserve discussion even though they are small in terms of relative size but in 5 years these could be substantial portions of the business. Thus, they deserve recognition.

Solar

Real Estate

Venture Captial

Here is a small breakdown of each segment

Loan Servicing and Systems

Nelnet Diversified Services

NDS could have been seen as a horizontal venture and was one of the first “fee” based revenue streams that the team at Neltnet spoke about when looking to venture away from the “spread” revenue in their early investor letters.

Loan Servicing Public and Private

Mainly, NDS is a servicing platform for loans. The segment is broken down into 7 different lines within this business but the overall theme remains the same. This might be a surprise to some but there are situations where the owner of the loan is not the person knocking on your door for the payment, the person knocking is the servicer. One of the big Crown Jewels for Nelnet is that their serving segment owns 2/7 service providers for the Department of Education. In total, they serviced $262.6 Bil outstanding loans with 7.8 mm borrowers for the Department. Nelnet earns a monthly fee for each individual borrower for the service. In 2021 the Department was the largest customer of the company representing 29% of the overall revenue and 69% of NDS revenue.

They are on contract to service the Department’s loans until December 14th, 2023.

In addition to the servicing side for the Department, Nelnet also originates and services private education loans too. In December of 2020, Wells Fargo announced the sale of their $10 Bil student loan portfolio representing 445,00 borrowers. The company was selected as the service provider of the loans and was able to add all of the borrowers onto their platform. As of year-end 2021, Nelnet was the service provider on behalf of 37 third-party servicing companies.

Other Service Provider Segments

The company also sells the software they use to service borrowers and sells that to other services for a monthly fee.

With all of this backend knowledge about servicing loans, they have been able to take their expertise and apply it to other areas such as their solar partnerships where they have been able to provide marketing, sales, and customer services for developers and financiers. In addition, they can handle payment processing, billing, verifying eligibility, and reconciliation. When you are a developer this service provided relieves a lot of headaches which only enhances the moat and reputation for NDS.

NDS Financials

As of quarter end 09/2022, the NDS segment reported revenue of $395 mm for the nine months ending and an operating profit of $47.49mm for the same period. During that time they were serving a total of $590 Billion in loans for 17.5mm borrowers.

Education Technology, Services, and Payment Processing

Nelnet Business Services

The NBS segment of Nelnet is where the businesses begin to differ a little, there are plenty of underlying themes and similarities between most of their businesses that mostly have to do with payments across a wide variety. But each of the segments breaks down into the following: FACTS, Nelnet Campus Commerce, Nelnet Payments, Nelnet Community engagement, and Nelnet international.

FACTS

FACTS provides solutions for K-12 private and faith-based markets. These solutions include: Financial Management, Administration, Enrollment and Communications, Advancement, and Education Development.

They service 11,000 K-12 schools and serve over 4 million students and families. The way I see FACTS is the backend for private schools, they take care of processing tuition, help with financial assistance, assessments, cafeteria management, attendance, grade book management, and scheduling. FACTS alone generated $185 million in revenue for the company in 2021. Think about how sticky back-end systems are for private schools. If you have one that works and has good service, you tell me who is going to switch.

Campus Commerce

Like FACTS, Campus Commerce helps with the backend for higher education universities. They were the service provider for 1150 colleges in 2021. With a similar service offering, Campus Commerce operates in two segments: Tuition management and Integrated commerce. Tuition management can be thought of as the back end to the bursar office on campus, which is where you go to handle all your payment details and integrated commerce is the back end to the bookstore and maybe convenience stores operated on campus. Campus Commerce generated $99mm in revenue in 2021.

Nelnet Payment Services (Formerly Payment Spring)

NPS is used by the other NBS segments for secure payment processing. They earn revenue through fees for credit cards and ACH transactions. For example, let’s say you want to pay a tuition bill with an ACH transfer. Well, you use Campus Commerce to pay the bill and NPS to process the payment.

In 2021, NPS earned $43mm in revenue.

Nelnet Community Engagement

This is the newest division in NBS and focuses primarily on providing the backend management technology to nonprofit, religious, healthcare, and professional services industries. In 2021 they reported revenue of $6mm. They break down the segment into 3 parts: Faith Community Engagement, Giving management, and Learning management. NCE serves over 35 archdioceses and 4,000 churches.

Faith community engagement focuses on giving church leaders and members a way to easily engage with each other. They have a customizable mobile app, text messaging, and other digital tools to strengthen communication among a group. They also help with content creation for bulletins, news articles, and event calendars.

Giving management provides back-end solutions for personalized giving and pledging. They have a dashboard where you can donate to your community or parish. Donors can set up reoccurring payments or one time.

Learning management is all about providing a comprehensive solution for facilitating the education of non-traditional certifications. They help with live and online training with simplified reporting and record maintenance.

I personally wouldn’t be surprised if this segment of NBS grows at a rapid pace and catches up to size with the other segments.

Nelnet International

Think FACTS for schools, governments, and health care around the world. They provide commerce solutions, financial management, and administration help with cloud-based platforms. In total Nelnet International earned $7mm in revenue in 2021.

NBS Financials

For the nine months ended 09/22, NBS reported $310 mm in revenue and $66mm in operating income.

Here is the picture of the segment they published in their Q2 presentation (peek that operating margin):

Nelnet Bank

In 2020, Nelnet was granted approval by the FDIC and the Utah Department of Financial Institutions for federal deposit insurance and an Industrial Bank Charter. This was the first industrial bank launched since 2008. They weren’t alone though, Square, now Block, also received a charter also.

The bank is going to be a key part of Nelnet’s asset replacement strategy as they begin to fill the hole that continues to grow as the FFELP loans run off. The bank is a true virtual bank with one location in Salt Lake City, Utah. From the most recent quarter, the company had a loan balance of $429mm consisting of $356m in private education loans and $72.9m FFELP loans. On these balances, they were able to produce an operating profit of ~$2.5mm for the nine months ended 09/22.

This bank is focusing on student loan refinancing and management has outlined they are well positioned for when the loan forgiveness program comes to a close and borrowers will be resuming their payments. Given their embedded nature in all of the higher education locations, they have been able to advertise their loan offering documents on campus. These small little entries into a campus can be largely underestimated as students go to take out loans to pay for school. Here was the average balance sheet from the Q2 Presentation in 2022.

Asset Generation and Management

Sometimes the same person who is knocking on your door to collect the loan is the guy who owns the loan. In the AGM part of Nelnet sits the biggest assets they have.

This segment is responsible for housing the FFELP loans that NDS services. At the end of their most recent quarter they held $15.5 Billion loans on the books and for the nine months ending 09/22 has generated an operating profit of $424mm.

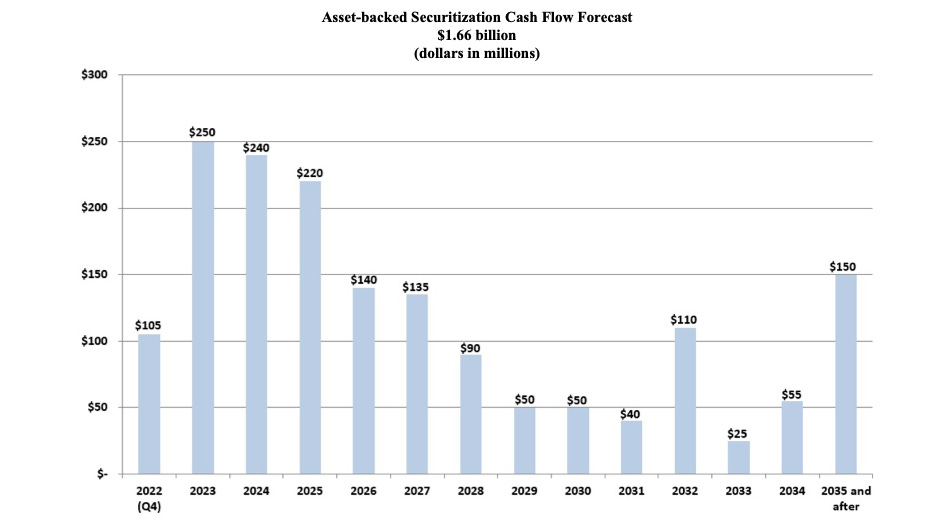

This loan portfolio has been bearing fruits for a long time and most of the seeds it has dropped have funded the investments into other subsidies. Here is what the portfolio cash flow looks like in the future as the FFELP loans continue to run off:

Over the next 10 years, the forecasted cash flows from the FFELP loan book will equate to about ~$44.86 in cash per share. Close to 50% of the current share price today. I am expecting this capital to be invested into the business but what do the other business segments look like in 10 years? Especially with growth rates this high, the FFELP loan cash flow could be dwarfed by the other operating businesses by then.

Communications/ ALLO

Nelnet closed on the acquisition of Allo Communications on December 31st, 2015 for $46.2mm. This was one of the first big investments in assets that were quite a leap from their traditional assets of loan serving and educational commerce.

In 2016, Allo was one of the only telecommunications companies that provided pure end-to-end fiber optic networks. Their focus was on smaller underserved markets that were not top priories for the big telecom companies. The day after the acquisition was announced the market opportunity increased sixfold from 23,000 homes to 137,000 homes along with an agreement to pass all homes and businesses in Lincoln, Nebraska within the following 4 years.

Management outlined a few key reasons why they were excited about the acquisition and I’ve cherry-picked a few of them for you here:

1/ Once Allo’s fiber is installed, it is a 20+ year asset, creating a 20+ year annuity stream, resembling the annuity stream on

long-dated loan assets.2/ Allo is a capital-intensive business, and the one thing they lacked was a deep pool of capital; we are in a non-capital-

intensive business, and we have significant capital. The industry is dominated by investors requiring short-term returns,

creating an opportunity for us as we are focused on long-term value creation.3/ Allo has a strong focus on operating efficiencies, primarily through utilization of proven modern technologies that create

a scalable platform for growth. Our service platform should provide talent and infrastructure to support future growth

opportunities.4/ Allo targets smaller markets that are not a priority for larger competitors, thereby adding true value to their communities.

After the deal was done the strategy was get big and get big fast. There is a nice synergy that occurs when you combine a business with wonderful unit economics starved for capital with another that had plenty of excess capital to invest.

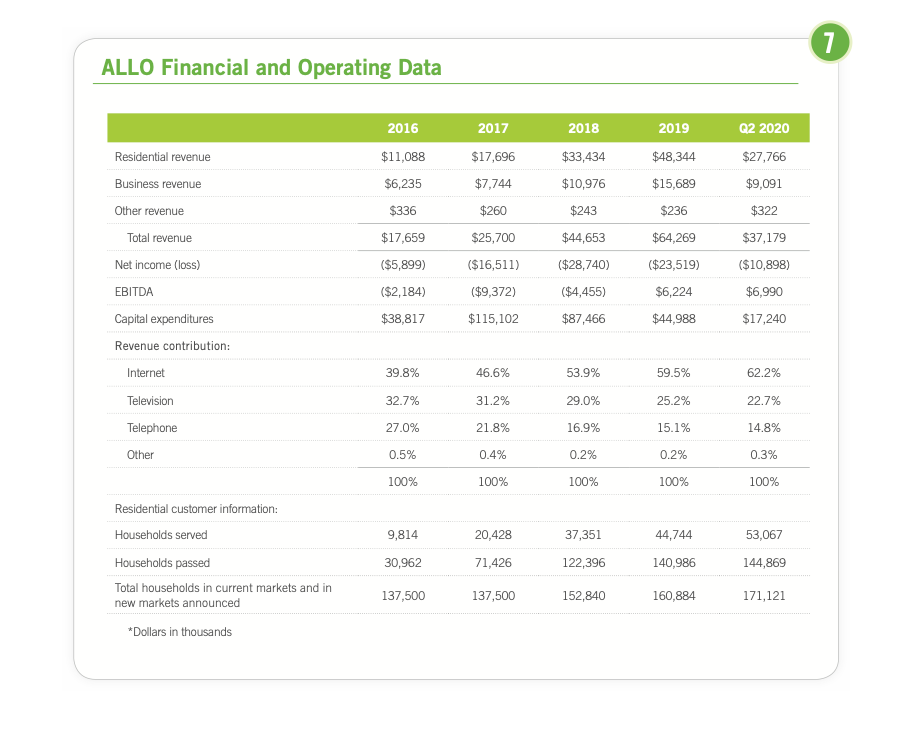

Here are some KPIs for Allo as the years progressed until Q2 2020:

As we can see, in the beginning, there were significant capital outlays to finance the build-out of the network. Those peaked in 2018 at $87mm and then decreased from there. Once the scale was achieved though we saw EBITDA go from ($9.3mm) to $6.9mm for 2Q20 YTD which we can estimate came out between $12-15mm in 2020 in total. The fiber tree began to bear fruit.

What I found interesting, as this segment was really starting to take off they did a transaction in 2020 where they sold a 48% equity stake in the business to SBC Capital Partners for $197mm, which put a value on the equity at ~$400 million. If my EBITDA estimate were correct that was a 26-33x multiple. That might seem crazy but it was growing like a weed and I am sure a current valuation would prove the investment to be prudent on SBC’s part.

After the transaction, Nelnet holds the rest of the equity plus $130mm in preferred shares earning 6.25%.

This transaction then took Allo from a wholly owned subsidy to an Equity- method investment which meant they no longer had to combine Allo’s financial statements. Now, the Allo investment is buried in the balance sheet at cost. This hides the real intrinsic value of the business which I can say with confidence is likely worth more than the cost it’s held at.

In the 2021 letter, we got an update on the business with current annualized revenue of $100 million and over 100K customers. If we apply an EBITDA margin of 32-40% from the earlier estimates, which is based on other fiber comparables (CABO: 50% BOC’s FIF: ~45%) that’s annual EBITDA of $32 to $40mm and in a business like this, those numbers convert to FCF nicely. My guess is the value is much higher than it was in 2020 when they only had ~50K customers.

Here is an interesting interview with the CEO of Allo, Brad Moline:

Solar

In the 2019 letter to shareholders, the company briefly disclosed that Nelent has funded or committed to fund $124mm to build solar projects through tax equity financing. In their most recent letter that number has grown to $288mm and these commitments between them and their co-investors will support the build of $980mm worth of solar assets. These projects will generate enough energy to power 50,000 homes.

Here is a helpful link that brought me from a complete idiot to less of a complete idiot in the arena of tax equity investment in regard to solar projects: what-solar-tax-equity-financing

Here is a small excerpt from the article:

The tax equity investor may be an individual, business or corporation with significant “tax appetite“… Tax appetite means that the investor owes – or will owe – taxes and would like to reduce the amount of tax they otherwise would have to pay by investing in a commercial solar project that qualifies for federal tax incentives.

Because many solar developers (aka “sponsors”) do not have enough of a tax liability to be able to utilize the federal incentives, the solar developer will assign the rights to the tax credits to the tax equity investor in return for a financial investment in the solar project.

The federal government offers three tax incentives2 for commercial solar development that solar developers can assign to tax equity investors, including:

1/ The solar investment tax credit currently at 30% (before any bonus credits)

2/ Bonus depreciation currently at 100%

3/ MACRS accelerated depreciation

All of these federal tax incentives and project cash flows over the life of the investment are available to the solar tax equity investor who invests in the solar project.

The internal rate of return (IRR) on a typical solar tax equity investment is in the 15% range.

Once a tax equity investor has achieved a certain target return on investment, the sponsor will buy back the project from the investor. The tax equity investor would also then receive a buyout payment at the end of the project.

Institutional solar tax equity investors often purchase tax liability insurance to protect themselves from an unfavorable tax ruling by tax authorities, such as the IRS.

Like with the Allo subsidy, Nelnet is able to combine its willingness to invest alongside an asset that can benefit heavily from outside partners with extra capital. The dollar developers don’t have enough tax liability to take full advantage of the benefits and so they seek outside partnerships that can use these benefits, i.e Nelnet.

They also showed their appetite to innovate within the solar space and grow their solar operations with the $30mm acquisition of GRNE Solutions, which is a utility-scale solar construction firm that focuses on building projects that range from 1 to 5 MWs of power.

In addition to the acquisition, they have been growing a community solar subscription business and currently manage 549 MW hours per year with 6,000 customers. This is an interesting line of business because the TAM could be huge connecting the benefits of solar energy to everyday individuals with a monthly subscription. Here is a simple graphic expelling what community solar is from Nelnet’s website:

This is going to be an area to pay attention to that could be a huge area of growth for the company

Real Estate

In the most recent letter to shareholders, Real Estate was said to be a part of the continual diversification strategy as the FFELP loans continue to run off. In the most recent 10Q, the company disclosed that they carry $81mm worth of real estate assets on their books. (This crying value could prove to be understated but I am not confident enough to say that with conviction)

Here is a small excerpt from the 2021 letter describing their real estate segment which I believe gives all of the information needed on how to think about this segment in the Nelnet portfolio:

“Real estate continues to be an integral component of Nelnet’s diversification strategy, and 2021 was a strong year for our portfolio, which includes 33 investments across the country with $69 million of net equity invested. We remain pleased with the risk-adjusted returns generated by the asset class and believe Nelnet’s portfolio is well positioned to withstand market volatility given our focus on capital preservation.

Despite ongoing uncertainty from the pandemic, 2021 was a record year for U.S. real estate from a valuation standpoint, and capital continues to flood the market due to the low interest rate environment and inflation protection provided by the asset class. Nelnet leveraged the competitive market dynamics to strategically sell 11 properties, generating $22 million of capital gains with weighted average returns exceeding 24%. We redeployed 86% of the capital gains into qualified Opportunity Zone investments in the real estate and renewable energy sectors, enabling Nelnet to have a positive community impact while also gaining tax efficiencies.

While our intent is to increase Nelnet’s allocation to real estate, we recognize the importance of maintaining our underwriting discipline and patience given pricing is at peak levels. We target middle-market transactions with a value-add component and invest across the capital stack to diversify risk. In concert with our internal acquisition and asset management proficiencies, the Nelnet real estate team identifies strategic partners with whom we share an alignment of interests, leading to long-term relationships that generate a pipeline of qualified deal flow. In 2021, we closed on eight transactions representing $31 million of capital commitments, the majority of which were multi-family or industrial assets. We look forward to the continued growth of the real estate portfolio and will remain proactive in strategically sourcing deals that meet our investment criteria.”

Nothing to add.

Venture Capital

Along with all their other investments, Nelnet has a venture capital portfolio of companies. In total, they have invested ~$115 mm over the past decade and the portfolio has returned $18mm with a remaining value of ~$204mm. In the letter, they give us their scorecard: 91 investments made, 15 exited, 23 duds, with 53 left in the portfolio. (These are #’s from 2021)

In this portfolio they hold an equity stake in Hudl, in total, they have invested ~$83mm into the company but the carrying value is $133 mm due to a $51mm gain in value from an investment round Hudl held in 2020 which gave Nelnet a comparable value at which they could reevaluate their stake’s value.

I can’t say with a high degree of confidence what the true IV of Hudl is but I am willing to say the company as a whole is likely a Unicorn (worth $1B in valuation) in regards to Nelnet’s percentage of that? I am not 100% sure. The disclosure on the financial statements says the ownership is less than 20%.

In a smaller investment, during October of 2021, CompanyCam inc. did an equity raise and the carrying value of Nelnet’s investments went from $1mm to $11mm.

In the 2021 letter, Jeff (CEO) addressed how they see the venture book and how they go about making investments in them. They focus on companies that are located in Nebraska and use a wider diversification strategy. They then list a bunch of things they look for in a business and here are some from the list:

Trusts/encourages the team to report to stakeholders when appropriate

Can set near- and medium-term goals that fall in line with long-term goals

Understands funding needs over the long haul and has planned accordingly

Knows and exposes the company’s key performance indicators (KPIs)

Knows how to prepare and read financial statements

The venture portfolio is a bit of a black box for the company. For shareholders, there isn’t much clarity on it but at this point, there doesn’t need to be. For example, even if Hudl is worth $1 Bil and Nelnet owns <20% of it that would mean an investment valuation of <$200mm which is less than 10% of the company. I believe the real value of the portfolio is being able to team up with extremely able and hungry entrepreneurs where the long-term relationship can bring much more value than the current investments.

That being said, I would also bet the carrying value of ~$240mm (recent 10-Q) understates the current intrinsic value of the portfolio.

Closing thoughts

This is the first time I have really been able to sit down and study the company that is Nelnet. It has certainly come into my sphere of attention given the curiosity I have around their growing segments in NBS, NDS, Allo, and Solar to name a few. These are the things I am really going to be paying attention to in the future.

Although the FFELP loans are running off there is still plenty of cash flow left coming from these assets and it seems that the market is only looking at the “decline in loans” as a way to look at the company. Now, they are not wrong in the sense that the core company product since inception is going to be gone one day. But this doesn’t mean, by any stretch of the imagination, the business is dead.

It would be remiss of me not to make a comparison of float in the insurance companies and apply it here. The loans have given the company a stream of cash flow that has allowed them to allocate elsewhere outside the business into opportunities that will hopefully replace the earning power that is the FFELP loan portfolio. So far, I believe they have done pretty well in that regard if we are to judge them on the growth in book value since their IPO in 2003.

What I find fascinating is that the company can grow earnings at 20% for the past 10 years and has beaten the S&P over the last 5 (80% vs 50%) but since 2004 has underperformed, see the table above. The assets of the future will not be the ones of the past and this company will continue to keep evolving. Look at what they have been able to do in the solar space and telecom. I wouldn’t bet against the team over at NNI.

In addition to reading many of the past letters to shareholders to get a firm grasp on the company, CEO Jeff Noordhoek did a podcast talking about Nelnet and I found it to be a great listen. He was roommates with Michael Dunlap in college and even lets you in on a secret about a certain poster in their dorm room which I laughed at because I also had one similar, I won’t spoil the fun for you.

I have begun to describe this next wave of conglomerates that I have been studying for a little while now as the “Baby Berkshire” wave. These are the generations of capital allocators who have been going through their formative years all while Buffett has been building Berkshire into what it is today.

If there is one thing we have learned from Berkshire it is that value creation for shareholders can come in the form of many different ways. Buffett showed us that one company can use cash flows to invest in outside businesses for the benefit of the shareholders and Jeff Bezos showed us the power of using the cash flows to invest in innovation inside a company that could lead to tremendous growth in value over the coming decades.

What I am getting at is if a CEO has the desire to push for shareholder value growth there has now been plenty of blueprints written on how it can be done.

Do I expect these smaller conglomerates to compound at rates like Amazon or Berkshire has? Absolutely not. But I don’t think it’s impossible for them to outperform the S&P if they are diligent about following the principles set before them.

In closing, given the growth engines underneath the FFELP loan, I think the company’s future is bright. I am also pretty confident they will continue to allocate capital for shareholders in an accretive manner. It’s the long track record that makes me feel this way. It has earned a spot on the watchlist and I am intrigued to see what the future holds for this name.

At the time of this writing, I don’t have a position in Nelnet.

Peace and Love,

Michael

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investment decisions. Thank you.