CNX: An Outsider in The Making?

They define success as generating and growing FCF per share, 30% of the company has been bought back in 2.5 years, and the Chairman wrote The Outsiders. Is CNX one of THOSE companies?

CNX first came across the desk last summer when Andrew Walker wrote about the name. The small introduction made me curious. This Nat Gas operator didn’t care for the highs and lows in the O&G space and opted for a hedging strategy to try and make the cash flows as predictable as possible.

They sought to minimize the characteristic that has defined the industry for decades.

This clarity into the future allowed them to buy back 16% of the company’s shares over the previous 10 quarters. Not only was this company doing their best to minimize the variance in cash flows but they were repurchasing an amount of shares that would make your head spin. Who were these guys?

Once I found out that William Thorndike was the Chairman, the capital allocation decisions made more sense. When the guy who runs the board meetings wrote one of the most famous books on investing in the last decade you perk up. Seeing the uncommon operations and the dedication to share repurchases was a pattern I couldn’t overlook.

If this team at CNX is shaping up to be the next generation of Outsiders I want to know.

Defining Success

“We define success through the lens of generating and growing Free Cash Flow per share to create an long-term attractive opportunity for our shareholders” - CNX 2023 Proxy

On the face of it, some consider this focus the holy grail, but they are so rare it’s hard not to be skeptical. For what it’s worth, Nick Deiuliis has been writing about this objective in the shareholder letters since 2014.

This metric of FCF per share is a broad theme that runs throughout this company, and you can’t find a document or piece of communication that does not mention or hint at the focus.

It isn’t surprising if you look at where the incentives lie.

The compensation plan is a base salary, a short-term incentive plan driven by the performance in FCF per share, and a long-term incentive plan. Half of the LTIC is tied to the overall performance of the share price and the price performance relative to their peer group.

It is an interesting comp stack. In the book, The Score Takes Care of Itself, Bill Walsh, legendary coach of the 49ers, makes his point that if one focuses on taking care of the little things the big things will fall into place. The incentive program at CNX runs parallel with this theme. If management can execute its STIC goals, then the LTIC will take care of itself.

Show Me, Don’t Tell Me

I believe part of a high school coaching job is to come up with little phrases that stick with your players that are simple but distill a powerful message. I can list a hundred from my own high school football experience, one stood out when reading through the annual reports for CNX.

“Show me don’t tell me”

Most of Nick’s letters are a repetition of principles he has expanded on in the past and even though his words are a nice reminder of the focus and direction of the company, I think more can be gained by studyng the actions of the recent past.

Implementing a Programmatic Hedging

Introduced in 2017, this systematic hedging strategy was put in place for 2 reasons.

It de-risks the operations of the business.

It gives management better certainty about the future thus optimizing decisions in the present.

It sounds great, but it’s a double edge sword.

By locking in a sales price now they could be giving up a higher one later. We saw this play out last year when the average sales price for 2022 was >$6.00 and CNX was only able to achieve ~$3.17 per Mcfe.

But we are also seeing the opposite play out right now with the hedged price higher than the current spot.

It is not uncommon to see Nat Gas companies use a hedging strategy to give some stability to their earnings, but it seems rare to have over 65% of volumes hedged for any current year. EQT and Range Resources have 62% and 55% of their 2023 volumes hedged and little for 2024.

CNX currently has ~83% of 2023 hedged and over 50% of expected volumes locked in for 2024 and 2025.

And here is the recent NYMEX strip prices

Guess what happens when they layer on new hedges at higher prices?

The Coal Spin-Off

Before CNX, there was CONSOL energy, a legacy coal business that has been around since 1856. The company had two segments of operations. Coal and Natural Gas. The future for the company was in the latter and shortly after Nick became CEO, plans were set in motion to separate the two companies in a tax-free spinoff.

This spin-off would allow each company to become an independent entity unbeholden to the other in terms of capital allocation and decision-making. In the years prior the company grew its natural gas operation, and it became apparent the legacy coal business could mask the true value of its new growth driver, so they spun it off.

At the end of November 2017, the two split, and the coal business retained the CONSOL name and CNX Resources was the name of the natural gas operation. Shareholders received 1 share of CONSOL (NewCo) for every 8 shares of CNX (Old Co) held.

CONSOL went public at ~$20 a share and currently trades ~$60 and CNX traded ~$14.40 post-spin and currently trades ~$16 a share. If one owned 45 shares pre-spin ($13.55 share price) their total would have been ~$610. If nothing was sold since the same lot would be worth ~$1,000. An 11% CAGR vs the SPY CAGR of ~9.2%.

Acquiring the Rest of CNX Midstream Partners

After the spin-off, CNX focused on growing reserves and production, implementing hedges, locking in future cash flow, and then allocating it where they saw fit. But in the summer of 2020, the company decided to acquire the remaining interest in the midstream assets they did not already own for ~$357M. This merger created one of the lowest-cost operators in the basin and the cash savings from the transaction would be lucrative.

The company has saved on average ~$171M annually from buying in the pipelines. Done in an all-stock transaction, CNX issued ~37M shares increasing their shares outstanding from ~187M to ~220M. Today the share count sits at ~165M and the asset has paid for itself in 3 years.

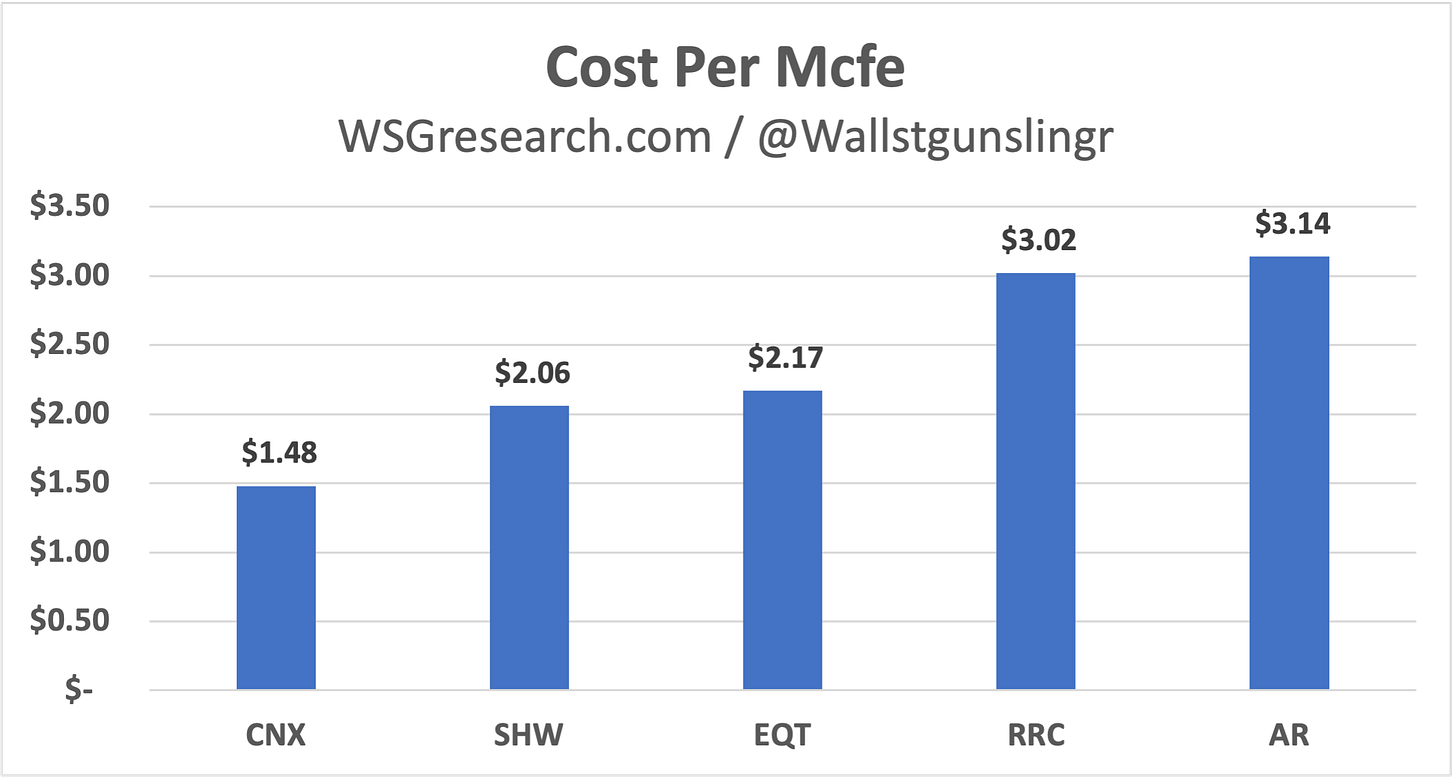

Nick likes to relate their operations to those of a manufacturing business where a competitive advantage can come from having the lowest cost to produce. When compared to their peers, CNX is the frontman.

This cost structure combined with the hedge book has allowed them to continue to be FCF-positive in all types of environments, even one like today. This ability to sit in the fire longer could lead to additional asset acquisitions from other operators who can’t handle the heat.

This is a structural competitive advantage.

Buybacks

CNX is a cannibal. In 2022 the amount of cash spent on buybacks and dividends amounted to >20% of the market cap and since 3Q20, post CNXM merger, the company has repurchased ~30% of its outstanding shares.

Buybacks are a central pillar of the capital allocation strategy for the company.

The math seems simple enough, last year they earned ~$3.92 in FCF per share and repurchased 33.4M shares for $16.92 a piece, a FCF yield of ~23%. If management thinks this yield can grow over time then this “investment” will prove to be an excellent use of capital.

When asked about using some of the cash going to buybacks for other purposes like M&A, the CFO Alan Shepard responded with the following:

“We always know what’s going on in the M&A space but the low-risk opportunity to grow FCF per share, right in front of us, is hard to compete with”

Coming Full Circle

In 2020 the company laid out a 7-year plan to generate $3.4B in FCF between 2020 and the end of 2026. So far, they have earned ~$1.66B with ~$1.74B left which equates to ~$116M a quarter.

I don’t expect the numbers to be smooth but when it’s all said and done, they should be able to do it. The NYMEX strip is higher today than when the plan was first announced so each additional layer of hedges should lead to a higher FCF return.

Should they continue to use ~ 80% of FCF to buy back shares, the total buyback spend will equal ~$1.4B. If the average share price is ~$18, then ~78M shares will be brought in, putting the outstanding share count at ~88M by the end of 2026 barring no major rises in equity.

However, they did raise a preferred convertible in 2020 at a ~$12 share price and a 2.25% coupon due in 2026. If fully exercised the DSO would increase by ~25M but the company can begin to redeem it in November of 2023. I wouldn’t be surprised if they refinance the bond and pay off the convertible to limit dilution.

When it comes to earning power, we have seen them produce ~$700M in FCF on 580 Bcfe on a $3.17 average selling price. I don’t expect them to be able to repeat $700M every year but if FCF averages ~$500M at the end of 2026, on 88M shares that’s ~$5.68 a share, a 2.8x multiple on today’s price of ~$16.

This could prove to be conservative if the average share price repurchase is lower than $18, annual FCF is higher than $500M, or production volumes are greater than 580 Bcfe.

The numbers however are noise in the short term and the signal is the dedication to growing the FCF per share year after year over a long-term time frame.

In Closing

There is little optimism in the Nat Gas world today. We just had one of the warmest winters on record and prices have fallen off a cliff.

When I took my initial stake in CNX about a year ago the thesis relied on two variables, the ability for CNX to continue to produce FCF near current levels and to allocate capital in a way that was accretive to the FCF per share. Even if the ride was rocky, I knew if I got these variables correct things would probably turn out alright.

I thought the hedge book would insulate the company from a major swing in FCF, but I was wrong. The estimations for 2023 are ~$250M compared to ~$700M last year. When Nat Gas drops from $8.50 to $2.20, no one can hide.

The more I think about this name, the more I am convinced the levels of FCF on any one-year basis are noise to the overall long-term trajectory of the company. Of course, I write these words now. I might look back and say this was a way for me to rationalize the large variance in results YoY, but I do think it’s not smart to judge the normalized earning power of any company on a one-year basis but rather a rolling average spread over a few years.

Using this lens, the 3-year FCF average for CNX is ~$480M. In my eyes, this paints a more accurate picture of the company.

Based on the evidence so far, Nick Deiuliis is shaping up to be an Outsider CEO.

He unconventionally runs the company, focuses on growing FCF per share, and takes steps to try and unearth the real intrinsic value of the underlying business. I.e. spinning off the coal division and acquiring the rest of the midstream operations.

The share price was $37 when Nick took over in 2014 and today trades at ~$16 when asked why the stock hasn’t worked on the 4Q23 call and Nick responded with this about the evolution of CNX:

“The first chapter, which wasn't all that long ago was trying to set us up to execute the strategy, to your point, that we've been employing in the past couple of years.

And that was no small task. That was a massive lift. We had a figure out how to reintegrate midstream. We had to figure out how to spin coal. We had to figure out how to refi our balance sheet and build it into what we wanted it to be. We had to delever, right?

So all those things were accomplished and it really put us in a position to be that positive free cash flow generator and then be able to allocate the capital.

Now when we started on sort of the capital allocation side, once we had all that other stuff accomplished, we didn't hide anything and told Mr. Market exactly what we intended to do. We're very clear about that.

Our Chairman of the Board, he wrote a book on it literally The Outsiders and if you want to get a read into how we think about our decision-making, just give that book a read. It's almost just a perfect road map of how we think on behalf of owners. And I'll say it's not rocket science, but it is absolutely different for the space that we're in.

And it's also, I think, incredibly effective over the long term. So you look at from 2020 to today, the strategy and the execution from our perspective under that philosophy, it is clearly working. A quarter of the company has been taken in. That's not noise, that's hugely material. And more importantly, this is like the crucial point or piece of it, it was done at very attractive prices compared to the intrinsic value of the company. And amazingly, to me, at the same time, we delevered the balance sheet.

So like we said in the commentary, that's rarefied air. And it might be one-on-one in a public company universe when you look at other public companies are out there beyond energy. So is the strategy working, I don't want to go into a rate here, but I'll say -- Mr. Market might have been sleeping on us a bit, and quarter of the company was retired over that time. And if Mr. Market is still asleep, we're still on the move with the strategy execution. And before you know it, these numbers start to get very substantial almost to the point where they get absurd. So we know this is going to work because, frankly, from our perspective, it's working. It's working as we speak.

And the last thing I'll say is everything to keep on doing this is entirely within our control. So we don't need to issue debt to win. We don't need to do a major acquisition to win. We don't need high gas prices to win. All we need basically is time to run the play and execute. So we're very pleased with where we're at.”

For now, I have no plans to sell my shares. I expect the FCF per share to increase at an attractive rate over the next few years and when their 2026 plan comes to an end, I think shareholders will be rewarded for sitting through times of turbulence like today.

If management continues to execute their definition of success, they have my vote and they have my patience.

If you would like to share notes on CNX feel free to email me at michael@wsgresearch.com. My inbox is always open.

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

Disclosure: At the time of this writing I do own shares of CNX

Good write-up, thanks for sharing!

A very interesting idea.

Do you think there is any possibility that their results from 2018/2019 would repeat in the future with low gas prices? Or have they overcome some issue that prevents that?