AutoZone 🚗

A boring auto retailer that has 100x since I was born.

Business Overview

AutoZone (AZO) is the leading retailer and distributor of automotive replacement parts and accessories in America. They began operations in 1979 and, at the end of the fiscal year 2021, the company had around 6,700 stores spanning 3 countries: U.S., Mexico, and Brazil. The two large markets they play in are the do-it-yourself (DIY) market and the do-it-for-me (DIFM) market. In addition to their expansive retail business, they also have a commercial side that sells parts directly to garages. The commercial business has been a large part of the recent growth in the past few years and is a heavy area of focus. Within their stores, they employ around 100K people, 60% of whom are full time.

Audio Version of This Report:

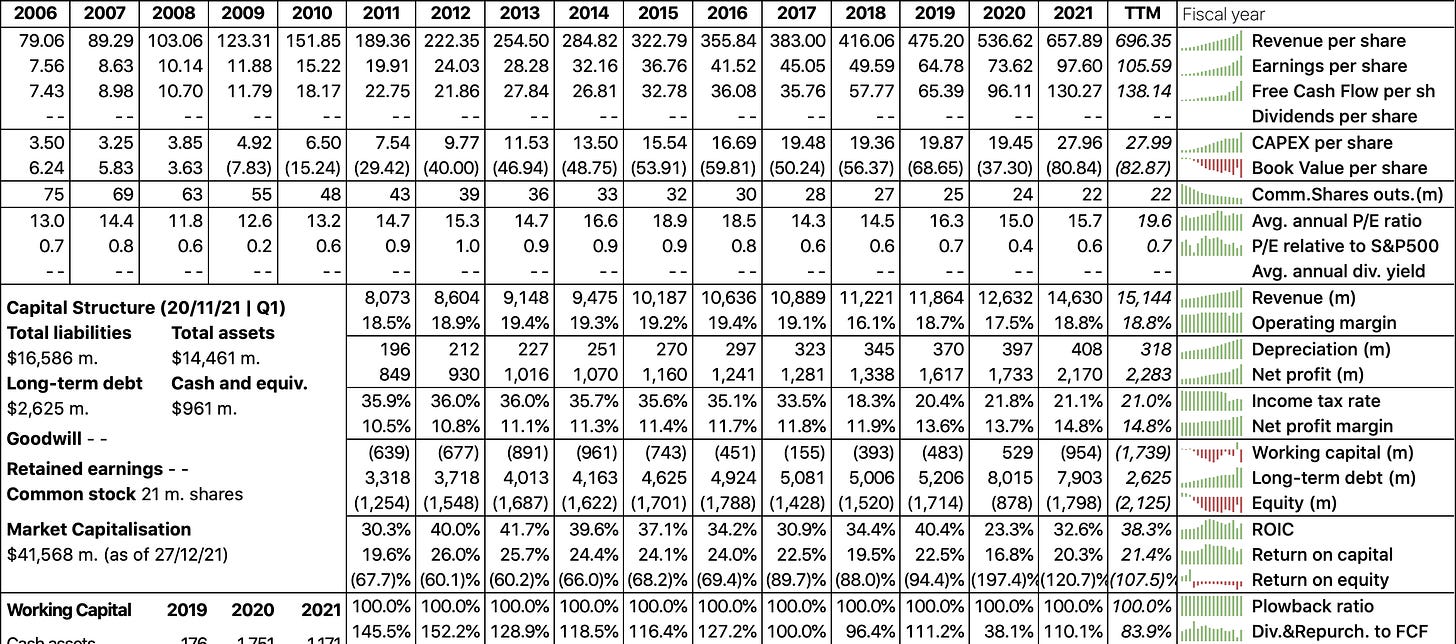

Below is a financial snapshot, courtesy of Roic.ai, of their operating results dating back to 2006.

On the surface, AZO’s numbers show us figures that many investors are taught to look for. Growth in sales and earnings, high margins, and high returns on capital. How they finance their operations can confuse some. They show a negative shareholder equity number which can throw some off. But there are a few numbers I want to highlight.

Revenue, EBIT, CAPEX

When I first look into the financial statements of a company the eye naturally heads for the income statement and works from top to bottom. AZO is in a mature industry and to those who are accustomed to the high-flying tech world, it might be a boring industry, so there are no massive changes in numbers YOY. But there is some magic when it comes to slow and steady which is what we are seeing with AZO. Revenues have been increasing every year for the past 10 years around 5% with EBIT and Capex following the same trajectory.

Margins

But boring can be fruitful and you don’t necessarily need to be in technology to have awesome margins. But, how does a company selling boring auto parts create margins this high? There is an argument that these types of products could be considered a commodity. I mean, what’s the difference between a light bulb sold at AutoZone and one sold at one of its competitors? (I should note that O’Riley has similar if not exactly the same margins as AutoZone. Advanced Auto’s numbers are slightly less)

They have margins this high because they deserve them. The backbone of the industry relies on the distribution channels and the infrastructure set in place with one goal in mind, make sure the customer can come in and get the part they need. This means having a massive catalog of SKUs and a delivery schedule that allows for multiple restockings during any given week. To create this network was not cheap but the convince it provides allows these big players to mark up their products. And the customer has shown they are willing to pay up for the value giving the big players in the industry pricing power.

Returns on Captial

Now here is where the wheat separates from the chaff. Growing sales and high margins are great but the ability to continue to allocate capital into these situations over a long runway is what brings the category of the business from good to great. TIKR defines return on capital as EBIT / (Total equity + Total Debt) which I am good with, I personally like to add in working capital to the denominator which, in this case, would increase the returns on capital even more because AZO runs a negative working capital financial structure.

To better understand the returns created for this company it is imperative to comprehend the unit economics. In this case, the unit that drives the success of this company is their store footprint, it is where the majority of the Cap-Ex goes each year. Here is my rough estimate of unit economics over the past 5 years.

During the past 5 years, the number of stores has increased by 738. Over this span, the EBIT has increased from $1.9 billion in ’17 to $2.7 billion in ’21. Cumulatively they have earned around $10.4 billion in EBIT during this time frame.

In the same period, Cap-Ex has increased from around $550 million in ’17 to $621 million in ’21. Cumulatively Cap-Ex has totaled $2.6 billion. If we divide Total Capex by the number of stores opened (This does overstate the Capex per store because this number includes the cost of the store and all the costs associated with integrating it into the network, so I use a range) it costs around $2.5 to 3.5 million per store. Each store currently does around $2 million in sales each year ($14 billion revenue / 6,767 stores) which translates to around $400K in EBIT per store. This means every new store will create a return of around 12 to 16% on year one with higher returns as the store matures.

We can conclude that each new store on average will add about $2 million in sales and $400K in earnings generating a 12 to 16% return on the money to build and integrate it into the network. Management has stated they have a hurdle rate for returns of each new store and I believe this number is on the higher end of my estimated range due to the conservative nature of my estimate by way of using a larger Capex per store than might be accurate.

Industry Analysis

From the data, I have been able to gather from investor days at both AZO and O’Riley they have estimated their TAM around 100 Billon to 140 Billion. During a presentation at the Gabelli Aftermarket Symposium in November of ’21 the CFO of Autozone, Jamere Jackson, said the following:

“Just a little bit of an overview of the market. First is the do-it-yourself market, or DIY market, we call it. It's about a $70 billion market. This is where the customer does the maintenance work themselves without the aid of systems or performance or professionals working with them. It's about a $70 billion market. It's been consistent and steady and growing about 5% a year, and we've maintained the #1 share in this marketplace for a number of years.

The second piece of the market is the Do-It-For-Me market. Again, a business that's a little bit over $70 billion. This is where customers who prefer to have a professional work on their vehicle and repair the vehicle for them. Again, roughly a $70 billion market. That industry has grown low to mid-single digits over a 10-year time frame. It's a highly fragmented industry. And even though you have big players on the DIY side of the business, the reality is that we, as a big player in this market, are only about a 4 or 5 shares. So there's a tremendous market opportunity for us. It's one of our key growth opportunities as a company and will be key for us to be a faster-growing business going forward.

Our sales in fiscal year '21 were about $3.3 billion. They were up 23%. We've grown the business double digits for the last 6 quarters or so.”

Using this information we can roughly estimate the market share of both AZO’s DIY business and their DIFM business. The DIY commands around a 15% market share (Total sales-commercial segment / DIY addressable market of $70 billion) and a DIFM market share of 4% ($3.3 billion as stated above / $70 billion)

Overall the industry is split up into 3 large buckets 1) the big 4 in aftermarket parts: AutoZone, O’Riley, Advanced Auto Parts, and Genuine Auto (NAPA) 2) The Mom and Pop stores and 3) The dealerships. Freddie Lait estimated the market share of each of these on The Business Breakdowns Podcast: 40% for the big 4 (AZO, ORLY, AAP, and Genuine), 40% Mom and Pop, and 20% dealerships.

Also, Young Hamilton has a great slide in his O'Reilly report breaking down the DIY and DIFM market and the market shares of the big 4. I didn’t want to use it without his permission so you can read his report here (It’s a great report):

The aftermarket auto parts industry demand is driven by two key variables. The number of miles driven and the aging vehicle population.

The slide above was put together for the ORLY analyst day in 2019 but has industry-wide application. The year 2019 is the most recent data available from the Bureau of Transportation (that I could find) which has the light vehicle market standing at a population of around 260 million.

In the most recent report by the Auto Care Association, the average age of a light vehicle is 12.1 years and the average vehicle travels 12.5K miles a year. The average age has been above 10 years since 2010 and the growth in average age can be explained by people keeping their cars longer and these vehicles are better engineered to last longer.

AZO explained in their annual report they target cars age 7 or older, these cars are usually past the age of warranty and owners spend more money to maintain them. The amount of maintenance needed for the upkeep of a vehicle increases the older it becomes and the more miles the car has on it.

A simple rule of thumb I heard on the podcast with Freddie Lait was it costs around 2K a year to maintain a car with 50K miles or more and around 5K a year to maintain a car with 100K or more. This is an industry in which one can see a few years out with a certain degree of clarity by looking at the number of new vehicle sales from years prior and how many will be entering into the “target” zone in the coming years.

Moat Analysis

AZO currently holds the top spot in terms of market share in the DIY market and the 4th spot in the DIFM market. In recent years, there has been a massive push to onload customers onto their commercial business to try and move up on the market share ladder.

Overall, there are two big variables that drive customer demand in the automotive repair market: 1) customer service and 2) part availability

Human Capital

When you first pick up a copy of the latest Annual report by AZO the first section discussed after the business description is titled “Human Capital Resources” which brings attention to the heart of operations at Autozone. While reading their annual reports you can feel they truly care about their teammates. Customer Service is the number one goal of Autozone. Every shareholder letter begins with the “Autozoners Pledge” which reads as follows:

This emphasis began with Pitt Hyde when he first founded the company in 1979. Most of his merchandising techniques came from studying Sam Walton at Walmart where he sat on the board. Employees are instructed to do whatever it takes to help the customer even if this means going out to the vehicle to help them install a windshield wiper, lending them a tool to fix a part, or running diagnostics to help a customer figure out what is wrong. Going the extra mile is the sermon for AutoZoners.

Distribution

It can not be understated how important distribution channels are for this industry. The last thing a customer wants is to drive 20 mins to a part store only to come to find out they don’t have the part in stock. Using the Hub and spoke model AZO has been building the infrastructure to make sure these situations arise only once in a blue moon.

There are 3 key layers to their distribution model. First, we start at the Distribution Centers, these 400K square feet facilities send tractor trailers of supplies to the mega-hub stores throughout the network. The DCs will replenish the Megahubs a few times a week. Mega hubs are about twice the size of a regular store. It was reported in their 2021 report there were currently around 240 hub stores. From these hub stores, supplies are then shipped usually overnight to the over 5,900 domestic stores to replenish supplies.

The huge catalog of inventory means they only turn it over around once a year but this massive amount gives AZO the competitive advantage of having almost any part you need when you need it. A huge combative advantage. They currently have the largest distribution network in terms of store count with over 6,700 with O’Riley in second with around 5,800 stores.

Vendor Financing

Another small detail that makes a huge difference in the operations is the vendor financing model they have implemented over time. In simple terms, a supplier will sign an agreement with AZO to supply them with parts and because of AZO’s stellar credit rating, they are able to pay extremely delayed terms on these supplies. This means when AZO has to stock a store full of inventory they are able to put the parts on the shelves without having to layout any capital. This gives them the flexibility to manage the cash flow into the business and put each dollar into the most optimal spot.

Doing business with AZO is a win-win for both parties. The vendor knows AZO will be good for the money due to their good credit rating so they are able to book a sale with the full confidence that cash will come in the door when they say it will and AZO doesn’t have to tie up any working capital to put inventory on shelves, leaving them more cash to put into buybacks.

Management

The story of AutoZone can be traced back to 1979 when Pitt Hyde founded “Auto Shack” which was a spinoff of his family’s grocery store business. After Radio Shack confronted them with a lawsuit they changed the name from Auto Shack to AutoZone and Pitt was involved with the company serving as its CEO and later Chairman since its founding until he stepped down from the Board after the fiscal year 2018.

As mentioned earlier, Pitt took a lot of the ideas which made Walmart a wild success and implemented them into his own stores like the simple construction of each store and merchandising strategy to give the customer the best possible value for their money with the best customer service possible.

Pitt laid the groundwork for the successive CEOs to build on the momentum and in 2005 William Rhodes was elected as the 4th CEO in the history of Autozone.

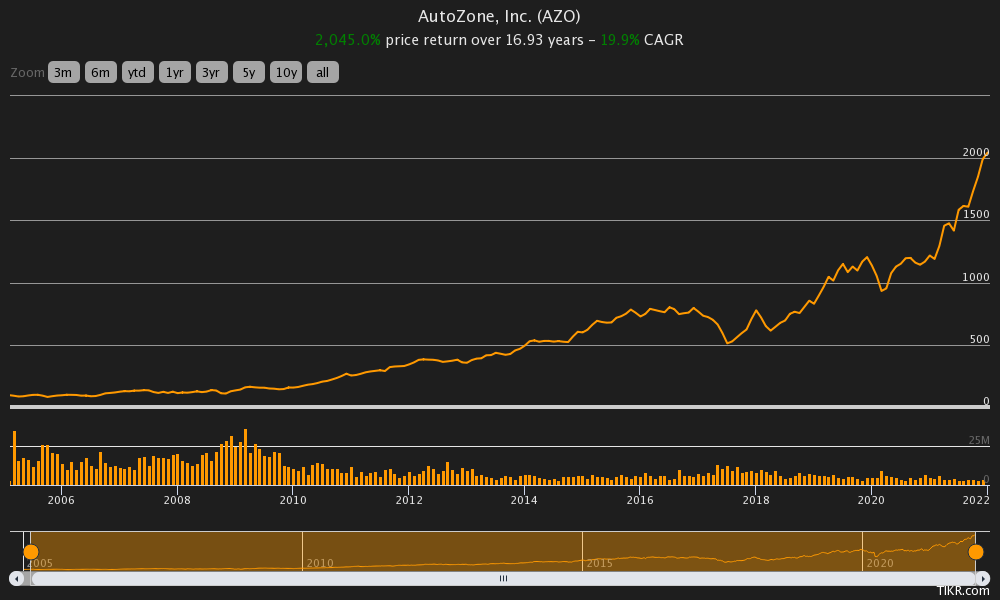

William “Bill” Rhodes has been running AutoZone for over 15 years now and has accumulated an impressive tenure. During his time he has seen sales grow from around $6 billion to over $14 billion, Net income go from $571 million to $2.28 billion. This trend of sales and income growth was occurring before Bill came onto the job but the relentless execution of only opening new stores that meet a specific hurdle rate of investment, turning to a vendor financed model, and shrinking the share count has rewarded shareholders. Starting on his first day in office during March ’05 the share price has grown from $190 to over $2000 a share during the time of this riding an impressive 19% CAGR.

Bill has made himself a generous wealth through the share price increase and personally holds around 167K shares, 135K of which are options to purchase shares. He personally owns a little less than 1% of the company but still, a figure around $300 million isn’t chump change. This is a good amount of skin in the game and I am sure he has taken his own personal holdings into account while making decisions to allocate capital thus reducing the agency costs to investors.

The most recent compensation arrangement for the CEO breaks down as follows: 10% of the pay is base salary, 15% is an annual incentive, and the remaining 75% is in the form of “Long term incentives” which means options. The other NEOs have a little more base pay and a little less long-term incentives.

Each year the annual incentive is decided using Return on Invested Capital and Earning Before Interest and Taxes. They also use an “Economic Profit” number which is the target for the executives to hit. They define this as, Net Operating Profit After Taxes minus the cost of capital at a charge of 10.5%, So Net Income - 10.5%.

The options are granted every year with a strike price equal to the market value of the shares on the date of the grant, which means the options are only worth the amount between the strike price on the option and the market price of the stock. They vest in 25% increments over 4 fiscal years and have a life of 10 years at maximum. In the most recent filings Rhodes vests over 30 Million in shares this year from his 2011 grants.

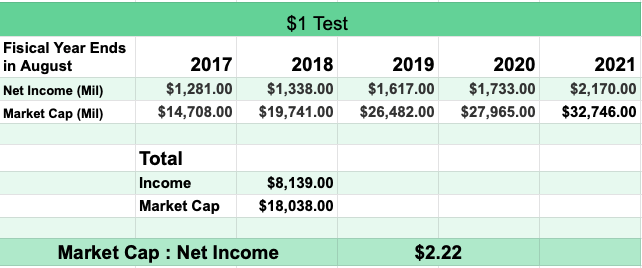

$1 Test

The usual Buffett $1 test uses retained earnings but with AZO it’s hard because every year the payout is more in share buybacks than they take in, in terms of earnings so I used cumulative net income instead. It’s not perfect but like Buffett, I would rather be vaguely right than precisely wrong. As we can see they pass the test with $2.22 of market value for every $1 they take in through income.

Intrinsic Value Growth Rate

I have been reading John Huber’s work since I was a young investor in the dorm room. To help me get a gauge of intrinsic value I like to do a rough estimate using his formula for calculating the growth rate of intrinsic value which is the reinvestment rate of capital multiplied by the returns generated on this capital.

This is a rough estimate but the numbers overall look good. The returns on the capital put to work show us a return over 30%, a fantastic number. The sad part is only 20% of these earnings are plowed back into the business. The overall growth of Autozone has been steady through the opening of around 200 stores a year and management has shown through history they are not willing to rapidly expand into areas. They are selective with their capital investments and the rest goes to shareholders through buybacks.

Capital Allocation

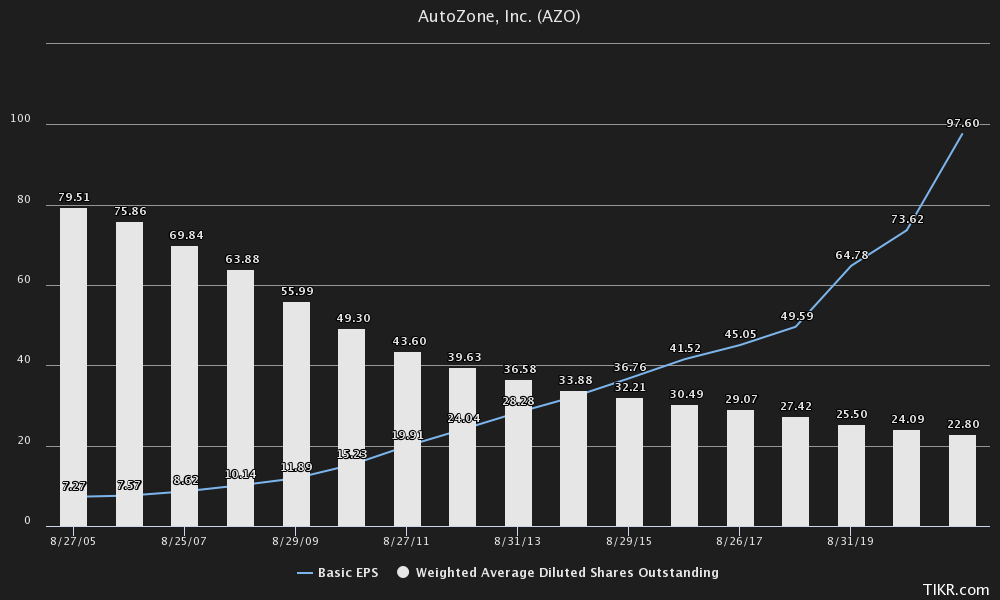

I eluded to it above but the overall strategy of AutoZone since 1998 when they first authorized share buybacks has been to invest capital into the ecosystem of the stores and the infrastructure which goes along with it like distribution centers. They have maintained a specific hurdle rate for the return on their investment and any additional dollar which was not invested into the ecosystem has been plowed into share buybacks which have translated into market-beating returns for shareholders since this authorization in ’98.

On August 31st, 1998 the share price was $25.94 as of this writing the share price hovers around $2,000. Since ’98 AZO has bought back $27.95 billion dollars and has shrunk the share count from 154 million to 22 million.

There are two drivers of these returns, the growth in income per share and the shrinking share count.

It has been said by investors much more intelligent than myself that the demonstration of capital allocation at AutoZone can be used as a study guide. In a world full of high technology growth it is easy to get lost in the sea of new but the simple strategy employed at an automotive parts store can show that tech isn’t the only area where a fortune can be made, a nod to effective capital allocation. Management could have easily chosen to push all the earnings back into opening stores, which, if the returns on capital above stayed constant might not have been a bad strategy but it also might not have. I would be willing to bet the majority of AZO shareholders who have been holding since ’98 aren’t second-guessing management’s capital decisions.

The consistency of this strategy must be given a round of applause because it isn’t uncommon for management to get sidetracked by the institutional imperative and waste shareholder capital. AZO has done the opposite and is considered an excellent steward of shareholder capital.

Here is a quote from Q1 ’22:

“Lastly, I'll spend a moment on capital allocation and our share repurchase program. We repurchased $900 million of AutoZone stock in the quarter. As of the end of the fiscal quarter, we had approximately 20.7 million shares outstanding. At quarter end, we had just over $1 billion remaining under our share buyback authorization and just under $700 million of excess cash. The powerful free cash we generated this quarter allowed us to buy back approximately 2.5% of the shares outstanding at the beginning of the quarter. We bought back over 90% of the shares outstanding of our stock since our buyback inception in 1998, while investing in our existing assets and growing our business.

We remain committed to this disciplined capital allocation approach where we expect to maintain our long-term leverage target in the 2.5x area and generate powerful free cash flows that will enable us to invest in the business and return meaningful amounts of cash to shareholders.”

Headwinds

Electric Vehicles- This is the biggest headline risk right now. With this shift to EV’s over the coming decade it could pose to be the biggest headwind to fight for the company. When we look at the total sales of EV to regular vehicles over the past couple of years, the full transition will probably take longer than others think. Plus, if these EV’s are mechanical doesn’t it mean parts will fall too and need repair? Just a thought

Stay at home Economy- With a massive push to Work from home, people won’t be traveling to work as much and this is a trend I see staying for a while. I do think there will be those who stay at home and those who like to go into work and see other coworkers. But the overall shift to stay indoors could become a more permanent trend keeping people inside and not driving, thus reducing customer demand.

Supply chain issues- We are experiencing a current log jam in the supply chain, this could cause AZO to not be able to get the parts they need and maintain their competitive advantage of having almost any part for any need. This problem is likely to be affecting conception as well but if a car battery dies and AZO doesn’t have the part but ORLY does, it could swing customer loyalty whether it is an unlucky circumstance or not. Here is a quote from their most recent earnings call about the issue, “ Our in-stock positions, while still below where we would like for them to be, are continuing to improve as our supply chain and merchandising teams have made great progress in a challenging supply chain environment. We've been able to navigate supply and logistics constraints and have products available to meet our customers' needs.”

Tight Labor Market- A major key to the success of AZO is hiring talented individuals who can provide outstanding customer service. Finding and attracting great people to work in the stores could prove to be a daunting task given how competitive the labor market is. We have seen a growth in resignations and the ability to switch jobs is easier than ever so attracting, keeping, and investing in talent will be a huge key driver to the success of the company.

Ecommerce- There has always been a threat of e-commerce entering into the space and the sea that Amazon could kill this industry. There are a few things keeping the players at bay though, 80% of the parts business is from failure and maintenance, so when your battery is dead and the car won’t start, one might opt to go get a battery that day instead of ordering it and waiting for it to get delivered. But let’s say they do enter the space and are willing to ship parts, they would have to replicate the entire infrastructure system of AZO to compete on price. Plus, batteries are heavy which means the shipping won’t be economically cheap to ship even if they offer free shipping, someone has to pay for it.

Here is a quote from PartsID’s most recent quarter, they are new e-commerce auto parts, “On top of this difficult year-over-year comparison, our sales and margins are also being impacted by the global supply chain disruption, which has led to inventory shortages, increased order cancellations, higher product and shipping costs and longer delivery times.”

The last three headwinds to me pose the biggest threat to the business and the industry overall. The hype around Electric Vehicles is real and they are becoming more present but based on the data there are still a lot of non-EV cars and trucks on the road and it will take quite a few years for them to win the majority.

Tailwinds

The TAM is growing- Over the past decade, we have seen an increase in the two demand drivers for the industry, the average miles are driven per car and the average age of the vehicles on the road.

Here is Freddie Lait on the subject, “I think looking at the kind of outline from the demand side of the industry, what you've got as sort of macro statistics to follow is an ever-increasing car park, more new cars being sold and the average age of cars being higher each year as the cars are built better. So the average miles driven as well is going up by about 1% or 2% a year. The car park itself is going by 1% or 2% a year. That leads to nearly 3% to 4% underlying addressable market growth.”Consolidation- The big 4 make up nearly 40% of the market and another 40% is made up of Mom and Pop shops. During the pandemic, there were a bunch of doors being closed for good which has led to market share gains for the big 4 and this trend is likely to continue as they consistently build out their stores and become bigger players in the DIFM category.

Big barriers to entry- I eluded to the big 4 above but if we look at the industry as a whole the moats surrounding these businesses are wide due to the capital intensive nature of building out stores and the distribution network assorted with it. Being within 20 mins of any of those names and having the massive inventories make it very hard for a new player to come in and compete.

Growth in the commercial business- AZO reported $1 billion in sales for their commercial business in 2011. In 1Q22 they reported $3.5 billion in TTM sales, a CAGR of around 12% a year. Management has touted this division as the real driver of sales growth over the next couple of years. They currently have the lowest market share in the DIFM space but the characteristics which made them win in the DIY space could translate well into the commercial space and it wouldn’t be surprising to see them move up the ladder in the coming years.

Closing thoughts

I wish my parents bought me some AZO stock instead of bonds when I was born. For me, it’s hard not to admire the results and the track record AZO has been able to produce since going public in 1991. I have heard the saying the best argument is a good example and when it comes to generating returns using simple strategies and prudent capital allocation AZO is one hell of an example.

But if we take a step away from the stock returns and focus only on the business economics they are par to none. The ROIC profile is top-notch, margins are well above average, and the TAM continues to grow at a steady 2-4% a year. There is nothing sexy about auto parts. They are not going to change the world. But you know what, when your battery dies or the fan belt brakes, it’s comforting to know you are likely within 20 mins of an AZO and it’s likely they have what you need in stock and will receive excellent service when you go to get it.

It’s easy to get wrapped up in the bull case for this company due to the track record but the rational side of me knows there is no such thing as a sure thing so rooting out the risks and assigning probabilities for the downside is just as important. I see the tide of moving to EVs being present even if the rate of change is slow. At some point, I am sure there will be a car mix with a bigger percentage of it being EV’s. I also can’t help but wonder if the pandemic pulled some earnings forward and the next few years won’t produce huge growth rates as we have seen. The stimulus checks proved to be very fruitful for this industry and it could hamper future results minimally.

However, the majority of cars are still mechanical, and mechanical things break down. With the growing population and average age of the car park and the number of miles driven per car increasing the tailwinds are strong. The data we see gives us some good clarity into the future and how many “new” cars will come into the target age for AZO.

Just to give you an idea, there were about 14 million new cars sold in 2021 (https://www.goodcarbadcar.net/usa-auto-industry-total-sales-figures/) and if we look back a few years, between 2015-2019 there were 17 million new cars sold in the US each year and all of these will be coming into the target zone before 2030. A healthy pipeline for the years ahead.

This analysis was done from 12/30/21-1/5/22 when the company had a Market Cap of $42 billion and a share price of $2,000.

Please be advised, Wall St Gunslinger is not an investment advisor and does not give personal investment advice. All content is for educational and entertainment purposes only and should not be interpreted as anything other than such. Investing entails a lot of risks and should be managed appropriately. Please do your own research and consult with an investment professional before making any investing decisions. Thank you.