Boston Omaha

Billboards. Bonds. Broadband. Build For Rent.

Disclosure, I am long $BOC and the Family Fund is too.

The deep dive on Boston Omaha was slated to be published a few months ago but then the newest edition of the annual letter and 10K was released so I put the analysis and the deep dive on the back burner to see if the newest refresh of documents would give me a better base of information. Well, they did me one better.

I don’t even think there is a reason for me to write a deep dive because this year, the annual letter and 10K give the investor any information they wish to know about the company without leaving you in a ball of confusion.

This was one of the easiest 10Ks I have ever read. If I was new to this company I would read this year’s annual letter and then move on to the 10K. Then go back and read every letter from the start back in 2015.

A podcast about the article:

Apple Link:

This name gets dunked on a lot. It’s understandable. When you are a small company, that writes an annual letter throwing out words like “rational capital allocation” and ending each letter with a section promoting that they are looking for businesses to buy, everyone and their mother rolls their eyes. It also doesn’t help that one of the Co-CEOs is the great-nephew of another big name CEO in Omaha.

There is no shame when I sit here and tell you that when I first discovered the name about 4 years ago I bought the stock because my young self fell intoxicated at finding the next, you know who. I poured over the annual letters, there were only three available at the time, and bought some stock.

It was the summer of ’18 and the stock was at $20. Today, it’s about the same.

I have not been a faithful believer the entire time. When I came back from school I sold my holdings to pay off my student loans and when compared, paying off the loan was a better investment than owning the stock return wise. After building my savings back up and keeping a close eye on the company, the luster of a nice shareholder letter faded and I began to take a hard look at the financials. The numbers weren’t there yet so I went and found other ideas.

Over the past couple of months, prices became a little more reasonable and so I decided it was a good time to get back in. I have been a believer that if the CEOs did what they talked about doing in the annual letter they would build this business into an attractive compounding machine.

“Since our first letter to shareholders in 2015, we have kept the same stated goal: “Boston Omaha’s focused objective is growing intrinsic value per share at an attractive rate, while seeking to maintain an uncompromising financial position.”” - 2021 Letter

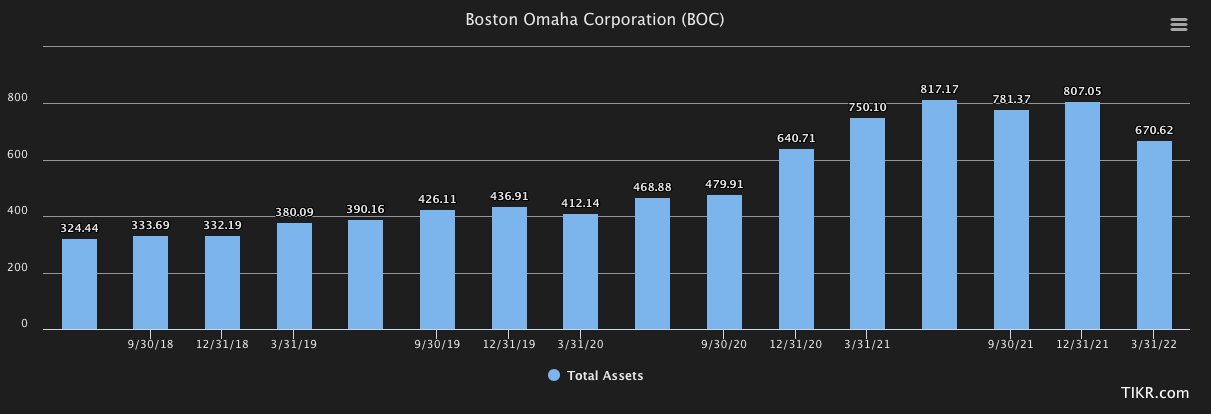

Here is a table of the total asssets in the businesses over the years.

Side note: “this April (2020), the SEC required a change in the classification of warrants issued by all special purpose acquisition companies (SPACs). What was once classified as an equity instrument is now mandated to be held as a liability, which set off a complicated accounting chain reaction ultimately resulting in the requirement that we consolidate Yellowstone Acquisition Company with Boston Omaha’s financials. Now, nearly $140mm of cash that can never be Boston Omaha’s has to be temporarily included in our financials until we either find a business combination for the company or Yellowstone’s shareholders get their cash back. Book value temporarily, and in the judgement of your management inaccurately, declined due to the restatement of the warrants as a liability.” - 2020 Annual Letter

Here is how the market cap compares over the years

Billboards

Some of the best investors in the world have stated that the best investments are the ones that have been the most boring. Billboards must be in the top 10. Link Media currently has ~3,900 billboard structures and began operations in 2015. Since then the team led by Scott Lafoy, has deployed ~$225m into the business.

The economic characteristics of the business are intriguing. It runs on about $45m in tangible capital and spits out around $12m a year for a 26% ROTCE. Not bad. Ask me how I feel about paying around 20x earnings for it and I am not jumping out of my seat. But there are a few characteristics of the business that make this purchase price not seem so rich.

Increasing regulation makes it hard to build new ones, they have a low capital intensity, and there are few alternatives to direct someone to pull off the highway and visit a fast-food chain or something as such.

The growth of this subsidy is largely dependent on the ability to buy the assets when they come up for sale. This is an arm in which it’s largely unpredictable. One year they might make a few small acquisitions and the next a few large ones. Like in 2017 vs 2018, the growth is all dependent on the assets coming up for sale and BOC being able to acquire them for a fair price. Combine this with a modest pursuit of operational expertise that has shown the ability to produce good returns on capital and we have a nice little business.

Management has spoken about being the “marrying kind” when it comes to billboards. This leads me to believe over the next couple of decades, if they stick to their word, these assets will throw off plenty of cash that is ripe for allocation into other lines of business.

Insurance

General Indemnity Group (GIG) is a surety insurance company. Surety is a small niche market in the insurance field. A surety bond is a guarantee of performance from one party to another. For example, to do big construction jobs some companies require contractors to be bonded so if they don’t complete to work done, the guy running the entire job can collect on the guarantee so they don’t lose money.

All in all, this has been a smaller portion of BOC only about $36m employed. But this capital gets two turns on it, one for supporting the underwriting actives and the other for being able to invest the capital effectively while it supports the underwriting.

The surety insurance market is small. To give you an idea here is a table from their 2016 annual letter that shows the 2015 results for Net Premiums Written for the overall insurance industry. These numbers are a little old, but you get the picture.

The two operating subsidies that started BOC, billboards, and surety insurance, both have a similar vibe to them. Small fragmented markets. This comes with the opportunity to enter and grow into a large player.

“At our size, we are less than one tenth of one percent of the surety market and made it onto the top 100 underwriters. Tripling our premium would land us solidly in the top 50. If we are going to hunt for opportunity, in general we prefer to go where the crowds aren’t” -2016 Annual Letter when premiums were $4.7m

I expect this one to be a slow mover in the years ahead but the idea that rapid progress is needed to advance in this industry is nieve what is needed is patience and a long time horizon.

Broadband

For captial allocators, this subsidy gets the blood pumping. Fiber is Fast, FIF, is where BOC runs its broadband assets. This is not the name the customers see but rather the vessel in which all of the companies are held. The company made the first fiber acquisition on March 10, 2020, with the purchase of Airbeam for $14m, and then in December of the same year bought Utah Broadband for $27m in December.

In 2020 Fiber generated revenues of ~$3.8m and in 2021 revenues came in at~$15.2m and have produced a gross margin of ~80% for both years. They ended the year with about ~18,000 customers but in April of 2022 BOC acquired a company named Info West which added 20K broadband customers to the business.

This subsidy presents management with the largest opportunity to deploy large amounts of capital at attractive rates. Here is what management has said about the reinvestment opportunity in past letters:

“It is estimated that broadband providers will spend in excess of $60 billion over the next five years building fiber to the home across this country 13, and we plan to do our part in our markets from Arizona up through Utah and beyond.” - 2020 Letter

“We believe these investments are good uses of capital in the long run, and unlike billboards, opportunities for deploying additional capital are less dependent on assets for sale, as we have plentiful opportunities to build last mile fiber to the home in our existing markets” -2021 Letter

They are willing and able to take years of pain in terms of laying out the capital now to reap the rewards down the road. The business is still new so there is a long road but the signs so far are giving me hope.

Investments

Management introduced Boston Omaha Asset Management in 2020 opening with this paragraph:

“As our investment operations have evolved, we decided to consolidate them underneath another wholly-owned subsidiary, Boston Omaha Asset Management (BOAM). Here we hold our interests in 24th Street Holding Co., Yellowstone Acquisition Company, and generally any investment funds where we are raising outside funds and managing third party capital. BOAM is small today, but we hope to increase its scope over time. Certain new investment opportunities may be uncovered where it may make more sense in a fund structure with limited partners investing alongside Boston Omaha, as opposed to Boston Omaha pursuing the idea with its limited balance sheet. “

Whenever there is a plan that isn’t common suit it can be met with skeptical eyes. It’s not usual for a public company to come out and say they plan to form partnerships instead of pursuing ideas outright. What started as BOC investing capital for itself, has now transformed into an entire investment business. When this was first introduced I wasn’t too excited, “Why are we going to put effort into partnerships when we should be focused on growing the company itself.”

This was a naive close-minded view.

After a full year of operations and reconsolidating in 2021 I see the competitive advantage and value driver that BOAM can become. It is also going to become a complex asset to value over time as more and more assets are put in the bucket.

Here are the GAAP asset values of BOAM as of December 2021:

Here’s where it gets complicated. The GAAP asset values don’t paint the real economic picture of the value buried in BOAM, so here is a small overview of each of the investments:

Sky Harbour

This investment is accounted for under the equity method because they own more than 20% so it will not be marked to market every quarter like their investment in DFH which will. Thus, one will need to do out the numbers to see the real underlying value of the investment, it won’t show up accurately on the balance sheet.

Dream Finders Homes

As of December 31, 2021, the total of unrealized and realized gains have totaled around ~$78m on a ~$10m investment back in 2017.

CB&T Holdings: acquired ~15% ownership in 2018 for ~$19.1m, and look-through earnings for 2021 were $6.5m. Crescent is located in New Orleans and generates the majority of its revenues from indirect subprime automobile lending across the United States. Last year they earned a 29% pre-tax return on equity with ~$50m sitting idle to excessively capitalize the bank for potential losses.

Logic Commercial Real Estate: ~30% ownership for ~$360k spread out between 2015-2017, pre-tax earnings since the original investment have accumulated to $1.8m.

“We say it annually, but Logic continues to distribute earnings well in excess of our investment, and besides the cash returns we also believe its intrinsic value is far higher than our carrying value. “ 2021 Annual Letter

24th Street Asset Managment: ~50% ownership acquired for about $48k in 2018, this company manages two real estate funds launched in 2020. BOC has been an investor in both funds, in total, they invested $6m and have achieved a return on capital of ~38% between the two funds. The management company has received distributions since its inception of $304k.

Breezeway: A small software company for property managers. Invested ~$100k in 2016 through GIG and is now valued at ~$200k. Breezeway is working with BOC to develop software for property operations for its own Build for Rent business.

Investment securities

Fund One: Boston Omaha Build for Rent

The newest venture is managed and financed entirely by BOC. They are in voting for others to invest alongside them in the single-family, build to rent market. Right now they have allocated ~$7m to purchase land in Vegas and Reno with the plan to build around 100 new homes. They have no plan not to sell these but are rather building assets to generate long-term cash flow.

Each of these neighborhoods will have several BOC products like FIF internet and text-based property management software from Breezeway. The dominant economic realign for the fund is because management believes they can economically make their per-unit cost materially lower than the cost to purchase an equivalent home in the same area. If this works, IF, they will be able to charge lower rents and maintain a cost advantage. I’d bookmark this and look back in a few years.

I’d also think about this:

“BOAM is beginning the process of putting our current build for rent assets in a fund structure, and following the example of 24th Street, looking to bring in outside partners to invest alongside us in this venture. BOAM will commit to being at least a 10% investor in the fund, but is limited both due to our finite capital base but also because our longer term goal is to spin-off the build for rent operation as a REIT once scale has been achieved.”

Closing Thoughts

I was in Omaha (not intended) a few weeks ago and met a money manager from Florida who worked under Lou Simpson. As we left the Markel brunch together he asked about my ideas.

“Have you heard of Boston Omaha?”

He rolled his eyes, “Yes, I have.” I gave him another name and went two for two with ideas and eye rolls. I am still processing what to think of this but he gave me a simple explanation for his eye rolls and thinking.

“Look, it’s a bet on the jockey, not the business. You’re betting the jockey can create value over the long term and I am just not confident they can do it.”

I shook my head because he was right, this is a bet on management. When you invest in a Hold Co like this the thesis is simple, management needs to take dollars and invest them into assets at attractive rates of returns. I am willing to bet he saw this idea pitched once on Twitter as the next “_____”, and it’s easy to dismiss the idea quickly because the same pitch has been said many times before and they haven’t worked out.

Personally, I despise it when others use the comparison. Just like you wouldn’t compare yourself to anyone else, companies are the same. Are there similarities, yeah but just because I like to lift weights and someone else also does doesn’t mean we are 100% alike.

When I first invested when I was 22, ideas outweighed assets. There wasn’t much vision for the company other than, “Hey we have a small billboard business, a small surety insurance, and some minority investments.” There was no track record to see if these guys were worth entrusting with capital. But the company is 7 years old now. For me, it has been long enough to come to the conclusion they deserve to be trusted. The market price for the company 5 years ago ran ahead of the company, but now in my opinion I believe the gap between price and value has substantially decreased and become negative. Thus giving investors an opportunity.

Let’s keep this simple, at the end of Q1 the total assets on the balance sheet were ~$670m which I believe are understated due to the depreciation charges and the lack of mark to market values in the minority investments segment. Right now the market cap is $674m. How big is the gap? That’s up to interpretation. To me, it’s large enough.

Let’s take CB&T for example, BOC owns 15% and carries the value on the balance sheet at ~$19m. Last year they earned $44 million in pretax income on a 29% pre-tax return on equity. Let’s give it a 10x pretax multiple, which I think is fair, valuing the business at $440m. 15% of $440m is $66m. So there is another $40m in value that isn’t reflected in the accounting statements. I encourage you to dig into each of the minority holdings including DFH and SKYH because they too, could be undervalued.

In the end either you believe management can take $1 of cash and turn it into $2 of value over a reasonable time frame or not. I believe they have the ability to do so but only time will tell.

Peace and Love,

Michael

Disclosure, I am long $BOC and the Family Fund is too.

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.

great review i am very interesting in this company i m holding guy and now the price is very favorable to entry