Getting Back In My Lane

Refocusing on buying the steak at a discount and getting the sizzle for free

Richard Feynman would be shaking his head at me. I fooled myself and it costs me money.

Yesterday, I made an investment decision. The decision was to swap out 2 names for 1. At the time the two I sold were underwater, locking in a loss, and collectively the names cost me about 5% of book value. Now, this might not seem huge. But it was an unforced error and thus I deserve the tomatoes for making it.

Here is a lesson I learned in 2022 and it’s embarrassing to admit. I like to think I come from the village of Buffett and Munger but if they saw this mistake I’d probably lose admittance to the annual meeting. I got lax in my implementation of the margin of safety principle that grandfather Graham spoke clearly about. Yes yes, I know. It hurts to even say the words.

The time is April of 2022, the stimmy bubble popped and the high-flying tech names began a steep descent from all-time highs reached not even 6 months ago. I liked some of these names. They wouldn’t classify as a pure play value investment but the products and the services they offered were ones I thought were sticky, had a durable competitive advantage, and were at the beginning of a long runway of growth. I was looking for a really nice “wave” to ride for years to come.

One big problem, I was overconfident in my ability to assess the real intrinsic value of the business. When I bought in the first place, the names were down 50% from all-time highs and I anchored myself to those prices. I let price help me make a call on the business valuation. What an immortal sin as a value investor. 🤢

The good news? I have touched the hot stove of “ATH is not intrinsic value” and learned my lesson. It pains me to admit that I still think the future is bright for these companies and selling the stock at these levels might be a mistake. I don’t know.

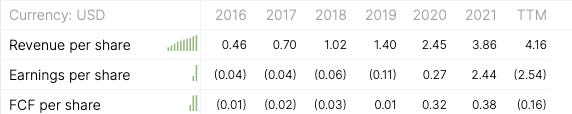

I also don’t know when the company could produce results good enough to warrant a retouching of the levels they once held. Answer me this, how do you value a company that looks like this:

And what do these numbers have to be for a $160 per share stock price?

Here I am confessing my sins, trying my best to make sure I don’t make them again.

The biggest lesson here? I am getting back in my lane of being much more conservative in my idea of margin of safety. My definition is one that is in the reality and earning power today and not tomorrow.

I am not saying you can’t make good investments by focusing on tomorrow. I just find it easier to execute on the companies that are worth X today and pay 1/2 of X today. I don’t want growth to bail me out. I want growth to be the cherry on top.

My hope is that I can continue forward and not make the mistake again of letting Mr. Market nudge me in the direction of a valuation that I didn’t come up with myself. I also accept that I am still young in my investing life and in order to continue to get better and better the failures and mistakes need to happen. But there is one I am going to be even more focused on: every investment I make needs to have a gap so wide between price and value that it protects me from myself.

I understand that for me to really find the limits of my circle of competence I probably needed to make these mistakes. It has helped me see where my “limits” are and as long as I can keep them small and survive to invest another day, eventually I will get it right. One small mistake at a time.

Peace and Love,

Michael

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investment decisions. Thank you.