Builders FirstSource

Collected thoughts on the name I should have paid attention to long ago.

After watching the name float around the internet and receiving a nudge from a friend, I decided to take a closer look and see if I could understand why the stock is up over 20x in the last 10 years.

Here is the simple framework that explains the meteoric rise.

A Consolidation of Distribution Networks

Since the name was released out of the hands of private equity in 2005, BLDR has been on an ever-expanding path of industry consolidation in a highly fragmented space.

The homebuilding suppliers were left for dead post-GFC, and if we have learned anything from the Robbotti investment philosophy, the seeds of success are sown during the period when no one wants to touch it

Since then we have seen two waves of consolidation among the major players.

One came in 2015 when the 4 biggest players became two and in 2021 the two biggest became one when BMC merged with Builders First Source. And even though they are the largest in the space with a presence in 89 of the top 100 MSAs, they only have ~2.6% market share.

This is to say, there is still a ton of room for consolidation in an industry where larger scales translate to increasing returns.

The building supply industry is a local business. The big products that go into home building such as lumber, plywood, drywall, flooring, windows, doors, and shingles do not travel well over long distances.

For professional homebuilders, deciding on a supplier comes down to two things, proximity and selection. If a supplier is close to the job site and stocks all the supplies you need, they become your first call, and if you fulfill the needs, rarely do they go elsewhere. These are sticky relationships.

As a way to make sure this relationship is not lost, BLDR takes the extra initiative to go the extra mile making the building process easier for builders through their value-added offerings and digital platforms.

The value offerings such as truss systems and millwork, are built to fit off-site and require only installation in the field. Manufacturing these components in a shop instead of the field is much more efficient and makes the overall process a little bit easier.

When you add all of these together, proximity, selection, and value-add services it creates a wide moat unlike many others in the building supply space.

This competitive position is illustrated by the growth in revenue from ~$1B in 2012 to over $17B in 2023.

What makes the story even more interesting is they have been able to push up margins over time too.

The simple understanding comes down to this:

BLDR through a series of acquisitions and mergers has achieved a national scale in a local business.

This has allowed them to become the strongest competitor in the markets they serve. The scale allows them to negotiate for better pricing on supply and produce efficiencies that others can not replicate due to their smaller size. This leads to an ability to pass on better pricing to their customers and attract more in the process. Attaching national purchasing power to a local business is a huge competitive advantage.

This wheel will continue to turn as the company continues to grow through more consolidation. It also helps to have a major tailwind.

Tailwind

BLDR’s business is directly tied to the number of homes built and we are going to need more homes.

The best explanation I have heard came from Ed Wacheneim when he was discussing DR Horton on the Business Breakdowns Podcast. (He gets into it around the 23-minute mark).

Here are the big things you need to know from this discussion:

The US has a basic demand for about 1.5M new housing units a year. 1.1M comes from population growth and ~400K comes from replacing homes that are torn down or damaged beyond repair from fire or flood

For the past 12 years, we have substantially underbuilt and as a result, there is a shortage between 3-4M.

The situation today is much different than 12 years ago as we have a shortage of labor and some materials so, in Ed’s opinion, we don’t have te building capacity to keep up with demand. He thinks there really is only the capacity to build between 1.6 to 1.7M units each year including apartments.

With a 3-4M shortage, an annual demand of 1.5M more, and the capacity to build 1.7M you will be chipping away at the deficit by ~200K a year. Which means it will take between 15-20 years to erase the deficit.

I will be the first to jump out in front of the bulls and scream, this will not be a straight line.

Housing is cyclical and there will be ups and downs to the cycle but for a company like BLDR, even if these numbers are slightly off, there is a massive tailwind pushing the demand. When you sell picks and shovels, it helps to have rising gold prices.

Proven Capital Allocators

Since the combination of BMC and BLDR in 2021, FCF has not been scarce. An above-average year in 2022 helped but on a 3-year average, they bring in about ~$2B a year in FCF.

The part I find more interesting is how they have taken the cash, used it to decrease the leverage in the business, and used the buyback machine to shrink the share count by ~41% since August of 2021 when they merged with BMC.

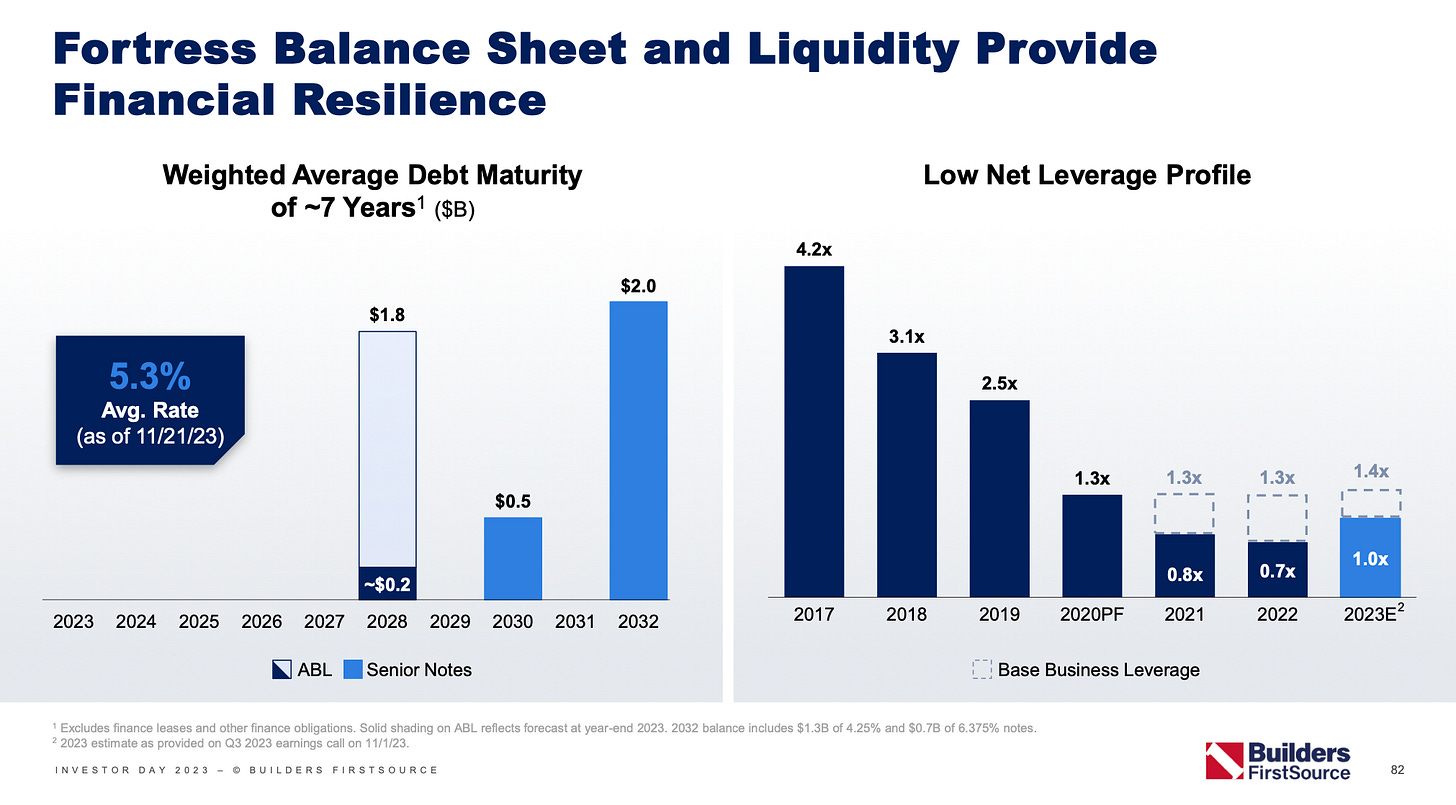

They like to use the term “fortress balance sheet” to describe their financing profile and aim to keep the debt load between 1-2x EBITDA which I think is conservative enough.

From 2022 through 2023 the company deployed a total of ~$6.1B.

$4.4B went to buybacks

$900M was used to make 13 acquisitions

$800M went to organic investment in their business.

During their investor day in 2023, they outlined their goal to deploy between $5.5-$8.5B between 2024 and 2026 through a combination of all 3 buckets, buybacks, M&A, and organic investments.

Something else I found interesting was their incentive structure.

50% of the long-term comp package for NEOs is based on ROIC goals and a TSR modifier compared to an industry index. It’s a good sign to see ROIC and not just a fixture on the earnings profile. This tells me they are both focused on growing the earning power of the company and making smart investments with their capital.

In Closing

It’s hard not to sit back and admire the success BLDR has had over the past decade. Yes, the stock produced eye-popping returns. But, it is the fundamental execution that I admire more.

Over the last decade, they have been able to complete two large acquisitions/mergers, grow both the revenue base while simultaneously increasing the margin profile, and have the conviction in their own plan to buy back a huge amount of stock when the market had a different opinion. It is an impressive track record and deserves attention.

I am not ready to give an opinion on the stock price as I am a beginner at understanding the company.

After a price run like we have seen over the last two years, it’s hard to argue the bullish nature of the situation isn’t already priced in. It’s safe to say there is a tailwind but with a price run-up like this the question becomes, “How strong?” and I don’t feel comfortable yet to give an opinion.

Disclosure: I do not own BLDR shares at the time of this writing.

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

I am not sure you can say growth has been factored in as the company is different than in the past. The forward growth & margins are better than in the past. The 2026 Forward looking P/E multiple of 10 times ($20 EPS) doesn't include much growth in housing demand. If increaed housing demand arrives by 2026 the multiple will even be cheaper.