Frontier Communications (FYBR)

Betting the ranch on turning copper into gold

Below is my analysis of Frontier Communications. If you are interested in diving deeper I put together a much longer report on the company that goes along well with the analysis. If you would like to access the PDF Report just click the button. Enjoy.

When a company must voluntarily file for Chapter 11 the question needs to be asked, how did we get here? You don’t end up sitting in front of a judge by running an optimal operation with the best capital structure. You end up there because someone over promised and well under delivered. But what went wrong? Did management get caught up in the reality of being in a declining industry with little room for growth and try to keep the music going by leveraging the company up with acquisitions? Or was the asset subpar and it was capitalisms way of Darwinism?

With Frontier, it was both.

The seeds of the downfall can be tracked all the way back to the first time they bet the farm and bough $8B worth of landlines from Verizon Communications in 2009. FCF prior to this purchase was ~$488M a year, 3 years later in 2012 FCF was ~$750M.

A $8B purchase only brought in an extra ~$262M in FCF. Abysmal.

So, what’s the next best thing to do after making a mistake like that? Go make another big buy! In 2014 and 2015 the company spent ~$12B acquiring assets from Verizon and AT&T and in 2018 FCF was only $600M.

Since 2009, the company spent ~$20B on 3 acquisitions and only improved the cash flow profile by $112M.

Watching this history play out makes me think AT&T, Verizon, and Frontier were all playing poker and cooked up these deals after Frontier went on tilt and had 6 rounds of drinks.

With no real sight to the other side of the overwhelming debt load, Chapter 11 in 2020 was the only choice. The restructuring only took a year and when they came out it became immediately clear, this was a different company.

Good Co Bad Co

When I am assessing a Chapter 11 reorganization there is one big question in my mind, did the asset kill the company or did management kill the company?

It was obvious that the decision to lever up and buy phone lines was a terrible one in hindsight. The lines however, threw off cash so you can’t blame the asset, you have to blame the person who decided what to pay for the asset.

These are two different things.

For example, GM emerged from bankruptcy and had a stock price in 2010 of $33 a share today’s price: $35 a share. At the end of the day GM was crippled by debt but on the other side, it is still an auto manufacturer with low margins, subpar returns on capital, and lack of a serious moat.

Frontier is not GM.

The second the plane landed with John Stratton, the new executive chairman of Frontier, the plan became simple. Replace the dying legacy copper assets with fiber optic cable, bring on killer management, and make broadband the center of the operating strategy. Out with the old rusty past and in with the new shiny, faster, technology.

It is a tremendous goal, one that was going to need plenty of capital and operational know-how to make it work but through the months after emerging John brough on a team of highly talented executives that had experience with building networks and turning around troubled assets. The preexisting network was the clay they had to work with, and it was their job to turn it into a work of art.

They have had two full years of working and I think it's time to asses the progress.

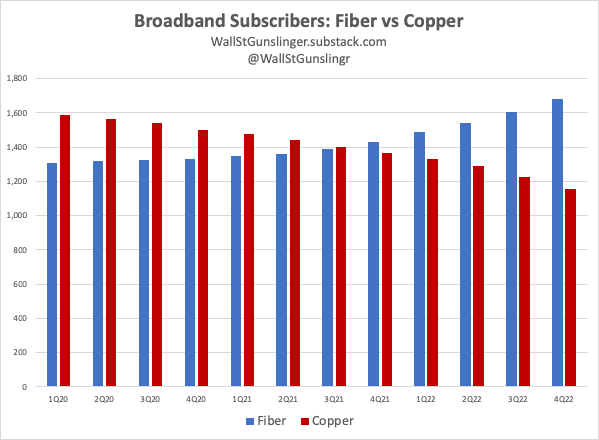

During 2022 the company reached a tipping point when the majority of EBITDA was earned by the Fiber segment and at the end of the year the net gain in fiber broadband offset the losses in Copper. This is now a fiber company, but it seems like the market is still viewing as a slow DSL provider.

Underneath the hood though, the economics of the two types of subscribers are much different.

Given the difference in margins do you think the fiber and copper business deserve the same type of valuation?

Fiber Earning Power

The most recent numbers show us the company ended ’22 with an LTM EBITDA of ~$1.7B, and of this ~$1B can be related to the fiber business. They had 1.682M subscribers which equal ~$615 of EBITDA per fiber internet subscriber. Not bad.

There are two factors that are going to determine the growth of this number over the next 5 years: Fiber passings and Penetration. How many dwellings can they put in their network and how much of that network can they capture.

Management has set goals for each build aiming for a penetration percentage between 15-20% after they have been in the market for a year, 25-30% after 2 years, and then a terminal rate of 45% in mature markets. The 2020 and 2021 build are currently hitting these goals and it will good to see how the penetration rate for 2022 matures as the year goes on.

With no serious obligations on the near horizon the company has plenty of breathing room to walk the course, focus on operational excellence, and the score will take care of itself. If they can hit their penetration goals for the builds, the debt load will be no issue when it comes do.

Source: Company filings

The biggest hurdles I see standing the way of them hitting these goals is the current uphill battle they have to repair the reputation which was destroyed by the horrendous service of the past. Then you layer on the title of Bankruptcy, and it only gets worse. This type of trust can only come back through action and social proof. If they can reach the critical mass of customers who can stand there and say confidently “Frontier is a better company now with a service offering that is not anything like the past and it’s worth the switch” then the big transition will come with more friction. It might take longer than they are expecting to win all of the trust back but with time their actions will peak more than their words.

Like my High School Football coach used to say to me, “Show me, don’t tell me”

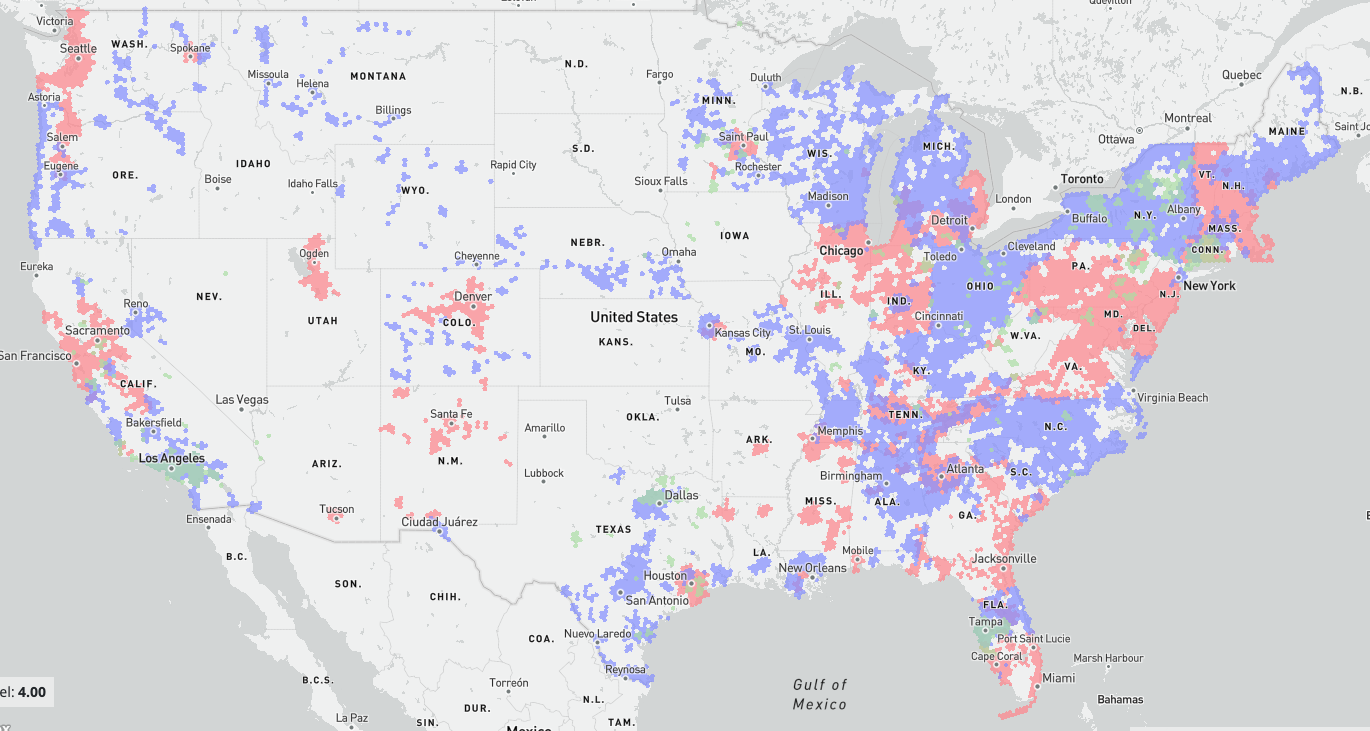

Then we bump into the barrier that is competition. Currently there seems to be two opinions in the industry and they separate themselves by the majority of their asset base. Big cable operators like Charter and Xfintiy have been slow to adopt a nationwide rollout of fiber to the home and are skeptical. Then we have the wireless carriers who have been building their own fiber broadband offerings for a few years now with AT&T and Verizon passing more than 30M homes combined with no signs of slowing.

The size of Frontiers fiber network could one day resemble the same size of their current copper network but I wouldn’t bet on it. I would expect them to expand into areas where they can replace copper with fiber, but I wouldn’t the focus to be in the markets where competition I intense by either incumbent cable companies or areas that are saturated by the wireless providers.

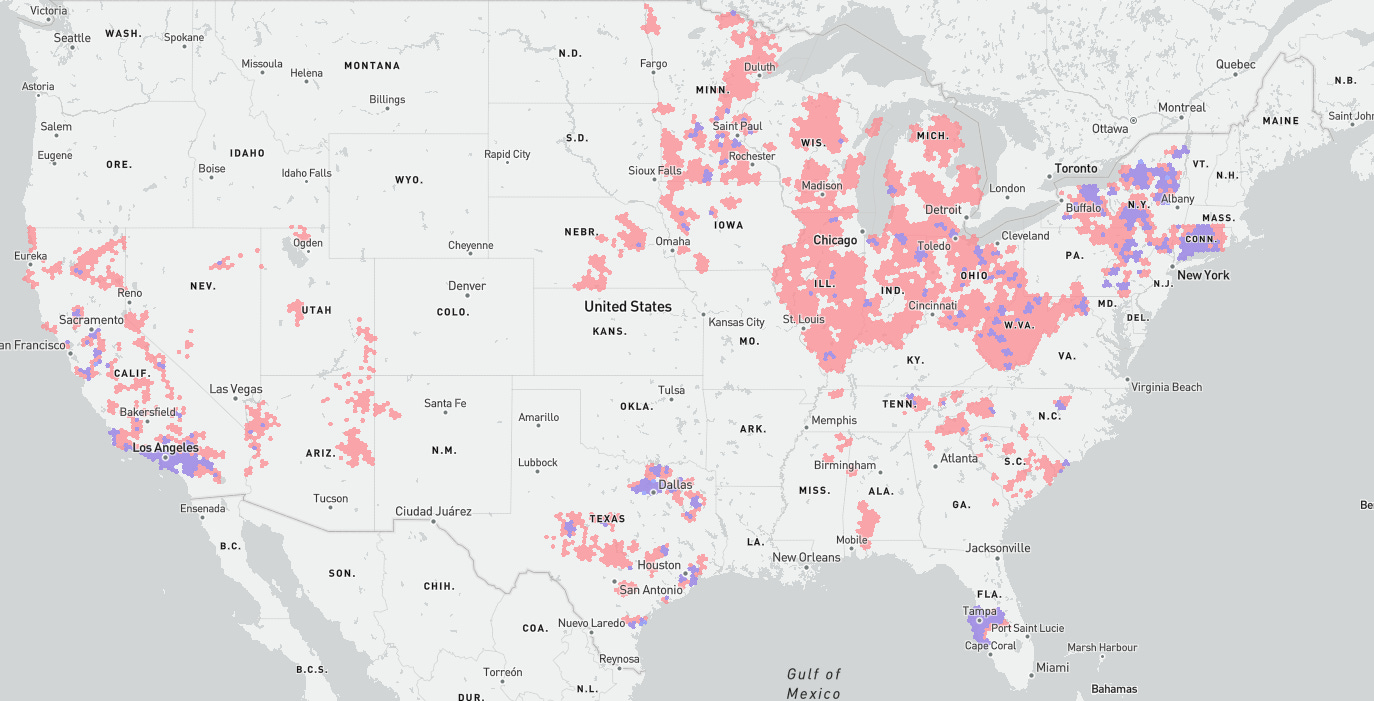

Frontier Fiber (Blue) vs Frontier Copper (Red)

Fiber competition footprint: AT&T (Red), Verizon (Blue), Lumen (Green)

Major Cable Networks: Xfinity (Red), Charter (Blue) with Frontier Fiber (Green)

Source: FCC Broadband Provider Map

Intrinsic Value Estimate

It doesn’t make much sense to me to continue to value Frontier at the valuation multiple they have earned in the past. What we have now is a growing fiber business that has 40% EBITDA margins that is masked by the poor, dying copper business.

There have been some slides thrown around by management that have used as much as 20x EBITDA as a way to value the fiber business. Do I agree? Not entirely. But that is what is great about the public markets, I don’t have to understand what others want to pay, I just have to know what I want to pay.

I am comfortable using EBITDA as a proxy for cash flow due to the nature of the business which requires large Capex upfront and much less maintenance the D&A state on the earnings statement. Usually, I like EBIT but here I think EBITDA might be a more appropriate gauge, even though I have my reservations about the metric.

When it comes to the copper business, I am going to give is a 3x EBITDA multiple based on 2022 EBITDA of $859M, I don’t think you can really say with confidence it deserves more than that.

Copper Value Estimate: ~$2.25B

When it comes to the Fiber business, I think it demands a much higher multiple given the unit economics being much stronger. I think 8X is too low and I have seen others pay as much as 20x. I feel comfortable in the middle between 12-14X EBITDA, this gives you an “earnings yield” between 8-7% that will likely grow into the future and a 7% growth would translate to a ~15% return.

Fiber Value Estimate: $12-14B

Intrinsic Value Estimate: $14.5.7B - $16.5B

If the growth is able to play out for the fiber unit we are looking at an EBITDA of ~$2B in 2025 when the build is complete, that would translate to about 3.2M subs with two more years before the final wave is considered matured. If that happens, we could be looking at a value between $24-28B for the fiber business. A double from today’s EV.

2025 Intrinsic Value Estimate: $24-$28B

Assumptions that could prove to be incorrect.

Passings of 10M and a penetration rate of 32%- If the company is unable to hit these numbers this investment will stay stagnant for a while. The growth in intrinsic value is directly linked to their ability to generate EBIDTA from their network. Which means passings and penetrations need to hit certain metrics to make the renovation investment worth it.

A constant EV assumption- Another big risk is the capital needed to fund the growth. If they are unable to generate enough cash flow to be reinvested, they are not going to stop the build, they will just raise the money through the debt and equity markets. If this EV starts to climb due to adding debt then there will be a point when the debt raised vs earnings generated won’t be accretive to value. If they decide to tap the capital markets then the dilution will hurt the returns of the stock holders as well.

Even if they under preform on those metrics the downside of the investment is protected by the growth in the fiber business. With a time horizon of 3-5 years I believe there is plenty of protection to the current price of $24 a share and an EV of $13B.

As the company continues to accelerate their fiber build out, win customers with better economics, rinse and repeat for the next couple of years I believe the appreciation for all the work that is being done will get recognized. Eventually the truth will be seen that Frontier is a growing fiber provider. If they continue to execute, they will deserve the multiple.

The unanswered question that rings in my mind is after all of this is done, when wave 2 of the build is complete, and the capex has been spent, will it have been worth it?

In the past three years they have spent ~$5.6B on capex with around $1.2-$1.4B directed to build out the network and EBITDA stayed relatively flat so we haven’t seen the fruits yet.

They are in the middle of their wave 2 build with around 4.8M passings left to build and at ~$900-$1000 a passing, there is still ~$4-$4.8B left to spend on construction.

At the end of it all, since the start of the program in Q42020 they will have built around ~7M new passings and spent ~$7B to do it. If EBITDA can hit a $2B annual rate at the end of 2025, the return on spend will be 30%. I would say that’s satisfying. Once the network is in place the maintenance capex should be much lower than and thus the FCF should begin to flow but this isn’t until a few years out.

In Closing

I took the initial position in fiber after the recent tipping point was reached when EBITDA inflected to the fiber business and the growth in broadband customers was positive for the year. The current price being offered in the market between $23-26 a share fits into my goal of finding situations that are trading at a discount to current intrinsic value that will be worth at least 2x in 5 years. Based on the numbers above the current discount is not huge but I also think that’s why you make a conservative estimate and then pay less than that.

There will be a close eye on the network build out and the penetration rates of each cohort. Given where the company is positioned today, the next two or three years will be fun to watch as the full transition is made from slow copper to lighting fast fiber.

And if you want to read more check out the FYBR Deep Dive:

Disclosure: At the time of this writing (03/18/2023) I own FYBR shares

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

I wonder how many homes using copper based providers eventually move to 5G solutions vs Fiber solutions. There are a fair number of moderate bandwidth users who would be quite happy with lower cost and trivial to install FWA from t mobile and Verizon. This isn’t just a Frontier issue but for all fiber buildouts. It makes me suspect that adoption numbers will be lower than targeted for everyone.

I'd be careful in taking management's word at what is "fiber" EBITDA... There is a big piece of data and internet services revenue that is "network access services" or a shrinking B2B/wholesale business, which along with the legacy voice business will be a big drag on the business... I think there is a lot included in fiber EBITDA that is not very high quality... This also makes looking at EBITDA per customer on the broadband business unhelpful... I find it curious that management has not give consolidated EBITDA targets that align with their broadband sub targets and that their compensation plans are largely based on fiber passings not ROIC/profit targets. I think the returns on these fiber builds are still very much up in the air and would not be surprised if they are lower then their 8-9% cost of debt. Lumen's pause and reevaluation of its build plans suggests they might not be so compelling...