Frontier, Continuing to Turn Copper into Gold

EBITDA had positive growth YoY for the first time in a decade and the margin profile is changing. It's hard to argue with execution.

Frontier Communications emerged from bankruptcy in April of 2021 with the goal of turning their copper network into high-speed fiber.

Since then, they have been executing the build-out and are now the #3 largest fiber network in the country behind AT&T and Verizon with ~6.5M passings and ~2M fiber customers.

This change from copper to fiber has been and continues to be transformational for the company. The margin profile of a fiber sub-base is far superior to its legacy business.

In the fiscal year of 2023, overall EBITDA grew for the first time in a decade.

This turnaround might work.

Financial Results ’23 vs ’22

Passings: 6.5M vs 5.2M

Fiber Customers: 2M vs 1.69M

Copper Customers: 936K vs 1.17M

Fiber Revenue: $2.99B vs $2.77B

Fiber EBITDA: $1.33B vs $1.16B

TTM EBITDA: $2.13B vs $2.08B

Leverage Ratio: 4.3x vs 3.4x

Let’s not kid ourselves, what they are trying to do is hard and expensive. Although emerging from bankruptcy has given them a “fresh start” they have wasted no time investing a ton of capital into their fiber build.

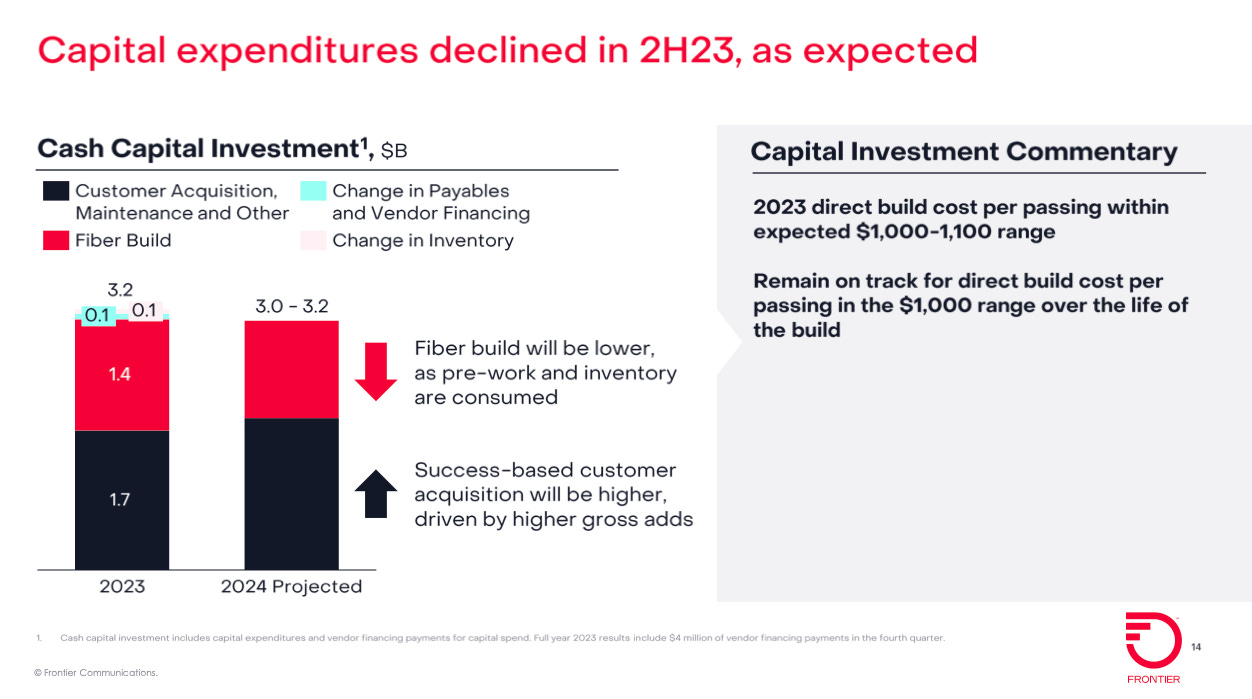

Over the past 3 years, capex has totaled ~$7.6B, spending $3.2B in 2023 alone. Although management has guided to lower capex for ’24, they still plan on spending $3-3.2B.

The past two years have been the heaviest in terms of capex and should be coming down as they get to their goal of 10M passings.

This has been a “bet the farm” play for Fronteir.

Execution

Fiber subs are growing, Fiber EBITDA is pulling the majority of the weight, penetration is in line with guidance, and ARPUs are up. This transition, so far, is working.

But, they did start with a bit of an advantage.

Instead of having to build from nothing, they walked into their new fiber plan with a fresh balance sheet and an existing network on copper lines. Their legacy business provided the infastructure, think tubes, poles, and lines to the house. All they had to do was repalce the copper with fiber.

We are in the early days of seeing the fruits of the labor.

The Fiber segment became the breadwinner in 3Q of 2021 but didn’t push overall EBITDA up until this year.

When it comes to inflection points, this was a big one.

Not only is the fiber rollout working, but it’s also fundamentally changing the margin profile of the company.

“Investors should be expecting us to deliver margin expansion, particularly as we shift a greater proportion of our business on to fiber.” - John Stratton, UBS Global Media and Communications Conference

As the fiber numbers continue to become a larger and larger piece of the pie, the overall margin structure will begin to reflect the company's current state. Right now, there is still enough cover from the copper to hide what is going on.

The Destination

“Our ultimate goal is to get to that point where we're generating $4 billion of EBITDA, we're kicking out $3 billion-plus of free cash flow. We're decreasing our leverage and we're returning cash to shareholders. This is a great outcome” - John Stratton, UBS Global Media and Communications Conference

This outcome will come down to two variables, ARPU and Penetration.

Consumer ARPU has been steadily climbing over the last 12 quarters. Management has guided towards ARPU growth between 3-4% a year, in line with the current industry practice.

And, they have been able to hit their targets for penetration.

Management believes the end state for penetration rates sits around 45% and they have evidence to back up their thinking.

Before the big fiber rollout, Fronteir had ~3.2M fiber passings. This group is what they refer to as their “base fiber network”. This network has had time to mature and currently sits with a penetration rate of 44%.

This gives them confidence to see a path to 45% in other markets as well.

“What we find is that in 86% of our footprint, we have either one or no gigabit-plus capable competitors. And that competitive dynamic is in play, both in the fiber base, the base fiber networks as well as in the expansion network. So very, very similar in terms of the competitive set.

And then the markets themselves, the market characteristics, all the things that we look at in terms of the attractiveness of our service look very, very similar in the remaining 7 million as they do in the first 3. So this is what gives us great confidence in our ability to get to 45%.”- John Stratton, UBS Global Media and Communications Conference

Based on 2023 numbers hitting 45% penetration on 10M passings would translate to ~$3B in EBITDA ($665 per sub). APRU growth and what is left over from copper will likely make up the remaining $1B between the above estimate and their goal.

Let’s not try to pinpoint this with accuracy but $3B in FCF on 250 shares outstanding gets you $12 a share which would be a P/FCF of ~2x today’s price. (Assuming the share count stays around the same levels)

The Path Remaining

FYBR sits today with about ~3.5M passings remaining on their “fiber expansion” plan. This will translate to ~$3.5B in build capex assuming the costs stay in line with expectations.

One of the initial concerns I had about FYBR was their ability to fund this entire build-out without diluting the shareholders. This meant funding would come from debt and push the leverage ratio higher.

Right now it’s up to 4 turns of EBITDA and it’s probably going higher this year.

I wouldn’t be comfortable with this if there were not strong evidence supporting growth in EBIDTA ahead.

As we move into ’25 and beyond, I expect it to begin to come down as the built network matures into a more terminal state and margins expand as fiber becomes a larger piece of the pie. This transition will lead to a natural deleverage as John spoke about.

But this takes time and I wouldn’t expect much over the next year in terms of delevering.

Closing Thoughts

In December, Jana Partners sent a letter to the Board of Directors stating,

“As we have expressed publicly and in direct conversations with the Company, we believe Frontier's equity is grossly undervalued and that it will continue to underperform if the Board maintains the status quo.”

Jana then stated they would like the company to conduct a strategic review that would create the best possible outcome for shareholders. This could include a joint venture, shedding the non-strategic copper assets, or even a sale of the company.

When asked about the letter the next day at the UBS media conference, John Stratton responded,

John Stratton: I would tell you is this, our Board is very much focused on the opportunities that are right in front of us. And what I would say also is that we are very willing to explore all alternatives that may be present for us to achieve our #1 objective, which, of course, is to achieve maximum value creation for our shareholders.

Interviewer: Okay. Everything is on the table?

John Stratton: Everything is on the table.

As of right now, they are conducting the strategic review and on February 5th, the company added Woody Young to their Board of Directors. Mr. Young has more than 30 years of experience in telecommunications M&A.

Right now it’s all talk. I share Jana’s opinion that the company is undervalued, and any move from management to unlock the value I welcome. But for now, I am going to stay focused on the fundamentals.

Here is what I am looking to see from FYBR over the next year:

Add ~250-300K fiber subscribers

Grow EBITDA by ~10%

Keep penetration rates in line with guidance

Fiber ARPU to grow ~3-4%

They will probably do another capital raise in a similar fashion to the one they did last summer and end the year with a leverage ratio between 4.5-5x.

The KPI I focus on the most is the growth in fiber subs.

This will be driving all of the value creation for the company. The leverage is getting a little high for my liking but if they can keep adding fiber subscribers, it will come down as the network matures.

Investing is not about where you are now but rather where you are going. With Frontier, they are continuing to execute their transformation from a sleepy copper provider to a high-speed fiber company.

Their earning power comes from their fiber but it’s still valued at a copper multiple. As long as they continue to execute I am sure the market will come around.

Disclaimer: At the the time of this writing I am long Frontier

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

Hi Michael,

you assume $3B of EBITDA on 10M passings and 45% penetration ($665/sub). Using current $64 ARPU, that means 87% EBITDA margin. 2023 EBITDA margin was 44%.

(Or, using 44% EBITDA margin means doubling their ARPU to achieve $3B of EBITDA.)

It doesn't seem realistic or does it?