Bob Robotti's Thesis for LSB Industries $LXU

The chauffeur pitch from Bob's MOI Global Best Ideas 2024 presentation

In January, Bob Robotti gave a presentation at Manual of Ideas where he pitched LSB Industries $LXU.

This article is an attempt to synthesize the thesis into a written form. For myself, it is only Chauffeur's knowledge but I put this together so others can hear about the idea too.

Here is the full presentation if you are interested, which I strongly encourage you to listen to:

LSB Industries manufactures chemical products for the agricultural, industrial, and mining markets. Their main products are ammonia, ammonium nitrate (AN), urea ammonium nitrate solutions (UAN), and nitric acid with an annual production capacity of ~900K metric tons. They operate 4 plants located in Alabama, Arkansas, Oklahoma, and Texas.

It is one of the smaller “pure-play” names in the space.

When you think ammonia, you think fertilizer. Right now most of the demand for the chemical comes from agriculture and LSB is no different.

However, the demand profile could be shifting.

As the world works to transition out of fossil fuels something has to fill the gaps. Solar, wind, and hydro only go so far. Ammonia has emerged as a possible candidate to help in the areas where the others might not be feasible.

Here are the 3 big areas where ammonia could aid in the energy transition;

Maritime Shipping

Right now several companies are working to develop a maritime engine that burns ammonia.

This advancing technology could unlock an enormous end market for the chemical. It is still in development and would require the shipping industry to retrofit or build new vessels. This could take a while. However, even a ship that has an engine that burns ammonia and traditional fuel would be a move in the right direction.

Power and Electricity Generation

Japan and South Korea are blending ammonia in with their coal fire plants reducing the CO2 output from coal burning. Both countries have signaled a bigger move to incorporate the blending to a larger degree.

This implementation requires no retrofitting and the adoption curve can be much quicker.

For what it’s worth, LSB is in talks with INPEX, Japan’s largest E&P company, to develop and construct a production and export facility on the Houston Ship Channel that would have an annual capacity of 1.1M MT of low-carbon ammonia. Right now INPEX is pursuing offtake agreements and the final investment decision to be made at the end of 2025. We wouldn’t see production from this hypothetical asset until 2029. Discount appropriately.

Storage and Transportation for Hydrogen

Hydrogen is one of the fuels we are looking for for a clean transition, the problem is the lack of infrastructure. Ammonia, although still difficult to move, has an infrastructure in place and when blended with hydrogen can move the chemical more easily.

Here is a chart from Yara, one of the world’s largest Ammonia producers, which outlines the potential growth in the ammonia market should these demand cases materialize

The Competitive Advantage for LSB

In a commodity environment, the lowest-cost producer wins and no one in the world has a better cost profile for ammonia production than those who have operations in the US.

The reason we can produce it so cheaply is our incredible supply of natural gas, which is the main ingredient in the production of ammonia.

Having their plants located in North America is the biggest competitive advantage for LSB.

The cost savings are so great that international producers have begun projects in the US with most of them not being complete until 2025. Should the demand case come full circle, this oncoming supply will still be dwarfed by the potential demand.

They also got lucky.

On top of being located on the right continent, LSB’s largest production facility (El Darado) sits on top of a cavern where it can sequester CO2 permanently without having to truck it out.

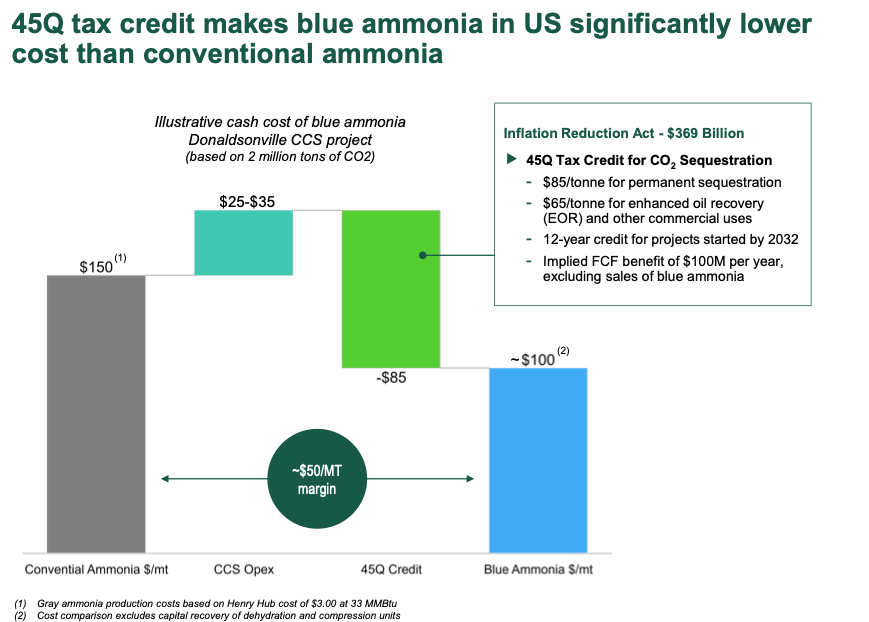

The passage of the IRA has created economic incentives to capture this CO2 and LSB has teamed up with Lapis Energy to conduct the sequestering.

Lapis expects to capture and sequester >450,000 MT of CO2. Lapis will then receive a tax credit (45Q from the IRA) and pay a fee to LSB for each MT captured. This project has the potential to produce an extra $15-20M in incremental EBITDA for the company.

CF industries highlighted the benefit of the 45Q Tax Credit during their 2023 roadshow.

These structural competitive advantages give LSB the ability to earn outsized returns, which we saw in 2022. Bob admitted in his presentation they probably “over earned” then and he forecasts normalized earning power to be ~$200M a year range but it will be lumpy.

As the prices for both Corn and Ammonia came back down from 10-year highs, the earnings readjusted to a more normal level in 2023 even though the results look awful compared YoY.

2023 vs 2022

Sales: $594M vs $902M

EBITDA: $120 vs $380

EBITDA Margin: 20% vs 42%

Diluted EPS: $0.37 vs $2.68

But this lumpiness and possible underearning in 2022 has put the stock around ~$7.50 compared to $28 in 2022.

Bob sees this as a huge opportunity.

Priced Well Below Replacement Cost

One of the main pillars of the Robotti investing philosophy is to find the survivors of a creative destruction cycle. It is the belief that after the destruction has taken place, the survivors can capitalize on the next upcycle with higher market share and even greater earning power.

Ammonia has been at the center of one of these cycles over the last 5-6 years. Returns on capital were low and in LSB’s case negative. No one wanted to be in the ammonia market. But, it seems that we are on the other side of that cycle.

Except no one cares.

The current price for LSB is less than half of what Bob estimates it would cost to build the same amount of capacity today. Based on 2023 M&A, he isn’t far off.

CF Industries bought the Waggaman Ammonia Facility (880,000 MT capacity) for $1.67B.

Koch Ag and Energy Solutions bought the Iowa Fertilizer (850,000 MT) for $3.6B.

These prices translate to ~$2K-$4K per MT of capacity, which would give LXU a value of $1.8-$3.6B. If we subtract the net debt of $276M we get an implied market cap between ~$1.5-$3.3B. Today the market cap is ~$500M.

Even if these prices are off, there is a significant margin of safety when compared to the price that LSB is trading for today.

Overall there are 3 things Bob stresses about LSB:

It’s priced well below replacement cost

There are structural advantages in place to generate outsized earnings

The change in demand profile for ammonia turns this into a growth company.

I enjoyed this pitch and will be diving into LXU more to shed the chauffeur knowledge. It does seem like an interesting play on a company that is trading at a serious discount to IV with the potential for growth ahead.

There is plenty of work to do before I am comfortable enough to give an opinion, but it does intrigue me.

Please be advised, Wall St Gunslinger is not an investment adviser and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.