AutoZone: Increasing The Numerator, Decreasing The Denominator

What happens when net income has increases 10x over 26 years and shares outstanding decrease by 90%. A hundred bagger.

Thank you for reading WSG! Here you can find the analysis, if you are interested in learning more you can download the PDF report which includes the analysis and a deep dive on AutoZone. Thanks for reading and enjoy!

Since instituting the decision to spend the majority of their FCF on share buybacks in 1998, AZO has returned 92.64x the original investment or an annual CAGR of ~19.58%. The purpose of this analysis is to attempt to answer the question, is there any more juice left in this name? If so, what do the forward-looking returns look like from here?

AZOs success has come from the execution of simple variables. Grow the top and bottom line by ~9% and shrink the share count by ~6-7% year after year. Combining these two variables has created a lollapalooza effect.

When a company decreases the DSO by ~ >90%, EPS doesn’t increase by 90%. It increases by 10x. Layer on total income growth of 10x over the same period and you have the formula for a hundred bagger.

AZO finished Q1 with ~7,000 stores their closest competitor is ORLY with ~6,000. During the trailing 12 months AZO has done $16.8B in sales, and ~$3B in EBIT with gross and operating margins in the 50s and 20s respectively. At the end of their most recent fiscal year, they achieved pre-tax returns on capital of ~53%.

How this type of dominance has survived the forces of capitalism (so far) is worth a study.

The Big Heavy Moat

The physical presence of their stores and distribution system alone is the biggest reason why no one else has come in and competed effectively with the national players. Right now, AZO maintains a store within 10 miles of ~85% of the US Population and we have seen the level of the per-store inventory rises, only making the selection deeper and the moat wider.

More store inventory leads to a greater ability to solve more problems for customers in the moment.

On top of the physical scale, the intangible assets only make the competitive position stronger. The knowledgeable and well-trained employees are the secret sauce for AZO, which the company acknowledges in the second paragraph of the 10K. It’s unusual to see a topic like this at the beginning of annual reports.

If I walk into a store with a vague idea of what’s wrong with my car, having someone there who can assess the situation, help me find the solution, and then give me the extra tip on how to fit the part right, will make for one happy customer. The human connection of getting help when you need it from a friendly employee leaves a lasting impression and makes it hard not to go back the next time a situation arises.

The growth in same-store sales tells us they are solving a lot of problems.

Looking Through the Windshield

AZO’s history illustrates the magic of proper capital allocation. They abide by a simple plan, increase the store footprint by ~200 units per year, build out the distribution network, and spend the rest buying back shares. All decisions are made with an internal hurdle rate that I estimate to be ~15-16% which has been met by both laying out capital to build stores and buying back shares.

Using the total capex number hides the real return on investment for new stores because it includes the maintenance capex of the existing footprint and distribution network. On a stand-alone basis the ROI on new stores I believe is above the hurdle rate.

Forecasting the growth for AZO comes down to two things, store count and average revenue per store.

Store count can be placed in a tight range of about ~200 stores a year +/- and I don’t see how this trend doesn’t continue as they work more into Mexico and Brazil while also rounding out the spaces left in the US.

Revenue per store comes with the optionality of driving serious returns for the company. Right now, the average sales per store sit at ~$2.3M a year throwing off ~460K in EBIT. We have seen an ~5% CAGR in average store sales over the last 5 years. Is it a coincidence that the average inventory per store increased at the same CAGR over the same time? I think not.

The commercial side of the business has been the growth driver for the company. Professional garages have different needs from the average Joe who needs to replace his battery. They require a more extensive catalog at any given time, as the commercial accounts continue to use AZO more and more they will be able to tailor the inventory needs and thus increasing customer satisfaction.

Not having to lay out the initial cash to meet these needs is a big advantage.

The Year is 2028

Average sales per store have been increasing by ~5% +/- some. The store count growth has averaged ~200. Here is what we could be looking at in terms of a revenue range.

I don’t find the conservative base case of 7,800 stores with an average store sale of $3M to be a stretch.

From here we can apply an 18% EBIT margin giving AZO an annual EBIT of ~ $4.2B and FCF of ~$3.74B. Using today's share count of ~18M we get $227 EBIT and $202 FCF per share in 5 years. Those numbers go up if you start to shrink the denominator. I think there is a high probability this occurs.

If the share count continues to decrease ~6-7% a year, then we are looking at a DSO of ~12.8M. Apply the numbers above and you get ~$335 EBIT and $292 FCF per share. These are estimates and I think about them in terms of a 20% +/- range.

What We Need for Another 100x From Here

I don’t find it fair to hold AZO to this standard, but for the sake of the experiment, I’ll imagine. If we use the same formula for getting there, we need a final share count of 1.8M and a net income of ~$24B. If they maintain an 18% EBIT margin, they need annual sales of ~$140B. From the current base using a ~10% annual growth rate, which is optimistic, we would get to $24B in about 25 years from now.

The national players still only make up ~40% of the after-market repair shops with another 40% being represented by Mom and Pops. There is a case for consolidation but it’s hard to fathom these numbers from standing in the current spot.

For me, the 5-year outlook is much easier to wrap your head around.

Evidence of the Past and Forward Returns.

It’s easy to get swept up in the story. The name is well-loved because most individuals understand the business. It’s easier to comprehend than cloud computing. But that isn’t enough to make a rational investment decision. From these price levels, you need a high level of confidence in the execution of their consistent capital allocation plan.

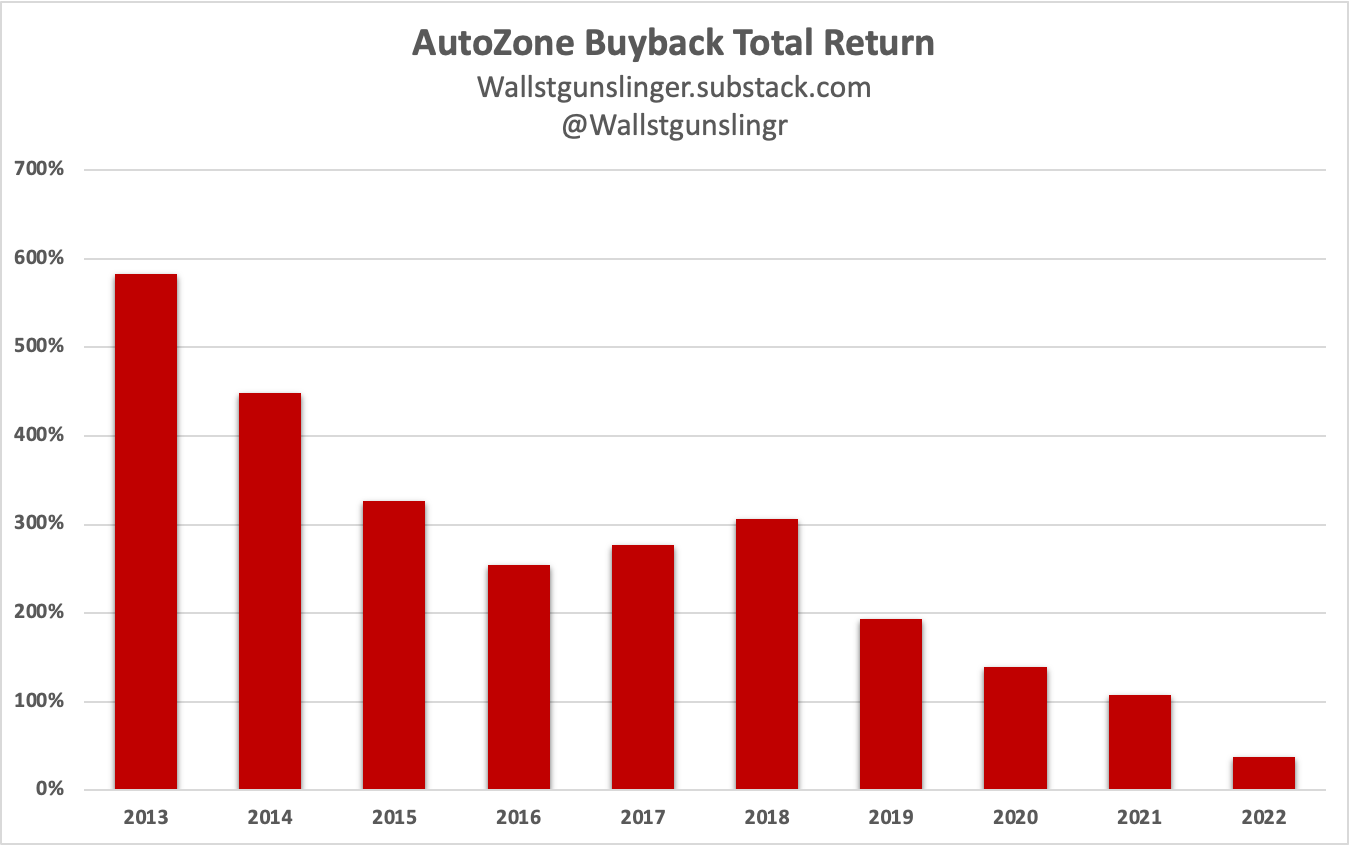

I have heard amongst other investors, “The returns have been so good because of the buybacks. But with the price this high, the returns on those buybacks are likely to be less.” Not long ago, I felt the same way, but the evidence has been swaying my opinion recently.

I understand the logic. Higher share price, less yield on the buyback, leads to lower future returns. But, the average P/E of AZO has stayed relatively flat for the past 10 years, with the average being ~15.7x

If that continues to hold over the future who is to say the returns won’t be similar?

I agree with the team over at Ensemble when they say, “If you assume that the growth rate of free cash flow is stable, then the free cash flow yield plus the rate of growth would indeed be the right way to approach valuation.” –The Risk Of Low Growth Stocks: Part 2

Put me in the same camp of estimating future returns by gauging the yield plus growth in FCF per share.

During the past 10 years, the level of FCF increased from ~$1B to ~$2.5B which equals a CAGR of ~9.6%. FCF per share however has gone from $27.35 to $125.25 or a CAGR of ~16%.

If one was to buy the company between a multiple of 16-18x, the yield + growth would equate to >20% a year. AZO’s stock price during the same period grew from ~$415 to ~$2,700 which rounds out to ~20% a year.

Could there be a change in multiple, maybe? If the average business is roughly worth 15x then what is a company with 20% operating margins, >35% Returns on Capital, and a solid competitive advantage worth?

I too held the belief that the forward returns might not resemble the past but so far I have been wrong. I bought some AZO for my parent’s Roth when Russia invaded Ukraine and it has trounced any of my other picks, forcing me to look at reality.

If the FCF yield stays constant ~5.5-6.5%, total FCF can grow ~7%, and buybacks eat up another 7%, we are looking at what could be another 19-20% (5.5~6.5 +7 +7) a year for the next 10 years. If this level is used for comparison to the hurdle then it would appear intelligent to continue the buyback program.

Right now, the stock sits at ~20x EPS. A 5% yield falls on the lower end of my estimated range but I don’t think management tries to time the stock. If the multiple climbs into the 30s, we are having a different conversation because the forward-looking returns drop to ~15-17%, respectable but within arm’s length of the internal hurdle rate.

Don’t ask me what happens there, who knows, maybe they pay a dividend.

At the current share price of ~$2,700, I don’t plan to buy any AZO. This might be a mistake, but I think a lot must go right to hit my internal hurdle. If the multiple begins to shift south, I will be much more interested. The evidence of the past is too strong to overlook.

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investment decisions. Thank you.

At the time of this writing, WSG does own AZO shares

I love it

Great work. Really enjoyed this piece. Thanks!