FG Financial: A Hidden Spawner

A small financial company underwriting conservative reinsurance and chasing power laws through merchant banking partnerships and sponsoring SPACs.

Before we get into it I have to make some points clear. FG Financial is a nanocap stock that is illiquid. I own and have purchased shares recently with no plans to sell them anytime soon. Investing itself comes with a multitude of risks but when you look at companies this small, things get even more dicey. I cannot stress this point enough, this post is for informational purposes only and should not be interpreted as investment advice. Please, do your own due diligence.

Publishing research in a public space like Twitter means the feedback loops are more immediate. On top of getting comments on articles, the inbound messages from others have created relationships with individuals I hope to stay close to for a long time.

If you are a seasoned reader then you know I have been writing about the Fundamental Global complex for about a year and a half and I am invested in the complex as well. The combination of being able to purchase a security with a significant margin of safety and partner with top-notch individuals is a situation I find hard to pass up.

Read my write-up on FG Holdings to get a better understanding of the entire complex here:

For the most part, other investors I have spoken with understand the makeup of FGH and the story behind it. However, when I start to talk about FG Financial, the understanding seems to trail off.

I don’t blame them. When I first got interested in FGH, wrapping my head around the value of the other components like GreenFirst, Strong Global Entertainment, and FireFly seemed more important to the overall thesis. FGF always seemed like the part of the puzzle no one really paid attention to, myself included.

However, while completing maintenance due diligence on FGH, FGF has begun to earn more and more of my attention and I think when you look out 5-10 years FGF is going to be one the major long-term growth engines for FGH and thus deserves a study.

The goal of this article is to shed some light and hopefully improve the understanding of one of the lesser-known components.

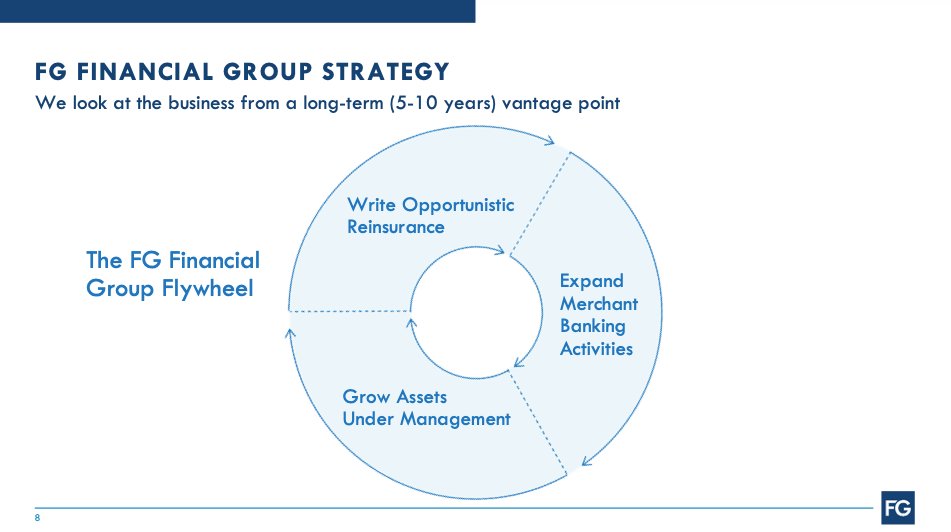

The Flywheel

We should start with the slide they show investors in every presentation to set the table. To go along with it they also state their mission statement,

“Grow intrinsic value per share with a long-term focus using fundamental research, allocating capital to asymmetric risk/reward opportunities.”

This visual summarizes the simplicity and power that resides in FGF. It shows you the time horizon, the runway, and the compounding feedback loops that can occur. Since the complete restructuring of the company in 2019, FGF has spent the past two years executing the strategy above.

Let’s break down each section.

Reinsurance / Asset Management

An insurance company can be optimally set up in one of two ways. You can either write conservative policies and make aggressive investments or you can write aggressive policies and make conservative investments. The strategy at FGF resides more in the former than the latter.

The reinsurance division specializes in writing collateralized loss-capped reinsurance policies. From my understanding, this type of insurance is some of the most conservative underwriting in the industry. These policies are not black boxes that become massive labilities after an event. They are straightforward contracts with straightforward returns.

I am not an insurance expert but allow me to paint a simple example of how these work.

Two parties enter into a contract and deposit money into a trust account, let’s say the pot is a total of $100. Party A contributes $80 and Party B contributes $20. If a clam arises during the policy period, Party B gets the balance but if it doesn’t then Party A receives their initial deposit back plus the premiums for spotting the risk which translates into a nice return on invested capital.

The types of policies written in this subsector have a lower probability of turning into claims and because of this, the company has to put up the capital as collateral to achieve these asymmetric opportunities.

Over the past 3 years, FGF has been able to scale the business from 2 reinsurance contracts at the end of 2021 to 7 contracts at the end of ‘22. Premium volume grew from $8.1M to $13M in ’21 to ’22 and in the first quarter of ’23, the insurance platform generated $1M in profits.

Now, the interesting kicker comes into play with the introduction of the Reinsurance Sidecar in December of 2022. This opened the door for the company to take in outside investment for use in the division where they can generate fee income off of the management of the contracts.

This type of insurance underwriting could be attractive to large institutional allocators because it offers the ablity to broaden their portfolio and generate uncorrelated returns.

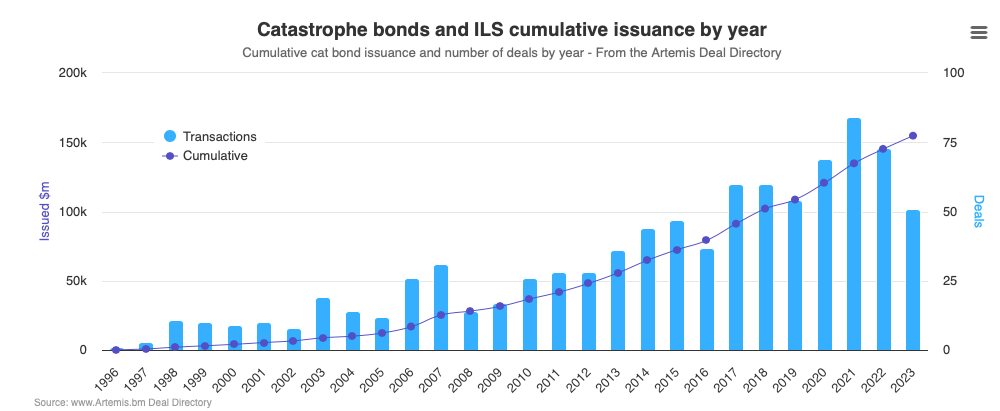

To get an idea of potential demand for the product, I looked to the closest parallel, catastrophe bonds. If the demand for these bonds is a good gauge of what FGF is going to offer then the wind is at their back.

By launching this Sidecar, they can leverage their existing knowledge and infrastructure to grow earning power without having to put up additional capital to do so.

But the underwriting is only half of the picture.

Merchant Banking Activities

Merchant banking is not a new idea for CEO Larry Swets Jr.

In his first letter to shareholders when he was at Kingsway Financial, Larry described the origins of merchant banking and the possible growth avenues that come with it.

Unlike traditional banking, merchant banking is not a retail operation where they collect deposits and make loans. It is much more of a relationship-driven business where clients become partners and the banker’s job is to solve the capital problems that the company faces. The compensation is also different getting equity instead of fees for their service.

Currently, the company has been able to earn equity in 6 companies through merchant banking partnerships and sponsoring SPACs.

The partnerships fall much more in line with the typical definition of merchant banking where they work hand in hand with entrepreneurs helping them with the capital side of running a company. This could mean a multitude of things like leading capital raises, making loans, working capital management, or getting ready to take the company public.

The SPAC platform offers similar qualities as the partnerships but in a different manner.

When a sponsor decides to raise a SPAC, they do the heavy lifting associated with creating a public vehicle. In the process, they front all the expenses but in return, if they are able to close a deal, the sponsor will receive ~20% of the equity in the company post close.

Some entrepreneurs are willing to go public through this route instead of a traditional IPO because it is a quicker process and the purchase is negotiated in private which is not subject to the mood of the overall market.

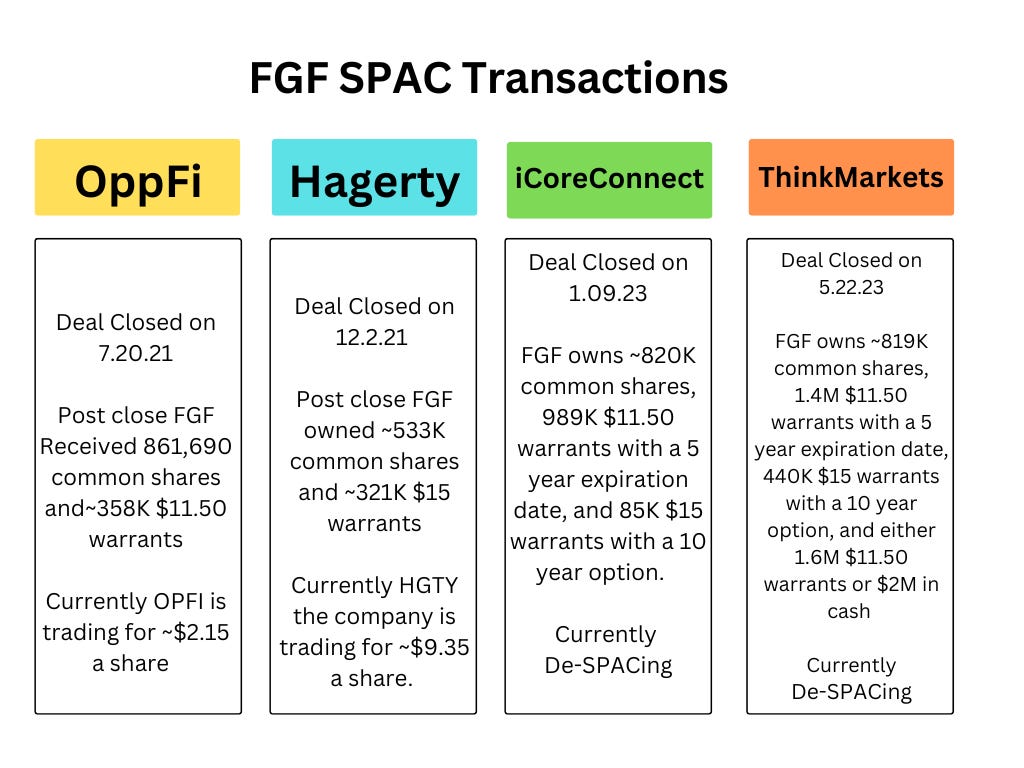

To date, we have seen the FGF create two meaningful merchant banking partnerships and complete 4 SPACs in a matter of ~2 ½ years.

Partnerships

Craveworthy- A partnership with Gregg Majewski, former CEO of Jimmy John’s, focused on taking smaller and legacy restaurant concepts and giving them the opportunity to scale. Currently, the company has 7 concepts and ~100 locations and is looking to add both in the years ahead.

See the companies offering memo here: https://24027146.fs1.hubspotusercontent-na1.net/hubfs/24027146/Craveworthy/Craveworthy%20PPM%204-3-2023.pdf

FG Communities- Founded by Michael Anise, FG Communities owns, develops, operates, and manages manufactured housing communities (MHCs) with a primary focus on acquiring existing MHCs, with fewer than 100 homesites, that are near capacity.

The Company earns income from leasing manufactured homesites to tenants who own their manufactured homes and from the rental of manufactured homes owned by the Company to residents.

Currently, the company owns ~470 developed sites and is doing an equity raise of $5M to acquire an additional 300 sites.

You can see the offering memo here: https://invest.equifund.com/offering/fgcommunities/details

SPACs

To date, FGF has raised 4 SPACs that have all been combined or are in the process of combing with an operating company.

I want to highlight the deal they did with iCoreConnect. The traditional route for a sponsor is to raise money, combine with a business, and get equity in the form of common stock and warrants post-close. This deal is a little different.

Each share of equity in FGMC (the company merging with iCoreConnect) will be converted into a preferred share with a 12% coupon. Then, after 12 months post-close, the share price will reset to either $10 or 20% above the simple average volume weighted average price. The reset cannot be lower than $2 or higher than $10.

This ability to think outside the box and get creative with the financing could lend itself to be a growth driver for the deal-making process with future SPACs.

To give you an idea of sponsor economics, FGF invested $2.6M into FGMC and $3.4M into FG Acqustions (The sponsor company combing with ThinkMarkets) upon closing, their preferred equity in FGMC will be worth ~$8.2M with a dividend of ~984K annually and the common shares in FGAA with be worth ~$8.1M.

The Black Box

Through their merchant baking activities, FGF has created an investment business model that resembles venture capital. The conservative underwriting in the insurance division allows them to make investments out on the riskier side of the bell curve with SPACs and new business ventures. With this reality, it is unfair to hold FGF to a standard of perfection.

You can’t outrun losers when you make investments like this but the hope is to do enough intelligent deals to find the big winners that will drive the majority of the returns.

Right now, time under tension is the largest ingredient needed to see how good the team is at making these deals and creating shareholder value. Each investment above is less than 2 ½ years old and ideas like this require a time horizon longer than a typical investment of 2-3 years, 5-7 might be more appropriate. Therefore, it is logical to conclude this company might need that much time to build a reputation in the marketplace.

To their advantage, FGF can stand on the shoulders of its management team and has decades of combined experience in the financial industry so they have a bit of a head start, as demonstrated by the deal flow over only 2 years.

In Closing

To me, if the company is able to grow the reinsurance division profitably and make investments that are a few percentage points better than the S&P, then things should end up fine for FGF over the next 10 years. Of course, this is easier said than done.

Over the past three years, the company has been able to get involved in 7 reinsurance contracts before the formation of the sidecar. During the next 12 months, I would expect the number of contracts to grow and the number of assets under management to also increase with it.

It’s a fool's game to try and guess how much growth we are looking at exactly but I wouldn’t be surprised if they are able to double the number of contracts over the next 2-3 years and bring in enough capital to achieve that number.

This division has a ton of potential and each new contract is a piece of evidence supporting that thesis.

The same can be said for the investments. The sponsor economics of raising SPACs is a lucrative business and if the company can continue to leverage their platform, I don’t see how money earned from the reinsurance division can’t be put to work here or in their merchant banking partnerships.

But this doesn’t come without risk.

Just as a master distiller earns the reputation of his whiskey, FGF will earn the reputation of the companies they foster.

Right now, we have a batch of barrels sitting in the barn and we really won’t know how good or bad they are for at least another 3-4 years. It’s naive to think each one will turn out great but it’s also naive to think each will turn bad. Given the experience and track record of the management team, I have confidence the result will be positive on a net basis.

However, there is a possibility I am wrong, and if the deals done in the recent past turn out sour, deal flow could dry up as entrepreneurs could look elsewhere for capital partners. It would be hard for management to overcome a track record of shareholder losses.

I do own shares of FGF and FGFPP, the preferred shares, and have little plans to sell in the near future so you can come to a conclusion on where I think the chips stack.

I’ll be paying close attention to the companies they have taken public so far and to the growth in the reinsurance/asset management division over the next year. I don’t expect any results from one year to knock me out of my chair but when stretched out over a long enough period I think they can score with enough shots on goal.

We have no idea which investments will be the big winners at inception but I hope when we look back on the progress after a few years, these little saplings have turned into a forest of shareholder value.

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

Good work here Michael, thanks for sharing!

Thanks for the write up, it’s interesting to watch all the FGH moving parts and investments including FGF