Defining My Fat Pitch

Focusing in on where I feel like I can hit .400

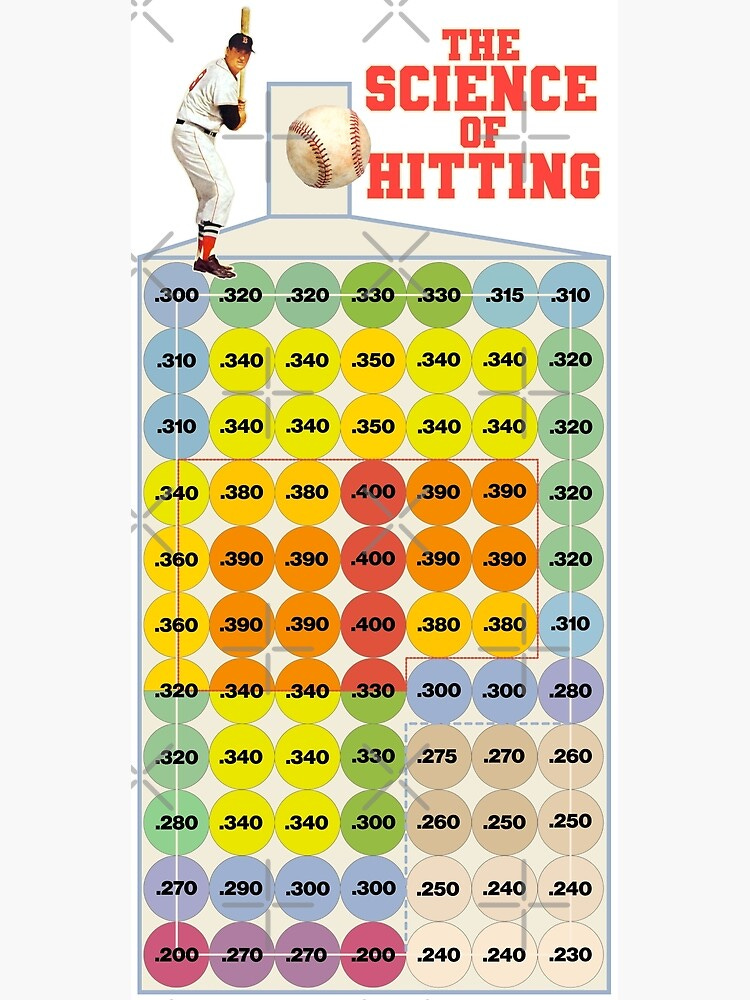

The legend goes that when Ted Williams stepped up to the plate he already had the strike zone dived into 72 cells all the size of a baseball.

Within those cells, Williams knew the respective batting averages associated with each cell. If the pitch was a little high and inside he would hit .300, down and away .230, but if it was right down the middle, he would hit .400.

I have yet to hear a better analogy for investing.

When one sets out on their own investing journey the goal in the end is to define your own fat pitch, as soon as you can and pray you don’t blow yourself up before you find it.

Something that can get lost in translation over the decades is the idea that Williams had this diagram of the strike zone in his mind on day 1.

At the start, we all come to play with blissful ignorance. I doubled down on Apple when I was a Freshman in college for the sole reason that it was now selling for less than $100 a share. I didn’t know what the earnings were, or where the market cap stood, and if you asked what the 5-year historical return on capital was I would have cocked my head to the side like a dog when it hears a funny sound.

Over time though I found my way into the the writings of Buffett, Graham, Munger, Marks, and Fischer. Although, it took a few years for the material to marinate. I have a sense of nostalgia when I think about reading, The Intelligent Investor for the first time during a Thanksgiving Break.

Since those beginning moments, it has been a nonstop effort of working to match my personality with the investing style and there have been plenty of mistakes and enough winners to keep me coming back.

I think one of the hardest things for me, through it all, has been defining my own lane.

In the early days, all I did was parrot Buffet and Munger, I bought Berkshire, held Apple and Bank of America, and when the account scandal hit Wells Fargo I swooped in to buy shares at what I thought was a discounted price. But once I read, “You Can Be a Stock Market Genius”, I began to really feel my oats.

There are few things more dangerous than a young male with a brokerage account who just read Greenblatt.

Convinced I could compound capital at 40% a year I began to venture away from the Buffett and Munger-style investments and started to sprinkle in some of the more loved corners of the investing world like Net-Nets, LEAPs, Warrants, and Spin-Offs. I found great enjoyment in these obscure corners as well as trying to improve my overall knowledge by reading any 10K I could get my hands on.

This tinkering with different investment philosophies continued well after graduation and it wasn’t until recently that I really sat down to contemplate what pitch I was looking for. I had swung at plenty by now to know what I liked and what I didn’t so I thought it was time to really define it in writing.

Defining My Fat Pitch

“These days, his notion of an ideal opportunity is to buy into a business for $1 million when it is really worth $2 million and will be worth $4 million in five years. Such situations, he acknowledges, are not easy to find. “We don’t have a lot of good ideas,” he says, “and therefore we don’t do a lot of things.”- An excerpt from, Tap Dancing to Work by Carol Loomis

This small little quote has been the ballast of my investing philosophy, but I think of the sentence above as the strike zone and I want to define my “right down the middle”.

Although I believe each position in my portfolio was made with this “north star”, I am not naive enough to think they will all turn out to be true. If I am off by a little, making an investment within the parameters above comes with two margins of safety, the first being the purchase price well below intrinsic value and the other being the growth of the value over the coming years. Call it a redundancy.

But I want to be more specific in what I seek.

So after much deliberate thought, here is the newest rendition of my ideal investment:

My ideal investment is a conservatively financed company that has averaged ~20% ROCE over the past 10 years with favorable long-term economics selling for ~10x Pre-tax during an environment where future returns are higher than normal.

The Three Pillars of My Fat Pitch

1. A Conservatively Financed Company with a 10 Year Average of >20% ROCE

“Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you're not going to make much different than a six percent return - even if you originally bought it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive-looking price, you'll end up with one hell of a result.” - Munger

Before I even decide to look at a company the first filter is whether or not the company is conservatively financed. I don’t have a specific formula but rather a few items on a checklist to gauge the health, kind of like a doctor will take your temperature, blood pressure, and check your throat I like to see the Debt/Equity Ratio, TTM FCF to Net Total Debt, and EBIT to Net Total Debt.

I think a healthy company can have a Debt to Equity ~1x and FCF and EBIT to TTM Total Net Debt between 1-2. But anything over that number starts to walk away from the “conservative” label.

The next question is, how good is the business?

The overarching goal of mine is to own great businesses for long periods of time. Why? A great business that has high returns on capital can translate into high price appreciation over long holding periods.

I like to use Returns on Capital Employed as this “quality metric”

ROCE defined as: EBIT / (Net-Working Capital + Fixed Assets)

I chose this metric because it was easy to measure the operating performance of the business. It isn’t the end all be all, I still pay attention to the other ratios like ROE, ROIC, and ROIIC but this was a good enough place to start for myself.

Why this metric?

Part of my job as an analyst is to make sure I am spending my time as efficiently and productively as possible. This means that I have to make sure I am not chasing dead ends and focusing my time on studying companies that could ultimately end up in the portfolio. To make sure I am optimizing for this I need a metric that can give me the most clues about a company and ROCE does the job for me.

ROCE not only tells me about the return profile of the company but a sustained 10-year average brings along a higher probability of other favorable qualities that I am looking for in a company like:

A Durable competitive advantage

A runway of growth

A strong management team

Intelligent capital allocation

If any of these metrics are subpar, they are kill criteria for me and my process. Starting with a 10-year average of 20% or greater decreases the probability that I will find kill criteria as I begin to drill deeper thus saving me time to focus on other ideas.

Let me be clear ROCE is not a perfect filter but it is a good enough starting point.

2. Selling for 10x Pre-Tax

In the 2012 annual meeting, Warren was asked what kind of multiple he would like to pay for a wholly owned business to which he replied, “Certainly 9-times pre-tax, maybe 10 times”

During my early days, I took this to be gospel and while doing more research on it I came across a blog post by the legendary, Brooklyn Investor, who found the same thing and decided to do a historical study on the metric and its use with Berkshire.

What he found was pretty interesting. Here is a reproduced table containing a small history of some of the bug deals Buffett has done and their appropriate Pre-Tax multiple. Eagle Point has also done some work on the 10x pretax multiple and they have added to the list.

Similar to the use of ROCE, 10x pretax is a rule of thumb. I like to think of it as training wheels and to me, this multiple level is the numerical representation of purchasing a great business for a fair price. It isn’t perfect but it is good enough for me.

I likely won’t get in too much trouble if I buy a high-quality growing company with a day-one earnings yield of ~10%

3. During An Environment Where The Probability of Future Returns Are High

“The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.” - Charlie Munger

As someone who reports to no one about my investment activity, I have a bit of an advantage. Unlike other environments where portfolio “activity” is being used to show “work” being done. I can sit on my hands for years on end and no one will say anything.

This is something I have come to appreciate with more respect.

I do my best to operate on the assumption that I am not a smart individual and most of the time the maker is in an efficient place. Although I pride myself on being able to find undervalued investments, I understand that there are times when it is better to either be a buyer or a seller in the market.

We hear that we should only focus on playing when the odds are in our favor. This can mean many different things to many different people but my interpretation of this is that when the market is falling and people are rushing for the exit, it is time to go to work.

I read an interview with with Arnold Van Den Berg a few years ago, I can’t find the link so take it for what it’s worth, where he talked about knowing when a good time to buy is and when to stay away.

He didn’t advocate for market timing but he said something along the lines of, “We have a watchlist that has about 150 names on it. On any given day there are about 4-5 names that are in our buy zones” then he added, “But every now and then the market will take a dive and we will have 50-75 names in our buy zones. That is when we want to be out making investments.”

What is the difference between someone who knows what they’re doing and someone who doesn’t know but stumbles into the right environment at the right time? From the outside, nothing.

I want to make investments during environments when anyone could play the game with a high likelihood of success because if I work my tail off to prepare for these moments, I should end up just fine.

This, of course, is easier said than done. If everyone was able to sit patiently on the sidelines and only make moves when the market fell over everyone would be rich.

Where we stand today

If there is one thing I wish I could have implemented sooner, it would be that I introduce a core systematic approach to my investing on the research side. I have made investments in the past where I have pulled the trigger quickly because I sensed a good opportunity and this “rush” is not a good state of mind for smart investing decisions.

To fix this, I have been much better about approaching the world of investing as a game of building a concrete watchlist with a paper trail of notes. In order for a name to come into my investable universe there needs to be a research file that I can lean on, how can I expect to be able to make a smart decision otherwise?

This was me identifying my strike zone, with the above being the “fat pitch”.

I feel like a clown that it took me this long to implement a system.

The Current Portfolio

If I were to apply the current definition of my ideal investment to my holdings today only a few of them would hold up. This doesn’t mean I will be cleaning the house and starting fresh. I am still confident in the names currently and their future outcomes. Some of them will work and some won’t. It is going to take some time for these situations to play out and I am in no rush to make them “happen” any sooner.

For now, I have begun planting the seeds I hope to harvest after the current investments have run their course. This has meant a deeper study of quality companies and an attempt to prepare a better wish list that I can exploit in the years ahead.

Based on the outline above of my own fat pitch, it would be a common dismissal to say, “Good luck finding investments that meet that criteria” and I have to agree.

I have set this up so the standards are really high and it might only lend itself to making a few investments over a number of years, this is by design. I recognize that I only need to have a few good investments over a lifetime to end up in the place I desire and my hope is that through a diligent process of studying great companies and waiting for the right environment, I will be able to harness those few.

Further Reading

Brooklyn Investor’s Article on Buying with a 10x Pretax Multiple- I loved this one, a simple and concise rendition of the powerful multiple.

Eagle Point’s Article on Valuation and paying 10x Pre-Tax- Big fan of all the writings that come out of Eagle Point.

What I Learned About Investing From Darwin by Pulak Prasad- This book introduced me to using the 20% ROCE filter and how starting here improves the odds of finding other high-quality characteristics in a company. I loved this read.

"There are few things more dangerous than a young male with a brokerage account who just read Greenblatt."

That's a great line.