CNX

A Low Cost Natural Gas Operator in Appalachia Hell Bent on Maximizing FCF per Share

Disclaimer: I personally own shares of CNX and so does the Family Fund. I am not an investment advisor and this is not investment advice, do your own work.

Today we are going to continue the theme from the last post about Oil and Gas. In the previous post, I talked about the overall sector thesis and in short, the energy supply from the oil and gas industry is being choked off due to political and social dilemmas, meanwhile, the demand is using gradually or at least staying the same. The difference between people who just have an opinion and investors is when we have an opinion and believe in the conviction strong enough, we put money down and vote with our dollars. This post is going to be about where I placed some of my votes, CNX Resources.

The beauty of being socially engaged and being subscribed to other substacks is the idea flow from reliable sources and this idea came from @andrewrangeley and his 4 part series on the oil and gas industry. More specifically his posts on CNX (you can find it here:

Now, most of what I am going to write about is very similar to his point of view on the topic and the thesis is essentially the same, a lot of this has already been said but I wouldn’t be doing my job if I didn’t go out and do the work myself. You can’t barrow conviction.

CNX Resources is an independent natural gas company engaged in the exploration and production of natural gas in the Appalachia Basin. Most of their operations take place in the Utica and Marcellus shale in Pennsylvania, Ohio, and West Virginia.

On the surface level, there isn’t much difference between CNX and other Nat Gas operations. They have acreage to drill and wells that produce. They pull gas out of the ground and ship it to the market. The slight difference in their operations is the fact that they also own 2,600 miles of gas pipeline through a similar region. But it is when you start to dig below the surface that. Things get interesting.

CNX isn’t a company I haven’t heard of before. A few years ago after reading, The Outsiders by William Thorndike further curiosity led me to CNX because William is the chairman of the board of directors. Naturally, it’s interesting that the guy who wrote the book on capital allocation is the chairman of a small Nat Gas firm. I glanced at the company back then but gave it little thought and moved on but after observing the energy industry for a little less than two years, the name came back across my desk when I read about it in Andrew’s blog post.

At first, the initial thoughts were similar, “Damn this is cheap. A 20% FCF yield” and “Wow, they buy back a lot of stock”. This led me to earnings calls, presentations, and shareholder letters. It became quite clear after a little digging that this small Nat Gas operator was something different.

When I read about a company that comes across optically as “cheap” my natural instinct is to believe it’s cheap for a reason. On top of that, almost all of the O&G companies right now are trading on cheap multiples because of the run-up in commodity prices but the current cash flow and earning power aren’t my focus. My focus is on answering the question, “Is this level of cash flow sustainable?”

The idea of CNX reached a tipping point when I began to see that the company has an uncommon strategy. They don’t care too much about the growing revenues, they have a superior focus on maximizing the intrinsic value per share for shareholders.

I know how this sounds and I can feel the eye rolling because at the end of the day it has been beaten into us as investors to look for companies that do this. And it even makes me a little uncomfortable when a CEO puts up a YouTube video under the title, “The Opportunity is Now” explaining why it’s a great time to invest in CNX.

At this point, every CEO has been trained that investors like words like “capital allocation” and “intrinsic value per share” some management teams still disregard these terms but others might use them in a manipulative way to convince the shareholders they are working in their best interest when in reality, they’re not.

Talk is cheap. With CNX I was pleasantly surprised to see that they have been preaching the same words for years now. These terms weren’t a one-off used to lure in investors. They have been standing on the soap box shouting, “We are working to maximize intrinsic value per share for shareholders” and then have followed up their words with actions that have led meetups to believe they are trustworthy enough to say what they mean and mean what they say.

What Makes CNX Different

I am not usually excited to jump headfirst into a commodity type of business. The swings are heavy and it can mean a wild ride. If you leverage up at the wrong time the entire company can blow up in your face and leave you with a permeant capital loss. But CNX is run differently than other E&P companies. Management makes it clear to shareholders that they don’t look at themselves as managing an E&P company but rather as a capital allocation firm with investments in the E&P space. It sounds cheesy but the way they have built the business makes it resemble what they describe.

The Hedge Book

I stated earlier the biggest comfort for me going in was the question, “Is this cash flow sustainable?” On the first side of CNX’s most recent earning presentation, the CEO comes right out and says:

“We built and now we manage a low-risk $700 million per year of free cash flow annuity that works year after year. And this helps to largely insulate us from the macro events that are out of our control, it creates confidence and conviction in our business, and it's sustainable and works in any business environment.”

Now, is this as certain as an annuity? No, but I get the analogy to get the point across. It was surprising at first. It’s not common to see a CEO talk about their business with such certainty which drove me to go do detective work as to how they have built this “annuity”. This brings me to the first of the two prongs in the CNX strategy: They Hedge Like Crazy.

On the surface, the strategy of hedging isn’t uncommon in the Oil and Gas space. Companies do it often to smooth out their earnings. It isn’t great. It’s boring. Part of the thrill around the industry is the ability to maximize earnings during an upswing so when prices are good cash gushes. From my understanding, when prices are strong companies are more hesitant to hedge because it caps their upside. No CEO likes to come into earnings season with their company showing the least profits out of all their peers because they took a conservative approach. So what happens? The companies let the hedges roll off, the price swings against them, and they blow up because they took on so much leverage to grow production. We almost saw it with OXY during COVID.

Why does this keep happening? Human nature is the only explanation I have.

CNX doesn’t do that. They heavily hedge the product as a way of being able to have the certainty of cash flows. The amount of cash flow isn’t the principal focus, it is the certainty of the flows that mean more.

Here is the current hedge book for CNX:

Currently, for 2022 they have 87% of production hedged. If we assume the production will stay around the same range for 2023 and 2024, they have 67-72% hedged for 2023 and 59-62% hedged for 2024. These percentages increase as the date comes closer.

Right now the environment is showing strength for CNX with the current gas strip well above the average hedge price they have on the books. The more they hedge at this point, the higher the average sale price will be thus eluding to higher cash flows. For example, in 2023 they have 407 Bcf of gas hedged at $2.46. The current strip for summer 2023 is priced at $5.06.

This conservative approach to a commodity business is something that made my ears perk up as an investor. Yes, this hedge book does choke the upside, but it keeps you from losing your shirt on the other end. If we remove the lens of looking at this company as a natural gas firm and just focus on answering the question of “How can we increase FCF per share consistently over the years?” Using this conservative approach is the best way to put a better probability of achieving that goal, which for me, is all that matters.

Buybacks

Okay, so now we have a company that has a high degree of certainty of cash flows staying at current levels. The next question is what are they going to do with that cash?

With the stock price at current levels, the answer has been buybacks, buybacks, and more buybacks. I would classify this company as an aggressive cannibal.

If there is one thing I have been able to comprehend over the years as an investor it is the magical formula of a constant and slightly growing cash flow with the combination of aggressive share reduction. You don’t need to be in a sexy, high-growth business to make your shareholders above average returns. This to me was fully comprehended after my deep dive on AutoZone.

I wish not to make the point that the result will be similar to what we have seen at AZO. We don’t know what the future looks like. But just like when you are dealt pocket aces on the button in poker, it’s a hand you want to play.

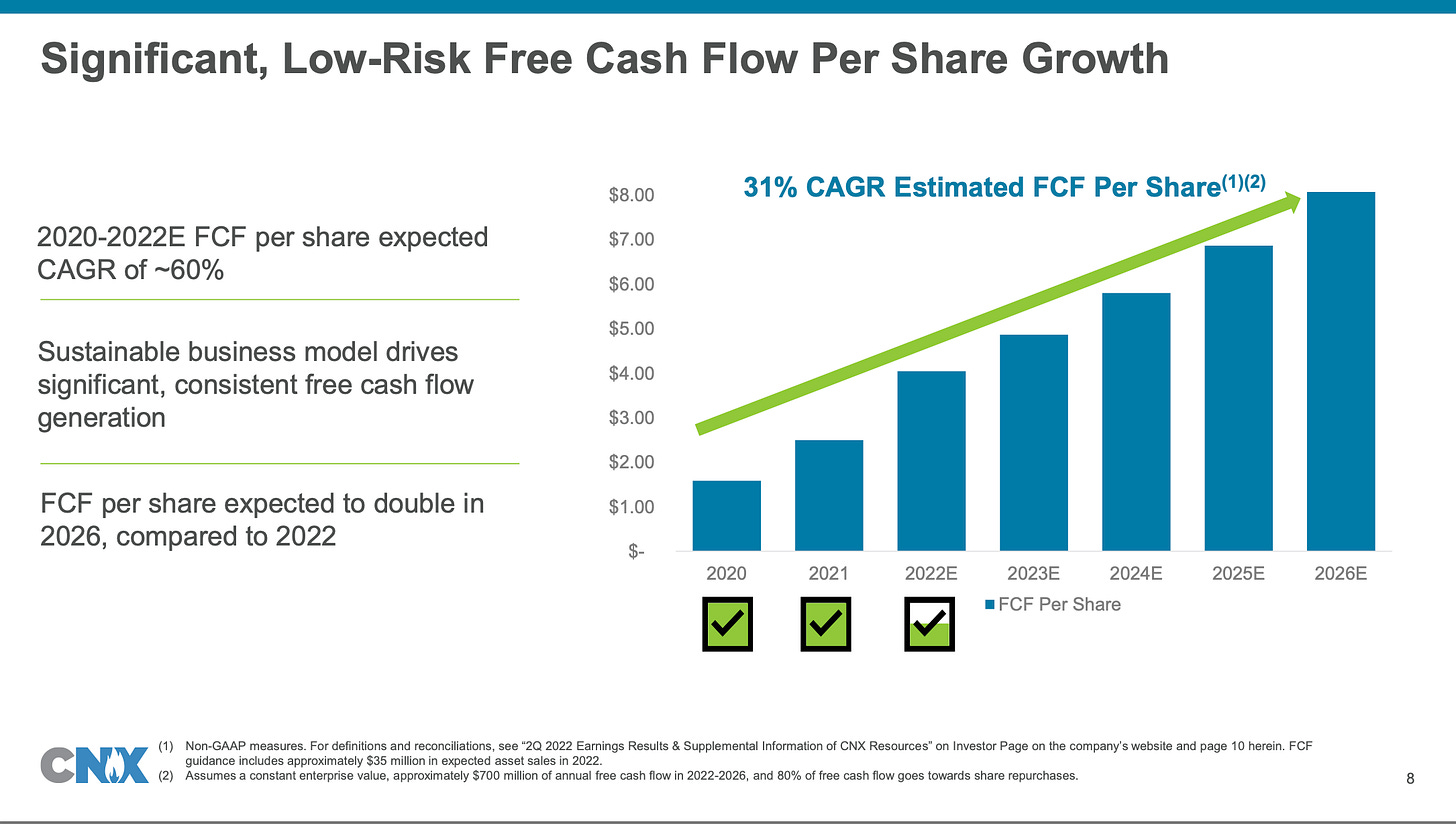

Management has made it easy for shareholders to see what the future looks like with this slide:

If we look a few years out making two assumptions: 1) The cash flow level will be maintained by their hedging strategy and 2) the share price will remain attractive enough to warrant repurchases, we are looking at $8.00 of FCF per share in 2026. Not bad for 4 years’ time. Personally, I am hoping the market continues to stay bearish on this stock so they can continue to pound the share count below the $20 mark, if it stays there long enough FCF per share in 2026 will be higher than $8 which puts us who knows where.

Going Forward

There are a few things about CNX that I left out of this post because I wanted to keep it as simple as possible but it’s worth mentioning. I wouldn’t feel as strongly about this company if they were not one of the lowest-cost operators of Natural Gas in the Appalachia region, the demand for natural gas will remain at consistent levels and even grow over time, and they will be able to keep production at current levels or more of around 550-600 Bcf per year. Another big nudge for me is William Thorndike being the chairman. I trust that he is doing his job and trust that he is helping guide Nick Deiuliis, the CEO, through capital allocation decisions.

When I look into this company's future, I will focus on a few things, mainly around watching the key points above. I want to see them continue to put hedges in place, resisting the urge to let higher gas prices lead them away from their core strategy of building an “annuity” like cash flow machine. You can’t call it an annuity if there isn’t a large degree of certainty and you can’t have much certainty without a solid hedge book.

I will also be paying attention to the buyback levels, as of this writing the share price is around $15 and they were aggressive in buying back shares at around $18 so I am hoping they will be opening the throttle even more and taking advantage of this market environment.

Given the background of management and the chairman this company, in my opinion, has evolved into an interesting situation to study. The outcome is still out to be determined but my money is behind it to be favorable for shareholders. If the goal of the CEO is to be written about in the second edition of the Chairman’s book then I am more than willing to play the hand.

Peace and Love,

Michael

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investment decisions. Thank you.